US Futures Slip on Earnings Jitters; Bonds Climb: Markets Wrap

(Bloomberg) -- US equity futures slipped in choppy trading as investors await the next batch of second-quarter earnings for clues on how well companies are coping with surging prices. Bonds extended an advance.

Nasdaq 100 contracts fell 0.4%, weighed by Snap Inc.’s poor results, while those on the S&P 500 ticked lower. The Stoxx 600 Index added 0.5%, poised for a weekly advance as investors shrugged off worries about the economic outlook.

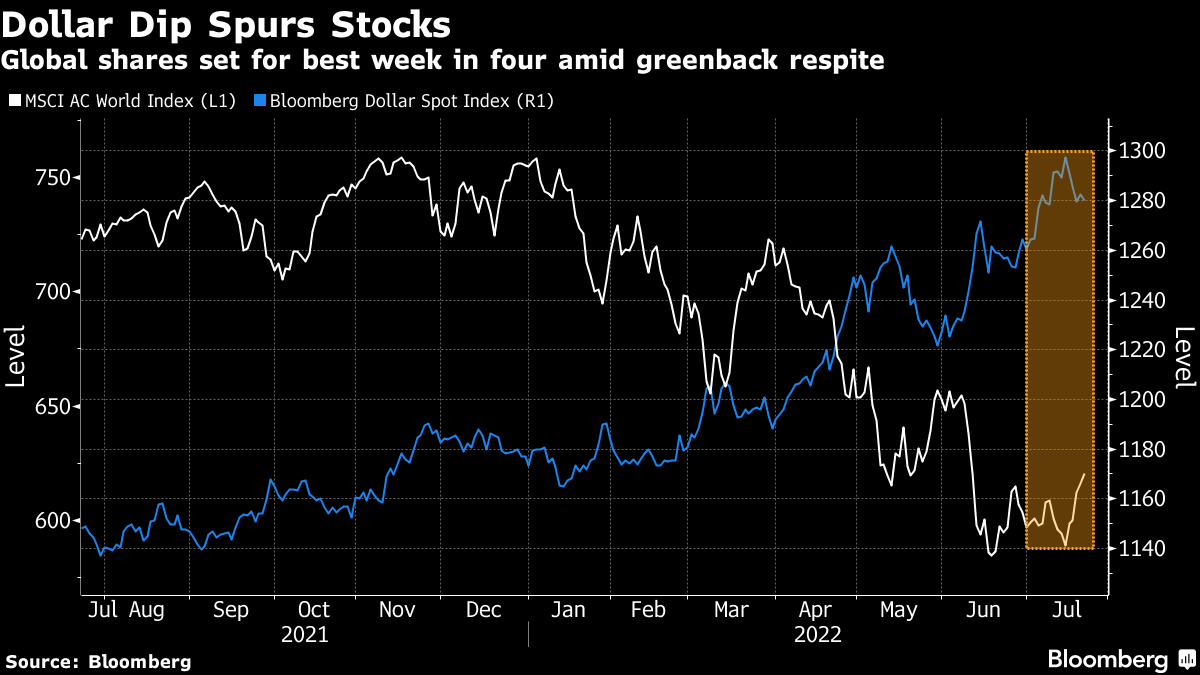

Global stocks remain on course for their best week in a month, paring this year’s equity market rout to about 18%. Speculation that the worst of the selloff has passed is partly behind the move. Tech giant Twitter Inc. is due to report results later.

“Q2 earnings were seemingly not as bad as feared,” Mizuho International Plc strategists Peter McCallum and Evelyne Gomez-Liechti wrote in a note to clients. “That said, tech giants announced spending cuts and a hiring slowdown. Consumer firms lowered this year’s guidance.”

But angst about the damage from inflation and rapidly rising interest rates is proving hard to shake -- despite a tempering in expectations of just how aggressive the Federal Reserve will be.

Underscoring recession fears, Treasuries extended an advance, pushing the 10-year yield to around 2.8%. Economic data Friday showed Germany’s economy shrinking for the first time this year as inflation squeezes businesses and households and the war in Ukraine destroys confidence. US PMIs are due at 9:45 a.m.

Snap’s disappointing revenue hit social media stocks, including Twitter, Facebook parent Meta Platforms Inc. and Google owner Alphabet Inc.

Read more: ‘Awful’ Snap Sales Wipe $69 Billion From Social Media Stocks

The losses mark the second major sector selloff sparked by Snap in two months, as its results become a barometer for ad spending as economic fears mount. There are growing signs that tech companies are preparing for a recession with some pulling back on hiring, while Meta has lost about half of its value this year after disappointing revenue forecasts.

Focus will now turn to the Fed’s meeting next week, where the central bank is again expected to increase interest rates to tame scorching inflation.

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 fell 0.2% as of 6:59 a.m. New York time

- Futures on the Nasdaq 100 fell 0.4%

- Futures on the Dow Jones Industrial Average were little changed

- The Stoxx Europe 600 rose 0.5%

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.6% to $1.0167

- The British pound fell 0.4% to $1.1953

- The Japanese yen was little changed at 137.30 per dollar

Bonds

- The yield on 10-year Treasuries declined six basis points to 2.81%

- Germany’s 10-year yield declined 17 basis points to 1.05%

- Britain’s 10-year yield declined 12 basis points to 1.93%

Commodities

- West Texas Intermediate crude fell 1.4% to $95.04 a barrel

- Gold futures rose 0.5% to $1,739.70 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight