Big Tech Weighs Heavily on Stocks as Yields Surge: Markets Wrap

(Bloomberg) -- Stocks tumbled around the globe as recession fears resurfaced, with the Federal Reserve struggling to get on top of inflation that’s proved more persistent and widespread than officials anticipated.

The rally that followed the Fed’s decision fizzled out, with the S&P 500 on pace for its lowest since December 2020. The tech-heavy Nasdaq 100 sank 4%. Kroger Co. slid after the supermarket company said higher costs hurt margins. Revlon Inc. filed for Chapter 11 bankruptcy as the supply-chain crunch proved the tipping point for the debt-laden cosmetics giant.

Read: Biggest Sell Program Since September Rocks Stocks on Open

Treasury 10-year yields resumed their swift increase, surging as much as 21 basis points to 3.49%. They later pared their advance by about half. Bitcoin, which earlier added as much as 6.1%, fell to around $21,000, and headed toward its longest losing streak in Bloomberg data going back to 2010.

Bad economic signals also weighed on sentiment, with mortgage rates in the US surging the most since 1987, ratcheting up pressure on would-be homebuyers and cooling the housing market. New US home construction dropped in May, highlighting the impacts of ongoing supply-chain challenges and sinking sales.

Declaring that it’s essential to tame inflation, Jerome Powell engineered the biggest rate increase since 1994 Wednesday and held out the distinct possibility of another jumbo hike in July. While the Fed chief sought to soften the blow of the 75-basis-point boost by saying he didn’t expect moves of that size to become the norm, he effectively admitted the chance of an economic downturn.

“We’re worrying about growth and where the Fed takes us ultimately,” said Chris Gaffney, president of world markets at TIAA Bank. “Yesterday everybody said, ‘Oh good, the Fed is doing something aggressive, they’re going to get aggressive, they’ll try to catch up to the inflation curve.’ But now, you’re looking at it and saying, ‘Yeah, but are they chasing something they’re not going to be able to catch?’”

The S&P 500 now implies an 85% chance of a US recession amid fears of a policy error by the Fed, according to JPMorgan Chase & Co. The warning from quant and derivatives strategists is based on the average 26% decline for the gauge during the past 11 recessions and follows its collapse into a bear market amid concerns about surging inflation and aggressive rate hikes.

Read: End of TINA Sends Stock Traders Looking for Places to Hide

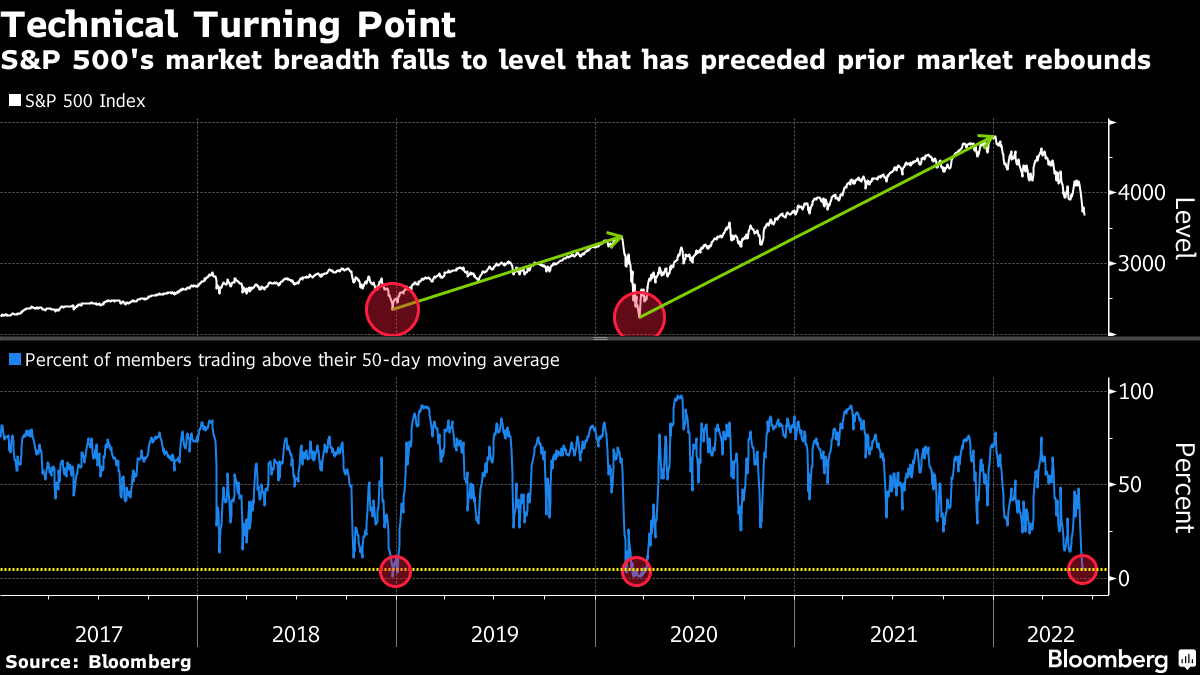

One technical indicator of US stocks shows the extent of the recent slump, while offering a whiff of optimism that it will soon come to an end.

The percentage of S&P 500 members that are trading above their 50-day moving average sank below 5% this week, the lowest level since Covid-19 fears battered shares more than two years ago. Both that selloff and the one that hit markets in late 2018, reversed course shortly after seeing a similar share of stocks dip below the closely watched technical average.

More comments:

- “Our main takeaway from the Fed is hawkish -- meaning the Fed is going to accept recession risk to deliver below-trend economic growth,” wrote Dennis DeBusschere, the founder of 22V Research.

- “The market got what it wished for, but maybe, just maybe, hiking 75 bps into a rapidly weakening economy isn’t the best idea,” wrote Peter Tchir, head of macro strategy at Academy Securities.

- “Despite their assurance, it’s unclear to me whether the Fed has the tools they say they do to tamp down prices,” said Jason Brady, chief executive officer at Thornburg Investment Management.

- “The band-aid wasn’t ripped off and, if anything, greater uncertainty about the magnitude of next moves has increased,” said Neil Campling, head of tech, media and telecom research at Mirabaud Securities

Elsewhere, investors dumped European bonds and the franc rallied after a surprise Swiss rate hike. The pound rose as the Bank of England raised rates and signaled it’s prepared to unleash larger moves if needed. Currency options traders are betting the Bank of Japan will deliver a policy surprise this week.

Key events this week:

- Bank of Japan policy decision, Friday.

- Eurozone CPI, Friday.

- US Conference Board leading index, industrial production, Friday

What are the next levels for the pound? UK is the theme of this week’s MLIV Pulse survey. Click here to participate anonymously.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 3.3% as of 10:49 a.m. New York time

- The Nasdaq 100 fell 4.1%

- The Dow Jones Industrial Average fell 2.6%

- The Stoxx Europe 600 fell 2.6%

- The MSCI World index fell 2.5%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.4% to $1.0481

- The British pound rose 0.5% to $1.2244

- The Japanese yen rose 0.8% to 132.79 per dollar

Bonds

- The yield on 10-year Treasuries advanced eight basis points to 3.36%

- Germany’s 10-year yield advanced 11 basis points to 1.75%

- Britain’s 10-year yield advanced 11 basis points to 2.58%

Commodities

- West Texas Intermediate crude rose 0.3% to $115.61 a barrel

- Gold futures rose 0.6% to $1,831.30 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company