U.S. Stocks Bounce Back With Focus on Earnings: Markets Wrap

(Bloomberg) -- U.S. stocks rebounded in early trading and Treasuries reversed a selloff on Wednesday as investors turned their attention to corporate earnings.

The S&P 500 bounced back from a one-month low, with all 11 industry groups advancing. The tech-heavy Nasdaq 100 rallied from lowest since mid-October. Treasury yields fell across the curve, even as expectations grow that the U.S. 10-year will top 2%. A dollar gauge declined for the first time in four days.

Bank stocks rose as the final day of earnings from the big six banks wraps up. Bank of America Corp. shares surged, despite reporting worse-than-expected trading revenue, after the bank saw loan growth return. Morgan Stanley rose after a surprise increase in equities-trading revenue.

Results beyond the financial sector also bolstered sentiment, with UnitedHealth Group Inc. climbing in early trading after beating analysts’ highest estimate, and Procter & Gamble Co. advanced after raising its sales outlook.

Elsewhere, data showed new U.S. home construction unexpectedly strengthened in December to the fastest pace in nine months, led by apartment projects and suggesting builders found some success navigating shortages of materials and labor.

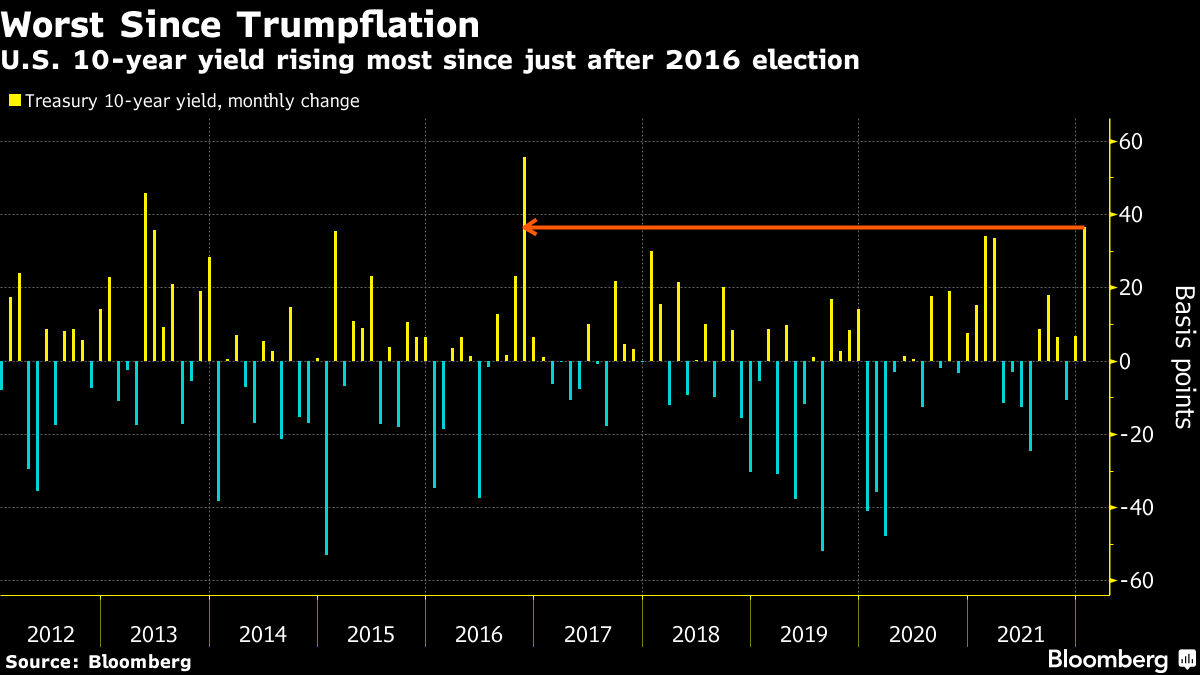

Earnings optimism offset speculation that the Federal Reserve may deliver more than a quarter-percentage point March interest-rate hike to fight inflation, while the Bank of England may move again next month. Britain’s inflation rate surged unexpectedly to the highest since 1992 and Germany’s 10-year yield turned positive for the first time since 2019, before dipping back below zero.

Global equities have had a volatile start to the year, hurt by a more hawkish Fed stance, economic disruptions from omicron and risks to company profits due to rising costs.

“We are in late stage of the cycle, where equities will post lower returns due to weaker growth and higher rates, but we expect the ongoing correction to be short,” Luca Paolini,, chief strategist at Pictet Asset Management, said by email. He’s forecasting the S&P 500 index at 5000 and U.S. 10-year yields at 2% by the end of the year.

Oil held gains above the highest close since 2014 as the International Energy Agency said the market looked tighter than previously thought, with demand proving resilient to the omicron virus strain.

In China, where policy is diverging from the U.S., the central bank has pledged to use more monetary policy tools to aid the economy and ease credit stress amid a real-estate slump.

For more market analysis, read our MLIV blog.

What to watch this week:

- Netflix is among companies publishing earnings during the week

- U.S. data includes jobless claims Thursday

- Interest-rate decisions due from nations including Indonesia, Malaysia, Norway, Turkey and Ukraine, Thursday

- EIA crude oil inventory report, Thursday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.7% as of 9:53 a.m. New York time

- The Nasdaq 100 rose 0.9%

- The Dow Jones Industrial Average rose 0.4%

- The Stoxx Europe 600 rose 0.8%

- The MSCI World index rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro rose 0.2% to $1.1344

- The British pound rose 0.4% to $1.3644

- The Japanese yen rose 0.2% to 114.34 per dollar

Bonds

- The yield on 10-year Treasuries declined two basis points to 1.85%

- Germany’s 10-year yield advanced one basis point to -0.01%

- Britain’s 10-year yield advanced five basis points to 1.27%

Commodities

- West Texas Intermediate crude rose 1.4% to $86.64 a barrel

- Gold futures rose 0.8% to $1,826.30 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight