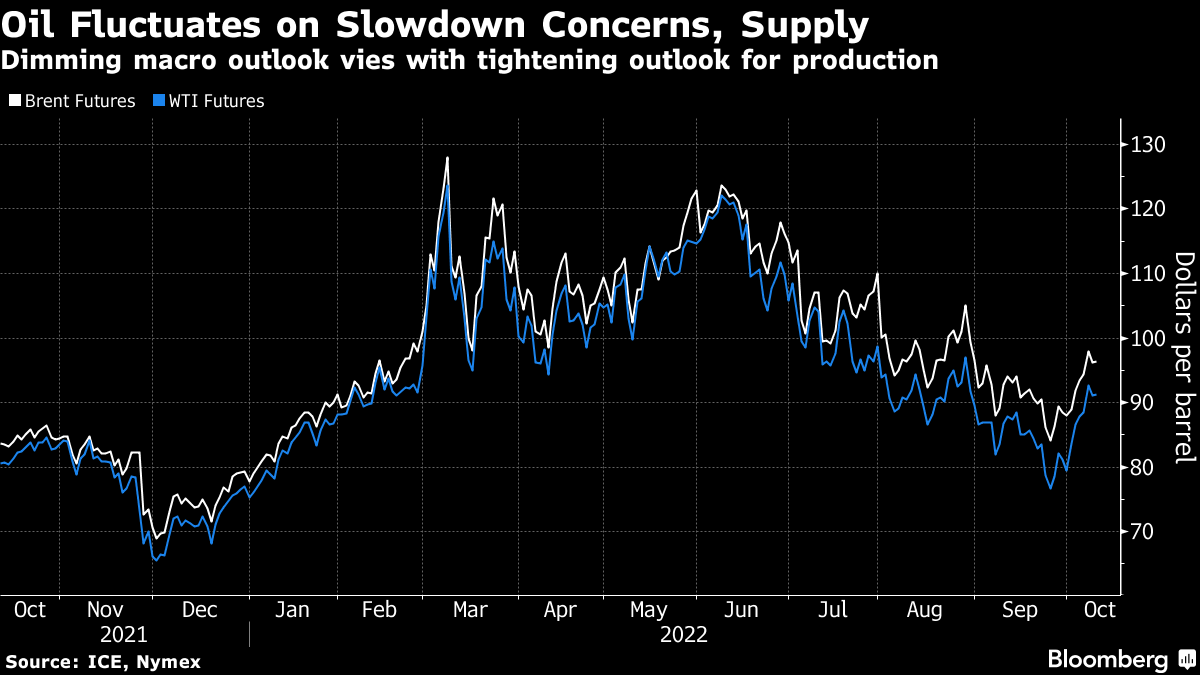

Oil Edges Lower as Slowdown Concerns Eat Into OPEC-Driven Gains

(Bloomberg) -- Oil swung between gains and losses as concerns over a global slowdown and potentially weaker demand vied with a tightening supply outlook after OPEC+ last week announced an output cut.

West Texas Intermediate traded below $91 a barrel after losing 1.6% on Monday. JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said the US and global economies are likely to sink into recession next year, while the International Monetary Fund and World Bank saw rising risks of a slowdown.

In China, the world’s largest crude importer, authorities are signaling that there’ll be no let up in the nation’s Covid Zero policy, potentially acting as a brake on energy demand. The approach is sustainable and the country must stick to it as it is key to stabilizing the economy and protecting lives, the Communist Party’s flagship newspaper said in a commentary Tuesday.

Oil hit the lowest level since January last month as slowdown concerns gathered force, only to rebound after the Organization of Petroleum Exporting Countries and its allies responded by reducing output. Investors are gauging the impact of higher interest rates as central banks including the Federal Reserve fight inflation, as well as disruptions caused by the war in Ukraine and the outlook for global supply heading into the northern-hemisphere winter.

“What OPEC+ did will put a floor under prices as they’ve demonstrated their will to support prices,” said Sean Lim, a Malaysia-based oil-and-gas analyst at RHB Investment Bank Bhd. Still, “recession risks will remain the talk for now,” he added, lowering his fourth-quarter Brent forecast to $98 from $105.

Widely-watched time spreads continue to signal increased market tightness, however. The difference between Brent’s nearest two December contracts was $12.95 a barrel in a backwardated structure, compared with about $9 a month ago.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight