Asian Shares Slip as Powell Primes Further Hikes: Markets Wrap

(Bloomberg) -- Asian stocks and currencies fell after Jerome Powell said the Federal Reserve would raise interest rates more than previously anticipated, sapping risk appetite.

Benchmark equity gauges in Asia fell in the wake of the S&P 500’s 2.5% drop, though declines in most markets were less than in the US. Shares in Hong Kong and on the mainland underperformed after an affirmation of the government’s Covid-Zero stance dashed hopes of a reopening.

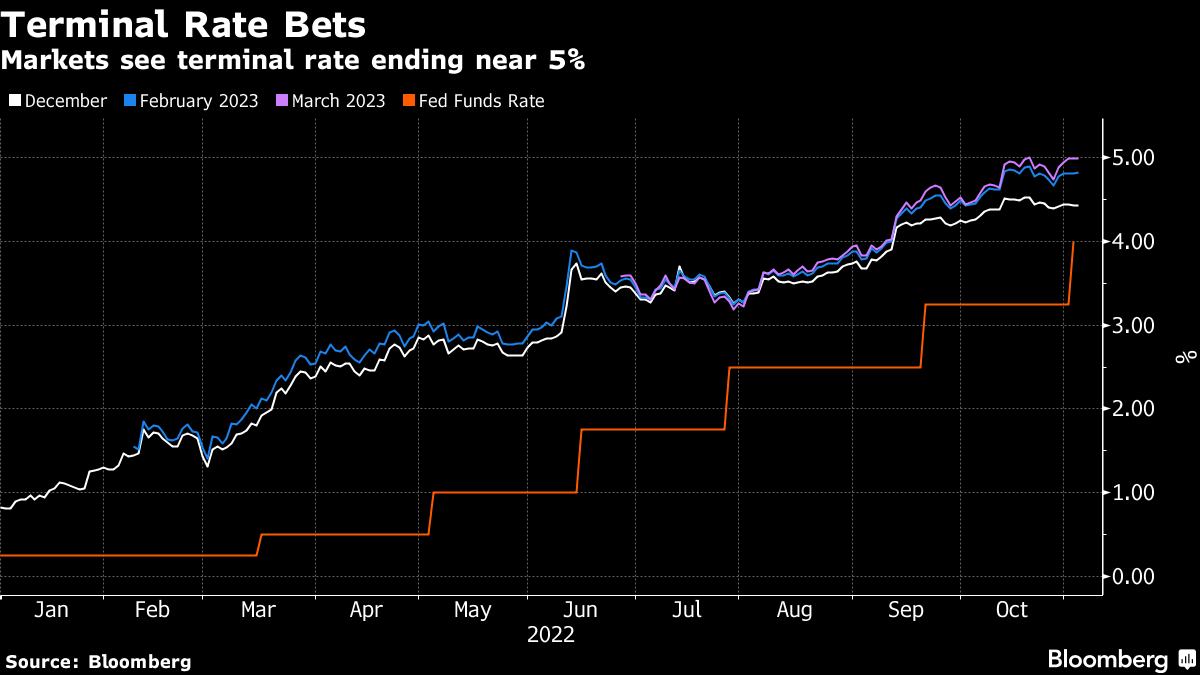

The Fed raised rates 75 basis points for the fourth time in a row, bringing the top of its target range to 4%, the highest level since 2008. Traders immediately raised the market-implied peak in interest rates for next year.

“Every time the market gets a little bit of dovish hope, it gets smacked on the nose with a rolled up newspaper,” said Scott Rundell, chief investment officer at Mutual Ltd. “There’s a lot of volatility still ahead.”

Australian and New Zealand bonds tumbled early Thursday in the wake of the Fed meeting. Australia’s policy-sensitive three-year yield jumped more than 10 basis points. There was no cash trading of Treasuries in Asia with Japan on holiday.

Two-year Treasuries led a selloff on Wednesday following Powell’s comments, but at 4.62% they are still about 40 basis points below the 5.06% peak in yields priced into Fed funds futures.

“Factoring in the bond market’s assessment, markets are becoming increasingly convinced that the path toward the terminal rate will include a recession,” said Quincy Krosby, chief global strategist at LPL Financial.

Still, the dollar fell against all of its Group-of-10 counterparts as investors pivoted toward US jobs data, which may help to determine the pace of upcoming rate hikes. An index of emerging-market currencies declined.

“There is likely some profit taking in long dollar positions after the big moves post the FOMC meeting outcome and Powell’s press conference,” said David Forrester, a senior FX strategist at Credit Agricole CIB in Hong Kong.

Wheat prices fell after Russia agreed to resume a deal allowing safe passage of Ukrainian crop exports. Oil dropped after Powell’s comments on interest rates overshadowed tightening supply.

Key events this week:

- Bank of England rate decision, Thursday

- US factory orders, durable goods, trade, initial jobless claims, ISM services index, Thursday

- ECB President Christine Lagarde speaks, Thursday

- US nonfarm payrolls, unemployment, Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 rose 0.3% as of 1:16 p.m. Tokyo time. The S&P 500 fell 2.5%

- Nasdaq 100 futures climbed 0.4%. The Nasdaq 100 fell 3.4%

- Australia’s S&P/ASX 200 Index fell 1.8%

- The Hang Seng Index fell 2.8%

- The Shanghai Composite Index fell 0.6%

- Euro Stoxx 50 futures fell 0.7%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.1% to $0.9830

- The Japanese yen rose 0.4% to 147.28 per dollar

- The offshore yuan rose 0.3% to 7.3227 per dollar

Cryptocurrencies

- Bitcoin rose 1% to $20,371.82

- Ether rose 3% to $1,557.36

Bonds

- The yield on 10-year Treasuries advanced six basis points to 4.10%

- Australia’s 10-year yield advanced 11 basis points to 3.92%

Commodities

- West Texas Intermediate crude fell 0.5% to $89.53 a barrel

- Spot gold rose 0.2% to $1,638.19 an ounce

--With assistance from , and .

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight