Oil Set for Weekly Loss as China’s Covid Outbreak Shakes Outlook

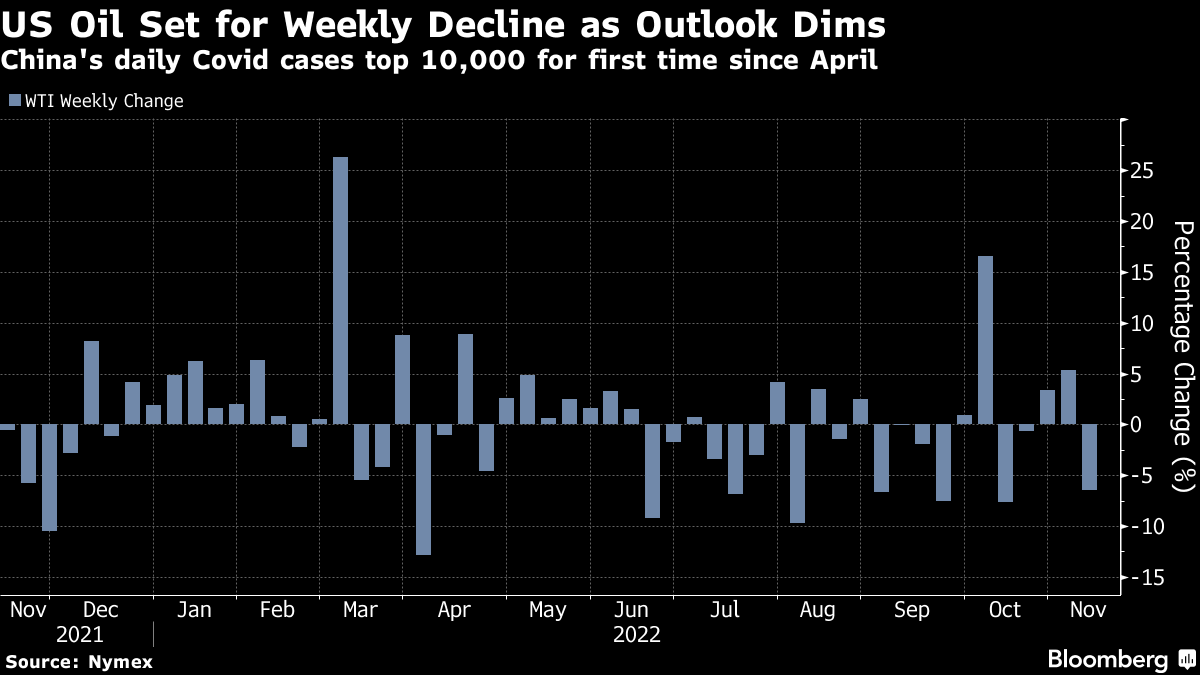

(Bloomberg) -- Oil headed for a weekly loss of over 6% as China continues to grapple with swelling Covid cases, weighing on the outlook for demand.

Daily infections have climbed to the highest since April as China’s top leaders reinforced the need to stick with Covid Zero, although they urged officials to be more targeted with restrictions. Investors have been watching for clues on any relaxation of the policy, with markets whipsawed recently by rumors of easing.

Still, West Texas Intermediate rose on Friday, edging toward $87 a barrel amid broader market gains after slower-than-projected US inflation. That’s led to speculation that the Federal Reserve could temper its interest rate hikes.

“Crude got some lift from the revival of Fed pivot hopes and increased risk appetite following the softer US October inflation data,” said Vandana Hari, founder of Vanda Insights in Singapore. “But the growing Covid cases and lockdowns in China will limit price gains.”

Oil has lost about a third of its value since early June on concerns over a global economic slowdown and aggressive monetary tightening by central banks. The US inflation read also led to a decline in the dollar, making commodities priced in the currency more attractive to investors.

In a meeting of the new Politburo Standing Committee chaired by President Xi Jinping, the members called for “more decisive” and targeted measures to curb the spread of the virus so as to resume normal life and production as soon as possible, according to Xinhua News Agency. Daily infections have exceeded 10,000 for the first time since April.

The market is also monitoring an uncertain supply outlook. Production cuts this month by the Organization of Petroleum Exporting Countries and allies will be followed by European Union sanctions on Russia crude flows in December.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output