Pound and UK Bonds Rally; Stocks, Futures Advance: Markets Wrap

(Bloomberg) -- The pound rallied and UK bonds surged as more of Prime Minister Liz Truss’s unfunded tax cuts were reversed. Stocks rose, with investors preparing for a number of key earnings reports this week.

Chancellor Jeremy Hunt scrapped plans to cut taxes and signaled consumers would shoulder more of the increase in energy prices as he set out a package of measures to get a grip on public finances in a televised statement on Monday. It’s the start of what may be a particularly torrid week for British assets, with the beleaguered Truss battling to rescue her premiership after the Bank of England ended its emergency bond-buying program on Friday and as mutinous backbenchers plot to oust her.

US equity contracts advanced more than 1% as investors turned their focus to company results -- including from Bank of America Corp., Goldman Sachs Group Inc. and Tesla Inc. Utilities and auto stocks led gains in Europe.

The yield on 10-year gilts fell 35 basis points to 3.98% and the pound traded 0.8% higher at $1.1263. Treasury yields and the dollar eased against its Group-of-10 counterparts, providing a touch of respite to harried currency markets.

“I think we’re in for a period where UK credibility is continually questioned and UK assets remain incredibly volatile for a significant period of time,” Benjamin Jones, Invesco Director of Macro Research, said on Bloomberg Television. “Watching the gilt market will be absolutely key in understanding if the market does believe Hunt to be more stable and if he will be able to push these policies through.”

Hunt will also speak to the House of Commons at 3:30 p.m. London time and Truss is due to host a reception for the Cabinet at 10 Downing Street on Monday evening. U-turns on the government’s “mini budget” now total £32 billion, however that may not be enough as the official estimate of the black hole in the public finances is believed around £70 billion.

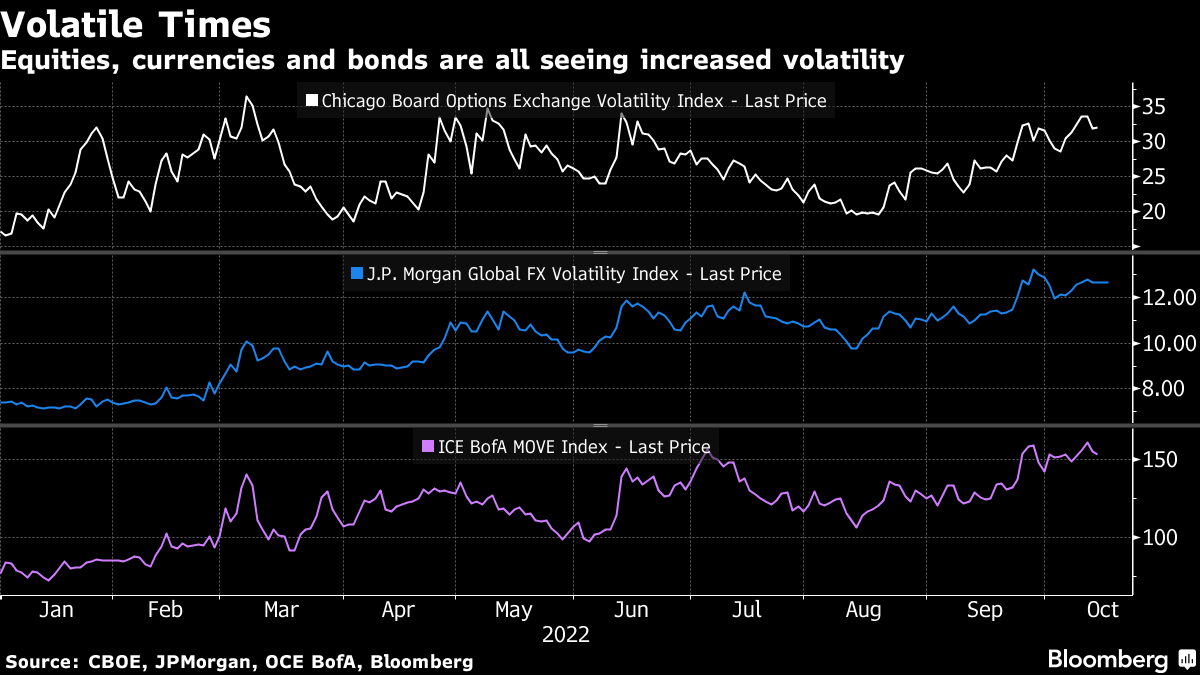

Meanwhile, the outlook for consumer prices in the US continues to fuel bets that the Federal Reserve may make jumbo rate hikes at its next two meetings, weighing broadly on the outlook for global economic growth and markets.

Fed officials in their latest comments suggested they were ready to hike rates higher than previously planned. Kansas City Fed President Esther George said the terminal rate may need to be higher to cool prices. San Francisco Fed’s Mary Daly said she’s “very supportive” of raising to restrictive levels and to between 4.5% and 5% “is the most likely outcome.”

Morgan Stanley strategist Michael J. Wilson, a long-time equities bear, said US stocks are ripe for a short-term rally in the absence of an earnings capitulation or an official recession. A 25% slump in the S&P 500 this year has left it testing a “serious floor of support” at its 200-week moving average, which could lead to a technical recovery, he wrote in a note on Monday.

US-listed Chinese shares rose in premarket trading, while Chinese stocks erased declines as President Xi Jinping reiterated that economic development is the party’s top priority and offered support for the tech sector in a speech, but disappointed investors hoping for signs of a shift away from Covid Zero.

Elsewhere in markets, oil fluctuated after a weekly slump as fears over an economic slowdown continue to weigh on the outlook for demand. Gold rose on weakness in the US dollar and as rising fears of a global economic slowdown boost the precious metal’s haven status.

Key events this week:

- Earnings this week will provide clues on the strength of a swathe of companies, including Bank of America Corp., China Telecom Corp., Contemporary Amperex Technology Co., Hindustan Unilever Ltd, Hong Kong Exchanges & Clearing Ltd., Goldman Sachs Group Inc., Johnson & Johnson, Netflix Inc., Tesla Inc. and United Airlines Holdings Inc.

- US empire manufacturing, Monday

- ECB Vice President Luis de Guindos speaks, Monday

- China retail sales, industrial production, GDP, surveyed jobless, Tuesday

- US industrial production, NAHB housing market index, Tuesday

- Fed’s Neel Kashkari speaks, Tuesday

- Euro area CPI, Wednesday

- UK CPI, PPI, retail price index, Wednesday

- US MBA mortgage applications, building permits, housing starts; Fed Beige Book, Wednesday

- Fed’s Neel Kashkari, Charles Evans, James Bullard speak Wednesday

- US existing home sales, initial jobless claims, Conference Board leading index, Thursday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 rose 1.1% as of 6:46 a.m. New York time

- Futures on the Nasdaq 100 rose 1.2%

- Futures on the Dow Jones Industrial Average rose 0.9%

- The Stoxx Europe 600 rose 0.6%

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.3% to $0.9749

- The British pound rose 0.8% to $1.1257

- The Japanese yen fell 0.1% to 148.84 per dollar

Cryptocurrencies

- Bitcoin rose 0.2% to $19,369.88

- Ether rose 0.7% to $1,319.37

Bonds

- The yield on 10-year Treasuries declined seven basis points to 3.95%

- Germany’s 10-year yield declined nine basis points to 2.25%

- Britain’s 10-year yield declined 35 basis points to 3.98%

Commodities

- West Texas Intermediate crude rose 0.5% to $86.06 a barrel

- Gold futures rose 0.8% to $1,661.50 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week