Oil Edges Higher on Broader Market Gains Ahead of Rate Decisions

(Bloomberg) -- Oil gained along with Asian equities before interest-rate decisions by major central banks.

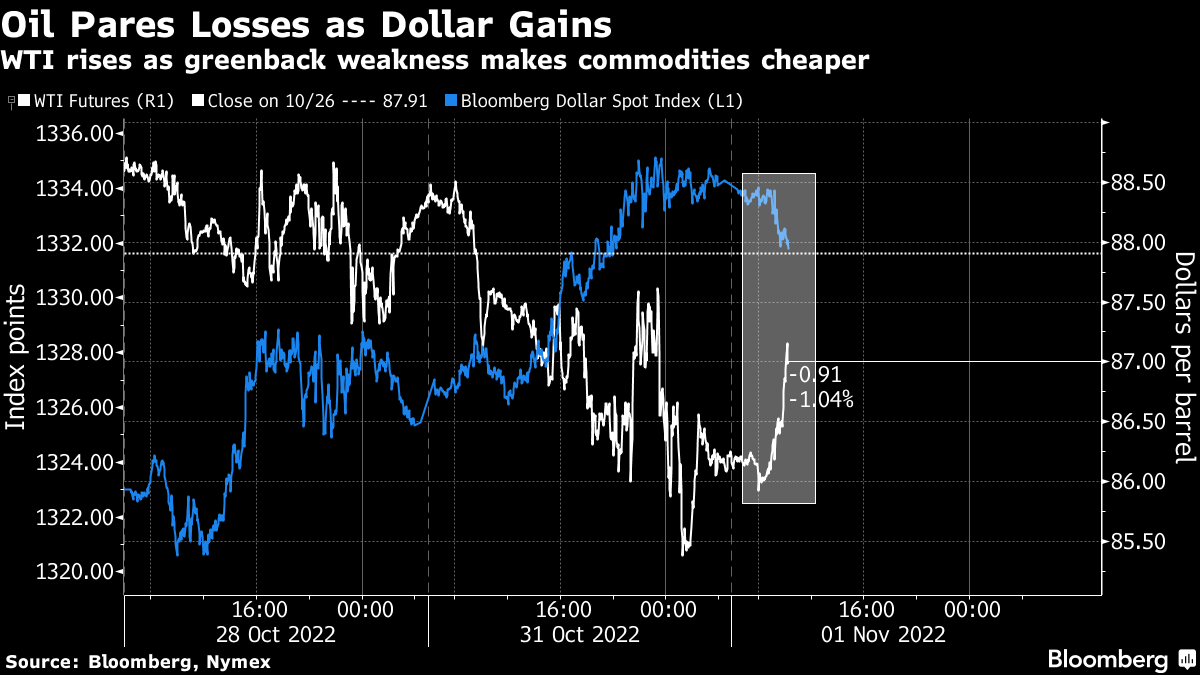

West Texas Intermediate futures climbed above $87 a barrel after losing around 3% over the previous two sessions. The Federal Reserve is scheduled to make a decision on rates on Wednesday, as central banks continue to tighten monetary policy to tame inflation. A weaker dollar also supported oil, making commodities prices in the currency more attractive to investors.

While oil has shed almost a third of its value since early June, futures capped the first monthly gain since May last month after the OPEC+ alliance agreed to sizable production cuts. Excess supply was the main reason to curb output from November, the group’s Secretary-General Haitham al Ghais said on Monday.

“If interest rates are going to move higher, then there’s greater chance of a recession, and OPEC would be right to worry that it’ll lead to further demand destruction,” said Vishnu Varathan, the Asia head of economics and strategy at Mizuho Bank Ltd. “That said, OPEC’s bias is to keep supply tight, as high prices are an economic windfall that they’re likely unwilling to give up.”

Click here to read Bloomberg’s daily Europe Energy Crunch blog

Cuts by the Organization of Petroleum Exporting Countries and its allies will be followed by European Union sanctions on Russian crude flows, further clouding the supply outlook. Moscow has mostly failed to line up fresh markets for its oil before EU penalties take effect from Dec. 5.

A US-led plan to cap the price of Russian oil sales, part of the broader international response to the invasion of Ukraine, will temporarily exempt shipments loaded before Dec. 5, according to the US Treasury Department. Cargoes must be unloaded by Jan. 19 to qualify for exemption.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad