Asian Stocks Decline; Yen Fluctuates After BOJ: Markets Wrap

(Bloomberg) -- Asian shares dropped following declines on Wall Street as investors contended with disappointing results from tech giants. The yen swung between gains and losses after the Bank of Japan kept monetary policy unchanged.

A gauge of Asian equities slid, weighed down by Hong Kong-listed technology stocks. Shares of miners and steelmakers in the region declined amid weakness in iron ore prices and a downbeat outlook for the sector.

Japan’s benchmark 10-year bond yield edged further below the 0.25% upper limit of the BOJ’s target range after the central bank maintained its ultra-low interest rates and projected inflation will cool below 2% next year. Traders are awaiting Governor Haruhiko Kuroda’s post-decision briefing later Friday.

US equity futures fell following Amazon.com Inc.’s plunge after hours as its sales forecast trailed estimates. Shares of Apple Inc. rose slightly in postmarket trading following a volatile afternoon.

Chinese assets also remained in focus, with foreign investors dumping a record amount of mainland China stocks this week and sending Hong Kong equities to a 13-year low. President Xi Jinping’s tightening grip on power hasn’t had the same impact domestically, with mainland investors hunting for bargains in Hong Kong.

Bond yields fell in Australia and New Zealand while Treasury yields held most of their recent drop, with the 10-year remaining well below 4%.

Gross domestic product data showed that the US economy rebounded after two quarterly contractions, but also highlighted that consumer spending remains under pressure because of inflation.

Elon Musk completed his $44 billion acquisition of Twitter Inc., according to people familiar with the matter. Holders will be paid $54.20 per share and the social network will now operate as a private company.

Economists still expect the Fed to hike by three-quarters of a percentage point for the fourth time in a row when it meets next week. But with recent data highlighting the effects of sharp rate hikes on the economy, investors expect the FOMC to slow the pace of tightening after November’s meeting.

Read: Bond Bulls Bet on Plateau in Rates as Dovish Signals Grow

Policymakers’ rhetoric lately “also supports our forecast that the Fed slows the hiking pace to 50 basis points in December, after another 75 basis-point hike in November,” a team of Goldman Sachs’ economists, including Daan Struyven, wrote in a note.

Elsewhere, oil headed for a weekly gain, supported by tightness in petroleum product markets, robust US exports, and a weakening dollar. Gold was set for its second weekly climb and Bitcoin traded above $20,000.

Key events this week:

- US personal income, personal spending, pending home sales, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 fell 0.5% as of 1:24 p.m. Tokyo time. The S&P 500 fell 0.6%

- Nasdaq 100 futures dropped 0.8%. The Nasdaq 100 fell 1.9%

- The Topix Index fell 0.1%

- The S&P ASX Index fell 1%

- The Hang Seng Index fell 2.3%

- The Shanghai Composite Index fell 0.8%

- Euro Stoxx 50 futures fell 0.7%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro rose 0.2% to $0.9983

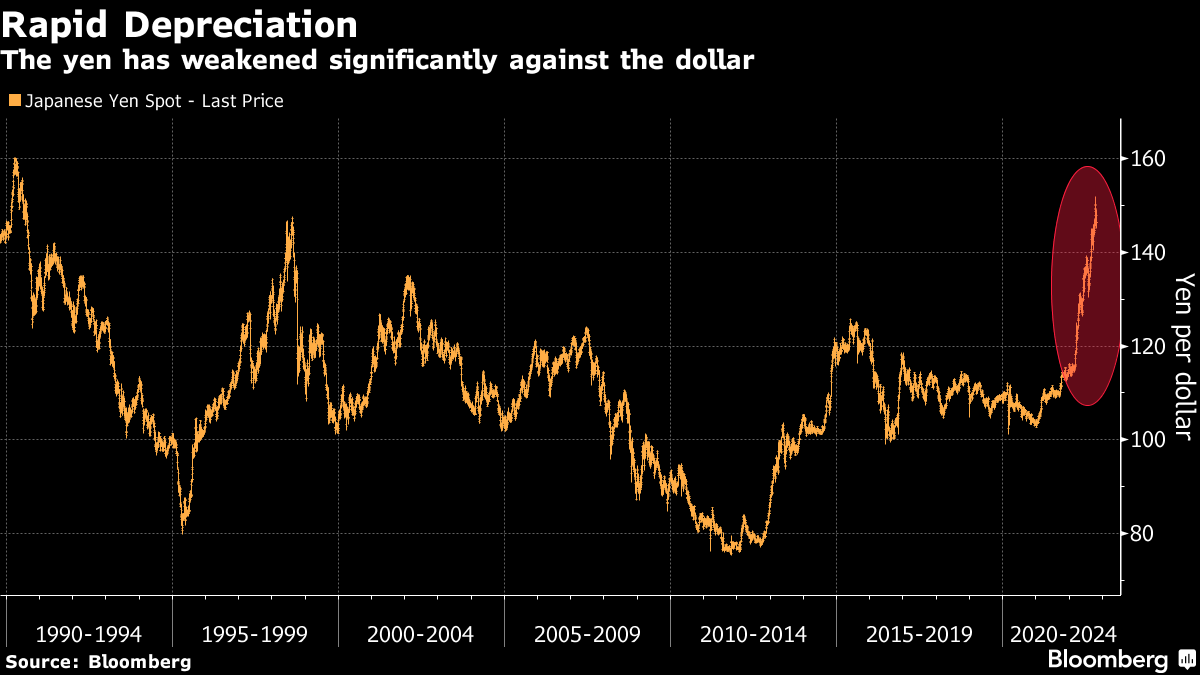

- The Japanese yen was little changed at 146.18 per dollar

- The offshore yuan rose 0.3% to 7.2337 per dollar

Cryptocurrencies

- Bitcoin fell 0.6% to $20,285.88

- Ether fell 1.3% to $1,507.71

Bonds

- The yield on 10-year Treasuries rose two basis points to 3.94%

- Australia’s 10-year bond yield fell six basis points to 3.77%

Commodities

- West Texas Intermediate crude fell 1.1% to $88.06 a barrel

- Spot gold was little changed

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output