Oil Steadies After Tightening Market Spurs Robust New Year Rally

(Bloomberg) -- Oil steadied near a two-month high after U.S. stockpiles contracted and energy agencies said markets were tightening.

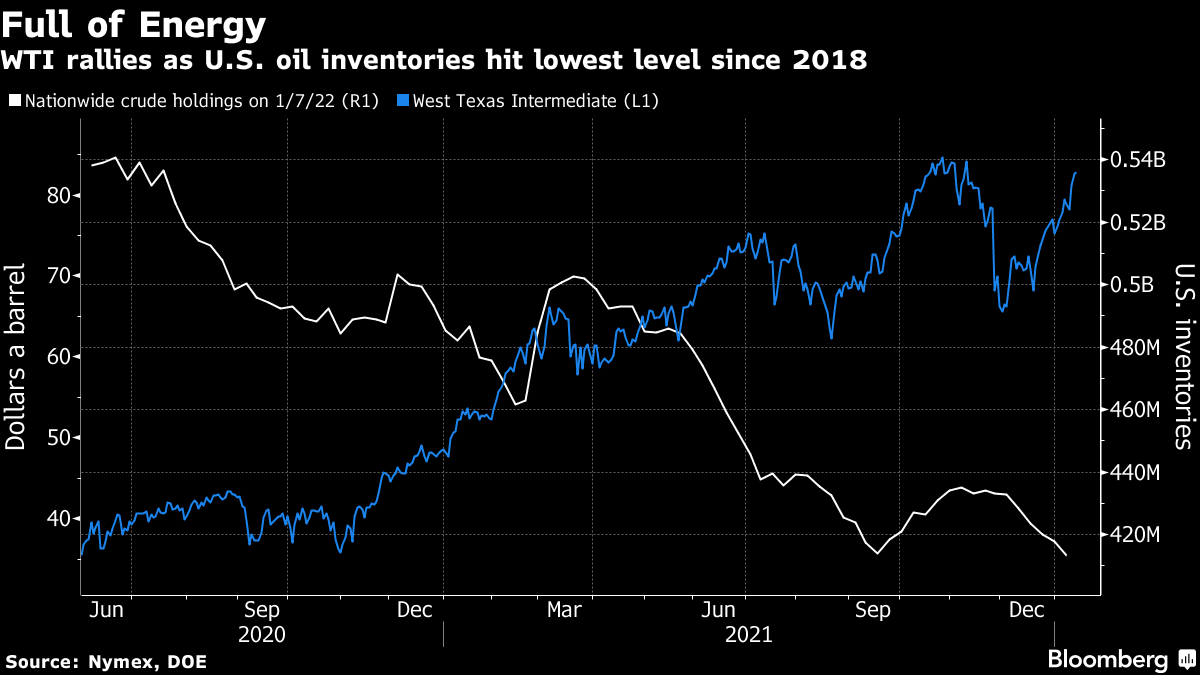

West Texas Intermediate held above $82 a barrel after closing at the highest level since Nov. 9 on Wednesday. Since 2022 began, WTI has surged almost 10%, joining other commodities in a strong start to the year.

U.S. crude stockpiles sank to the lowest level since 2018 last week, according to data from the Energy Information Administration on Wednesday. Inventories at the key storage hub in Cushing also fell, the government agency said.

Crude has surged this month on signals that global consumption is largely weathering the hit from the omicron virus variant as key economies continue to recover from the pandemic. The International Energy Agency said demand is stronger than expected, while the EIA’s latest outlook showed that global oil inventories are set to decline slightly over the first quarter. Prices have also been aided by supply disruptions in Libya and Kazakhstan.

Sentiment “remains largely constructive,” said Warren Patterson, Singapore-based head of commodities strategy at ING Groep NV. “Supply disruptions, uncertainty over OPEC spare capacity and waning concerns over omicron have all proved bullish for prices. EIA numbers provided a further boost.”

Still, there are some warning signs. Road traffic has thinned across Asia at the start of the year as omicron sweeps through the key crude-importing region. Fewer vehicles have transited through most capital cities so far this month than in December, according to mobility data from Apple Inc.

Oil’s renewed surge -- along with gains in other raw materials -- will fan inflationary pressures as central banks shift gears to battle escalating price pressures. Federal Reserve Governor Lael Brainard said tackling inflation while sustaining an inclusive recovery is the U.S. central bank’s most pressing task.

Optimism about the outlook is reflected in the market’s bullish backwardated pricing structure, with near-term contracts trading above those further out. The spread between WTI’s two nearest December contracts -- the one for 2022 and for the same month next year -- was at $6.37 a barrel. That’s up from less than $5 at the end of last year.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight