Crude Oil Buckles as Recession Angst Rattles Commodity Investors

(Bloomberg) -- Oil sank as investors weighed escalating concerns that the US may be headed for a recession, while the Biden administration prepared to step up its fight against lofty pump prices by calling for a tax holiday on gasoline.

West Texas Intermediate tumbled below $106 a barrel, echoing last week’s retreat, with prices falling alongside other raw materials including copper. With investors concerned about the impact of sharply higher US interest rates, Federal Reserve Chair Jerome Powell is due to testify before Congress Wednesday on his bid to curb inflation raging at the fastest pace in decades.

President Joe Biden will call for a gasoline tax holiday, a person familiar with the plan said, after the average US retail price topped $5 a gallon this month following a surge of more than 50% in 2022. The initiative comes ahead of a meeting Thursday between refiners and Energy Secretary Jennifer Granholm.

Oil is headed for a monthly loss as concerns about a broad economic slowdown offset the fallout from the war in Ukraine and signs of still-tight conditions. Supermajor Exxon Mobil Corp. warned this week that crude markets may remain tight for years, while Vitol Group, the world’s largest independent oil trader, flagged rising fuel demand in China. At the same time, soaring margins are offering refineries an incentive to buy every barrel of crude they can get.

“Broader macro influences have been dictating price direction for oil recently,” said Warren Patterson, head of commodities strategy at ING Groep NV in Singapore. “However, fundamentally the market still remains constructive. The oil balance is set to be tight for the remainder of the year, while in the shorter term strong refinery margins should be supportive for crude demand.”

Concerns about a potential US slowdown, which may sap energy demand, have mushroomed in recent days after the Fed hiked rates. Everyone from Tesla Inc. Chief Executive Officer Elon Musk to economist Nouriel Roubini have warned of the growing likelihood that the world’s largest economy will fall into recession.

Oil’s slide came together with losses in other commodities, as well as risk assets more broadly. Copper and iron ore both declined, as did equity gauges.

Still, oil markets remain in backwardation, a bullish pattern that’s marked by near-term prices trading above longer-dated ones. Brent’s prompt spread -- the difference between its two nearest contracts -- was $2.87 a barrel in backwardation, compared with $2.73 a barrel at the start of this month.

“With commodity demand above supply, markets remain tight even as growth rates slow, as evidenced by the high level of prompt backwardation in key markets like oil,” Goldman Sachs Group Inc. said in a note. “Investors should remember that Fed-induced slowdowns are simply a short-term abatement of the symptom, inflation, and not a cure for the problem, underinvestment.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

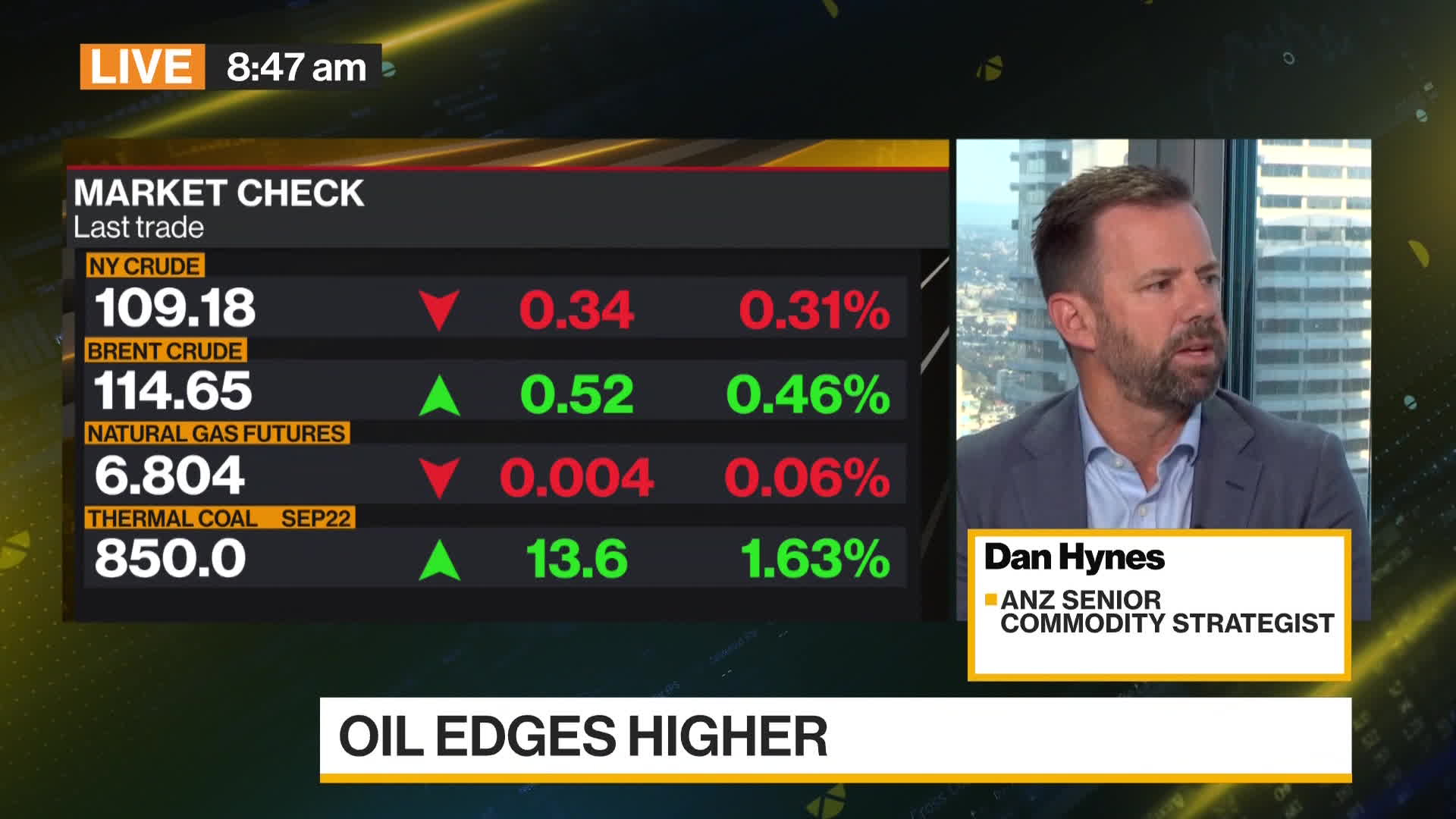

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week