Oil Pares Gains After Report Shows U.S. Gasoline Demand Fell

(Bloomberg) -- Oil pared gains after a U.S. government report signaled high prices may be depressing demand for fuel during a time of year that consumption is usually taking off toward its summer peak.

Futures in New York climbed above $108 a barrel on Wednesday but pared back earlier gains after gasoline demand fell for the third consecutive week, defying seasonal trends. This could be the first sign of high prices impacting demand. Meanwhile, U.S. crude stockpiles fell 3.45 million barrels last week, larger than predicted, according to an Energy Information Administration report Wednesday.

Prices were higher overall after a two-day drop as peace talks between Russia and Ukraine appeared to stall. Earlier, Russia said peace talks in Istanbul yielded no breakthroughs, according to Kremlin spokesman Dmitry Peskov. Ukrainian President Volodymyr Zelenskiy said that Russia is sending new forces as attacks continue on Kyiv.

The war is already taking its toll on Russian production, which fell below 11 million barrels a day in the second half of March, while deliveries to refineries slid about 11%. Supply is starting to show a “significant decline relative to the beginning of the month,” consultant OilX said in a note.

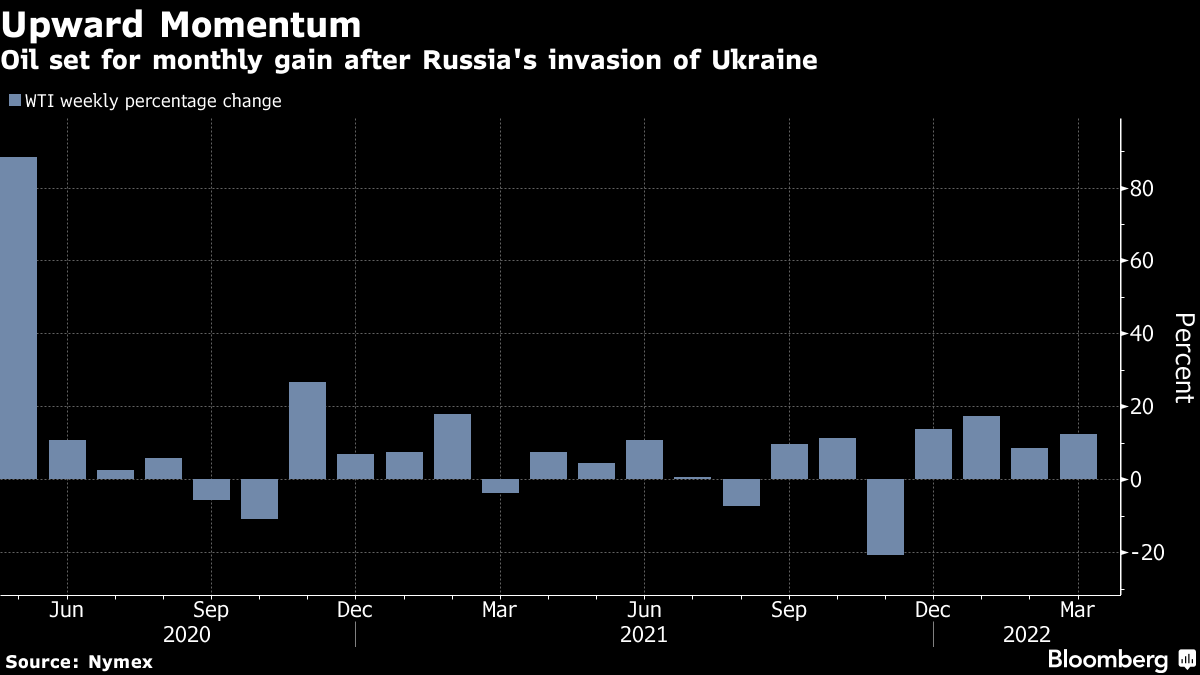

The war has triggered huge price moves in the oil market, spurring massive volatility and forcing some traders to head for the exit. The exodus has lead to low liquidity which in turn has led to even bigger swings. West Texas Intermediate has averaged $9 trading range for the month of March. Brent has moved by $5 or more in 23 of the past 24 trading sessions.

“Markets remain skeptical of an immediate cease-fire,” said Keshav Lohiya, founder of consultant Oilytics. Russian production outages “will quickly snowball if the current situation continues.”

OPEC+ meets on Thursday to discuss its supply policy for May, with the group expected to stick with its strategy of modest output boosts even as the war in Ukraine disrupts flows. Major importers are urging OPEC+ nations with spare production capacity to open the taps faster, but the group’s key members have so far remained unmoved.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output