US Futures Waver Before Earnings Rush; Bonds Gain: Markets Wrap

(Bloomberg) -- US equity futures wavered as investors await key earnings reports from big Wall Street banks. Bonds advanced, led by UK gilts which benefited from speculation that controversial tax-cutting plans would be revised.

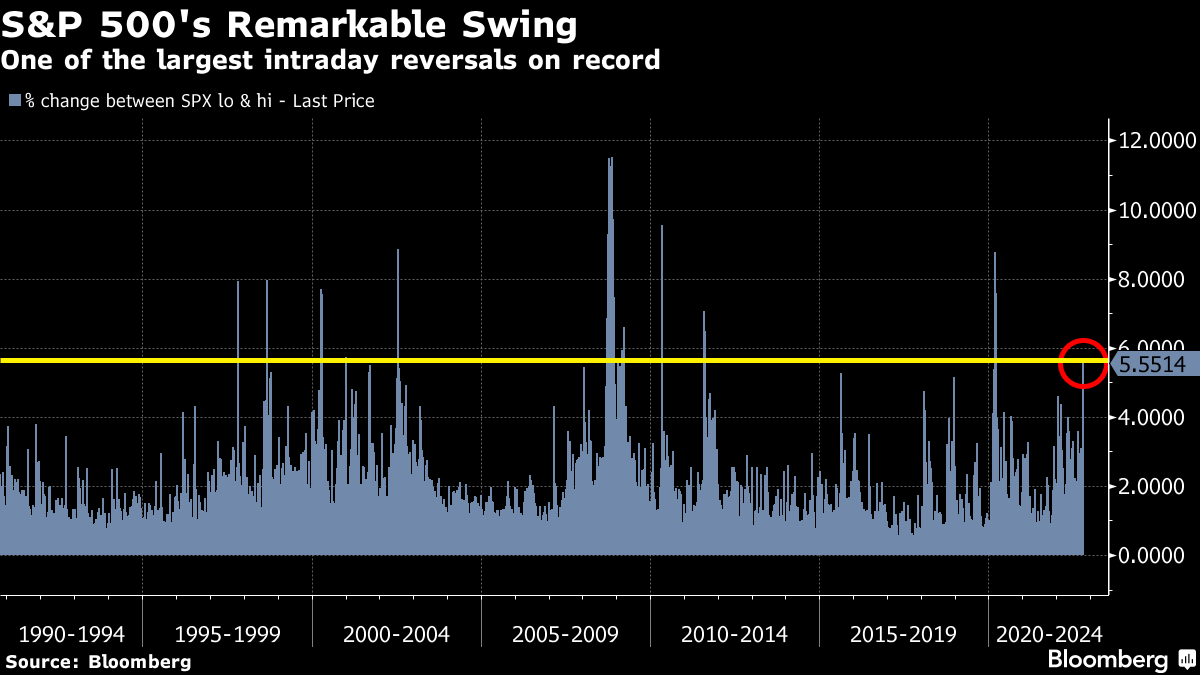

Contracts on the S&P 500 and Nasdaq 100 fluctuated after erasing an earlier loss. The moves follow Thursday’s 2.6% surge that ended a six-day losing streak for Wall Street, even after above-forecast inflation data cemented bets on further outsize Federal Reserve interest rate hikes.

A slew of corporate results is the next focal point for markets. JPMorgan Chase & Co, Citigroup Inc. and other big banks are expected to post the biggest profit decline of any S&P 500 Index sector, according to data compiled by Bloomberg Intelligence.

“Even though investors may look through a disappointing CPI print, it will be a much higher bar to look through weak corporate earnings.” Invesco global market strategist David Chao told clients. “Growth is below trend and decelerating because the Fed is still tightening. This is a tough backdrop for risk assets.”

The dollar advanced but held below two-week highs hit earlier this week against major currencies. Bond yields slipped, with two-year rates shedding four basis points.

UK markets remain in focus as investors awaited more news on the government’s tax-cut package and on the Bank of England’s emergency bond-buying program which expires later on Friday.

While the pound eased after Thursday’s sharp rally versus the dollar, 10-year gilt yields extended their fall. They dropped 27 basis points, falling further from the 14-year highs hit on Wednesday.

Jefferies analysts said a government U-turn would be a step “in the right direction,” which “should take some pressure off the gilt market and the BoE.”

In the premarket, financials’ shares broadly weakened amid concern tha Fed tightening could spark defaults and force banks to set aside higher provisions against losses.

JPMorgan Chief Executive Officer Jamie Dimon offered a stark warning this week that the US is likely to enter a recession within six to nine months and that the S&P 500 could see an “easy” 20% drop.

Read more: Bank Results to Give Clues on Market’s Next Move: Earnings Watch

Chipmakers Nvidia Corp and Advanced Micro Devices shed about 1% each as Jefferies became the latest bank to highlight the impact of higher rates and US restrictions on shipments to China. Other tech giants, Microsoft Corp, Apple Inc and Alphabet Inc also lost close to 1% in premarket trading.

Elsewhere, oil headed for weekly losses as signs of a global economic slowdown and tighter monetary policy threaten to sap energy consumption. The International Energy Agency earlier warned crude production cuts agreed by OPEC+ group risked causing a price spike that tipped the global economy into recession.

Crypto assets gained, with Bitcoin touching a one-week high, within reach of surpassing the $20,000 level.

Key events this week:

- Earnings on Friday: JPMorgan Chase & Co., Citigroup Inc., Morgan Stanley, UnitedHealth Group Inc., U.S. Bancorp, Wells Fargo & Co.

- US retail sales, business inventories, University of Michigan consumer sentiment, Friday

- BOE emergency bond buying is set to end, Friday

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output