Surging Competition Forces Asia Plastics Makers to Stifle Output

(Bloomberg) -- Some of Asia's biggest producers of the building blocks used to make plastic are cutting processing rates after a robust expansion of capacity last year led to rising feedstock costs and weakening profit margins.

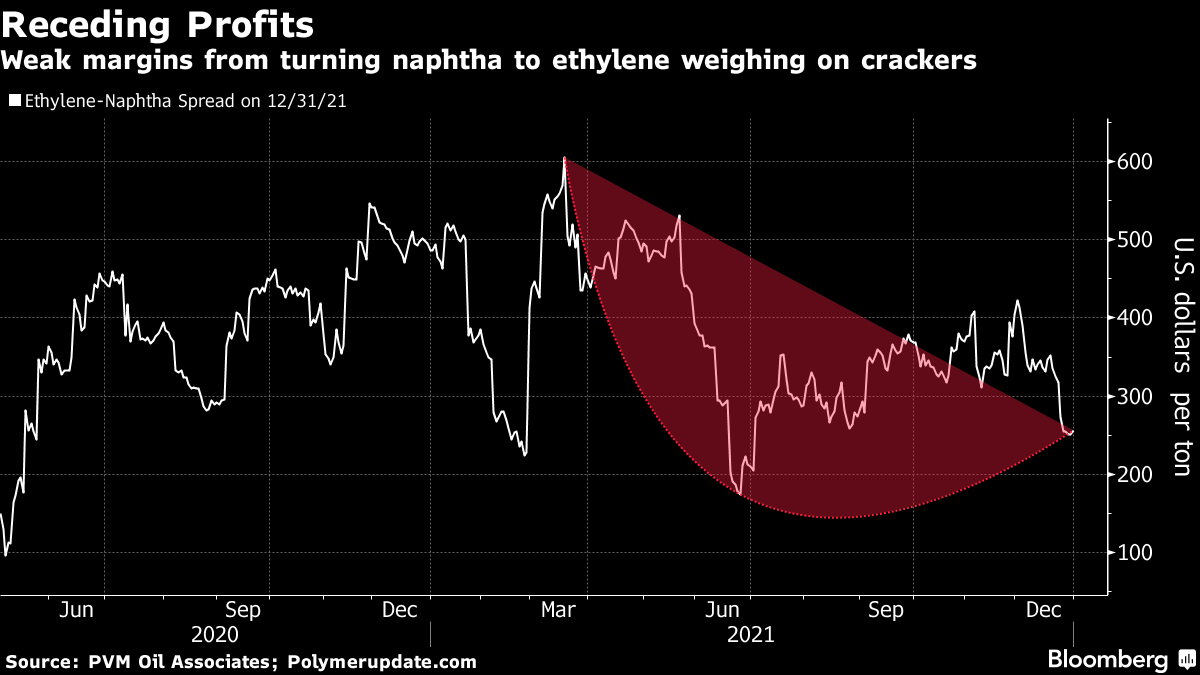

Output has surged, while oil-based naphtha has become more expensive due to increased demand and the rising cost of crude. That's combined to drive profits from converting naphtha to ethylene to the lowest since July. Ethylene cracker operators including Taiwan's Formosa Petrochemical Corp. and South Korea's LG Chem Ltd. responded by trimming processing, said traders and an analyst.

We expect cracker margins to remain fairly weak through January as downstream demand, especially in China, will be muted with the Lunar New Year approaching, said Jeslyn Chua, a lead analyst at industry consultant FGE. Ethylene supply in Asia has increased due to capacity additions.

Â Â

Â

Asia's total steam cracking capacity rose by about 20% in 2021, according to FGE, with LG Chem among processors expanding operations. Rising naphtha costs have also prompted some companies to seek liquefied natural gas as a substitute feedstock. LPG is typically used more frequently outside of the winter months, when heating demand eases.

South Korea's Hanwha Total bought LPG cargoes for January and February delivery for cracking, FGE's Chua said. A trader confirmed the purchases. A spokesman for the company didn't respond to an email seeking comment.

See also: Plastic Makers Reel on Soaring Oil Costs, Rising Competition

China's Sinopec Zhenhai Refining & Chemical Co. started its 1.2-million tons a year cracker at Ningbo late last year, while South Korea's Hyundai Chemical Co. ramped up output at its new 750,000-tons a year cracker in December, according to FGE. Earlier last year, South Korea's GS Caltex Corp. and LG Chem added a combined 1.55 million tons.

LG Chem cut processing rates at all of its crackers and is currently operating at about 80% capacity, while Formosa is running its plant at 90% to 95%, three traders said. The companies didn't respond to emails seeking comment.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight