Oil Pushes Higher as Tight Market Edges Out Slowdown Concerns

(Bloomberg) -- Oil rose for a second session as investors weighed signs of tight physical markets against concerns over an economic slowdown.

West Texas Intermediate futures edged toward $97 a barrel after closing 0.5% higher on Wednesday. Time spreads are signaling scarce supply and Goldman Sachs Group Inc. said the market is “screaming” it’s very tight. However, sizzling US inflation raised the prospect of further interest rate hikes.

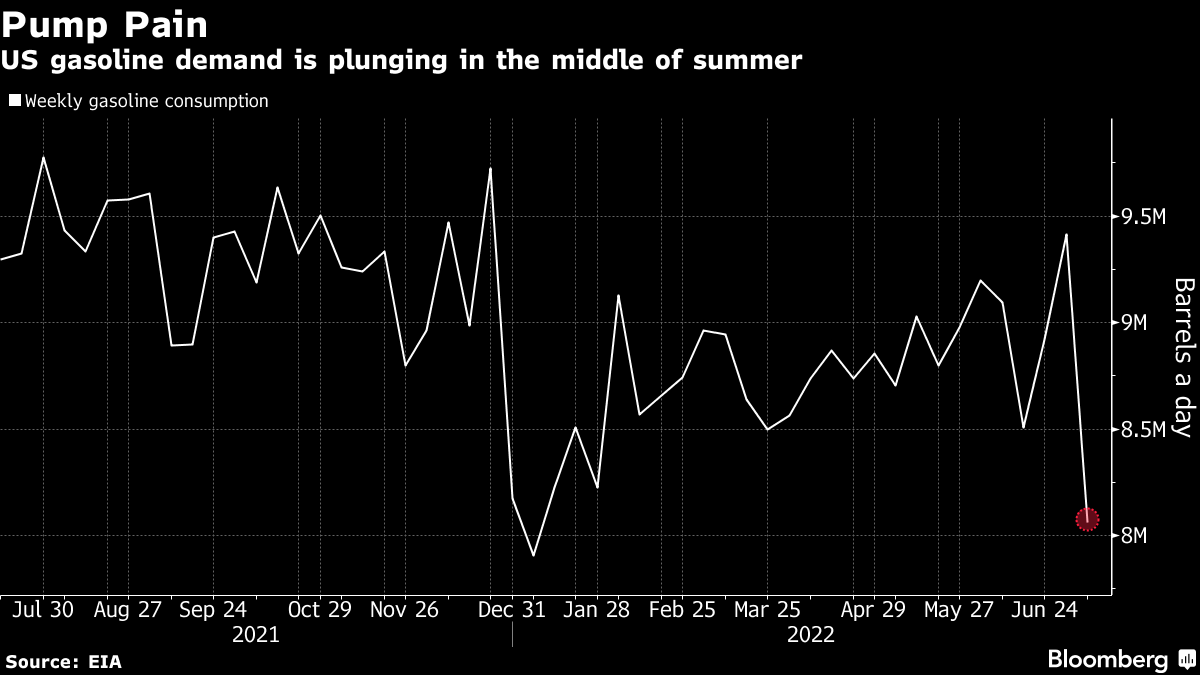

Crude is still heading for a second weekly decline and poised to end the week below $100 a barrel for the first time since early April. High US gasoline prices are starting to taking their toll on consumption, with demand falling last week to the lowest level for this time of the year since 1996.

President Joe Biden landed in the Middle East on Wednesday just as a report showed inflation soared to a four-decade high last month, reflecting higher costs including gasoline, which are a central issue in US elections. Biden has repeatedly called on OPEC to pump more to help tame rising energy prices, and he is scheduled to visit Saudi Arabia during his regional tour.

“Demand is starting to show some weakness,” said Gao Jian, a Shandong-based analyst at Zhaojin Futures Co. “The market is paying high attention to the Biden visit. Any supply increase news could drive prices lower.”

US gasoline demand fell last week to 8.06 million barrels a day, also below the same week in 2020, according to the Energy Information Administration. Aside from the same period two years ago, the four-week rolling average of gasoline demand was the lowest on a seasonal basis since 2000. Crude stockpiles rose by 3.25 million barrels.

Renewed Covid-19 outbreaks in China have also weighed on the outlook for oil demand. Shanghai’s flareup appears to be easing, but other regions are being locked down and facing restrictions to curb the spread of the virus. Nationwide, 292 cases were recorded on Wednesday.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company