US Futures, European Bonds Drop on Economic Woes: Markets Wrap

(Bloomberg) -- US equity-index futures and European bonds fell as investors worried about the twin threats of dwindling economic growth and stubborn inflation.

Contracts on the S&P 500 and Nasdaq 100 dropped 0.3% each after the underlying indexes capped their 11th decline in 13 weeks. European stocks rose for the first time in four days as dip-buyers emerged. The dollar weakened at the start of the US Independence Day holiday after a report the US may ease tariffs on China. Italian bonds tumbled with investors watching domestic political tensions.

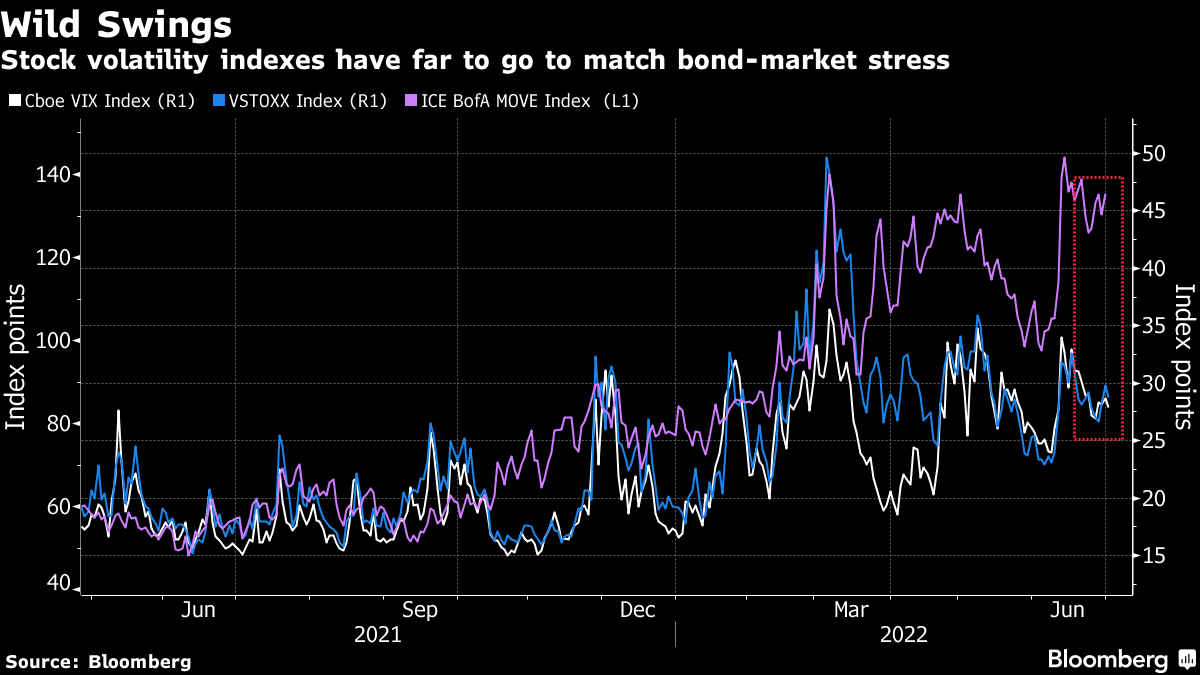

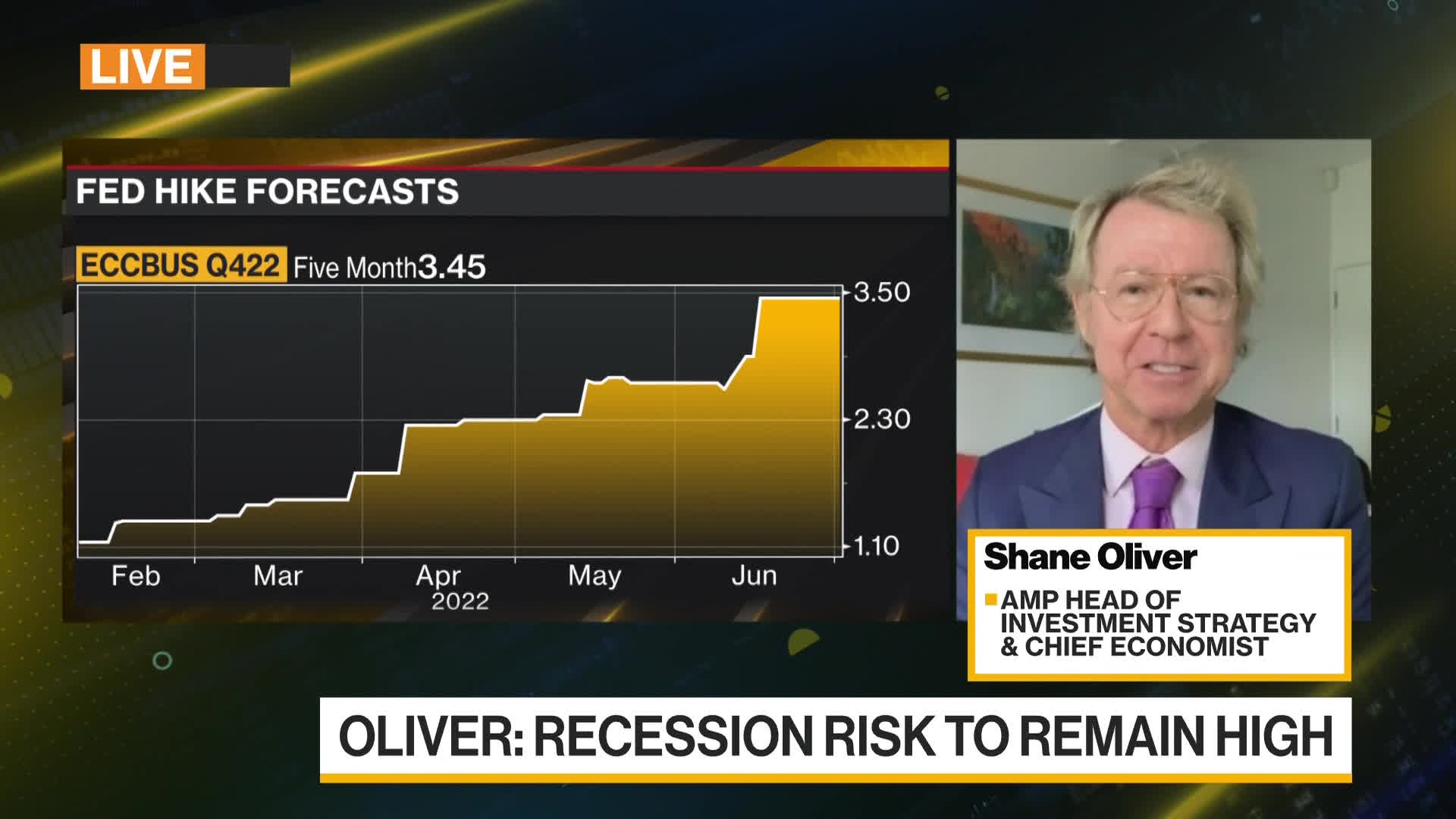

World stocks and bonds are in the grip of the worst selloff in at least three decades as increasing chances of a US -- or even global -- recession are spooking investors. At the same time, sticky inflation has left little room for the Federal Reserve to apply brakes on monetary tightening. This toxic combination presents markets a trading challenge not seen since the late 1970s.

“The market has begun to worry more about economic growth than just liquidity withdrawal and inflation,” Stephen Innes, managing partner at SPI Asset Management, wrote in a note. “Unlike previous downturns, inflation is much higher and unemployment is much lower. These dynamics delay any potential dovish central-bank pivot despite the rapid shift in front-end rate expectations over the past week.”

The MSCI All-Country World Index, the global benchmark, plunged 21% in the first half, the worst year-to-date losses since at least 1988. Similarly, the 14% loss in the Bloomberg Global Aggregate Index of investment-grade debt was its worst performance since 1990, the earliest date for which records are available.

The dollar slipped Monday, sending the euro and British pound 0.3% higher. US President Joe Biden may announce the rolling back of some tariffs on Chinese imports as soon as this week, Dow Jones reported.

In Europe, the Stoxx 600 benchmark climbed 0.7%. Energy, commodity and travel stocks were the biggest gainers.

Italian bonds slid before a meeting between Prime Minister Mario Draghi and Five Star leader Giuseppe Conte to settle weeks of political tensions. The nation’s 10-year yield jumped 12 basis points to 3.21%, widening its spread over German bunds to 1.90 percentage points.

In China, officials were trying to repel a Covid flareup that could buffet an economically significant region. That’s another test of Beijing’s strategy of trying to eliminate the pathogen with mass testing and disruptive lockdowns.

Separately, developer Shimao Group Holdings Ltd. said it didn’t pay a $1 billion dollar note that matured Sunday, among the biggest dollar payment failures so far this year in China.

Crude oil traded steady around $108 a barrel and Bitcoin hovered above the $19,000 level.

What to watch this week:

- Australia rate decision, Tuesday

- PMIs for euro area, China, India among others, Tuesday

- US factory orders, durable goods, Tuesday

- FOMC minutes, US PMIs, ISM services, JOLTS job openings, Wednesday

- EIA crude oil inventory report, Thursday

- Fed Governor Christopher Waller, St. Louis Fed President James Bullard, scheduled to speak, Thursday

- ECB account of its June policy meeting, Thursday

- US employment report for June, Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 fell 0.3% as of 6:48 a.m. New York time

- Futures on the Nasdaq 100 fell 0.3%

- Futures on the Dow Jones Industrial Average fell 0.2%

- The Stoxx Europe 600 rose 0.9%

- The MSCI World index rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.4% to $1.0451

- The British pound rose 0.3% to $1.2132

- The Japanese yen fell 0.2% to 135.42 per dollar

Bonds

- Germany’s 10-year yield advanced six basis points to 1.30%

- Britain’s 10-year yield advanced seven basis points to 2.16%

Commodities

- West Texas Intermediate crude was little changed

- Gold futures rose 0.3% to $1,806.50 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output