Ukraine Crisis Ripples Through World Markets From Stocks to Gold

(Bloomberg) -- It’s been a volatile start to the week for global equities, and that was before U.S. markets began to trade following a holiday-extended weekend.

Stocks in Europe fell as much as 2% on Tuesday before recouping most of those losses as investors digested increasing Ukraine tensions that almost put major indexes at the brink of a correction. Following similar gyrations on U.S. stock futures, the S&P 500 Index slipped 0.6% in early trade, with investors staying on the sidelines after having loaded up on havens such as gold and U.S. Treasuries.

Given the extreme volatility over the past two weeks, the S&P 500 is still at risk of hitting a fresh July 2021 low and strategists have warned of a sharper selloff if there is a full-blown conflict.

The biggest impact, however, has been felt by Russian stocks amid growing worries about sanctions from Western nations on the country after President Vladimir Putin recognized two self-proclaimed separatist republics in eastern Ukraine and ordered troops to be sent to there. Russia’s main stocks index plunged as much as 19% for the week at one point.

Elsewhere, brent crude got very close to $100 a barrel.

Here are five charts that capture the picture in markets:

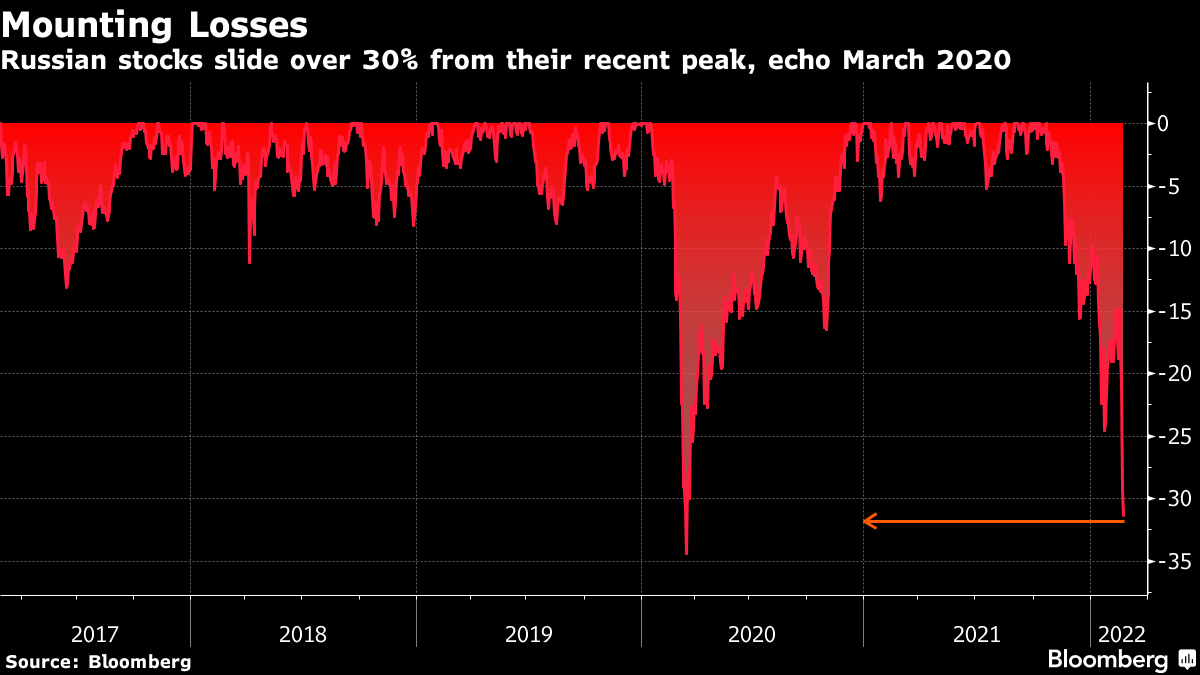

Going Down Quickly

Russian stocks extended their declines on Tuesday after Putin ordered forces to the breakaway regions. The benchmark MOEX index is down more than 30% from its October peak, with most of those losses incurred this week.

Ruble in Trouble

The ruble had dropped to the lowest since late 2020 before erasing declines and trading 0.9% stronger by 5:36 p.m. in Moscow on Tuesday. It’s still one of the worst-performing currencies of 2022 amid rising tensions with Ukraine.

Europe’s Good 2022 Start Is Faltering

The standoff adds to a wall of worries for global stock markets, following a rout triggered by concerns over aggressive monetary tightening by central banks anxious to tame surging inflation. The less-forgiving macroeconomic backdrop has pulled major benchmarks off their record highs, with the Stoxx Europe 600 index nearing a 10% correction.

S&P 500 Correction

The S&P 500 Index is also nearing correction territory. Strategists at Goldman Sachs Group Inc. see a full-blown conflict in Ukraine implying downside of 6.2% for the benchmark and an even sharper drop of almost 10% for the Nasdaq 100 Index. Both Goldman and Morgan Stanley see a potential de-escalation leading to a relief rally of about 5% for U.S. stocks.

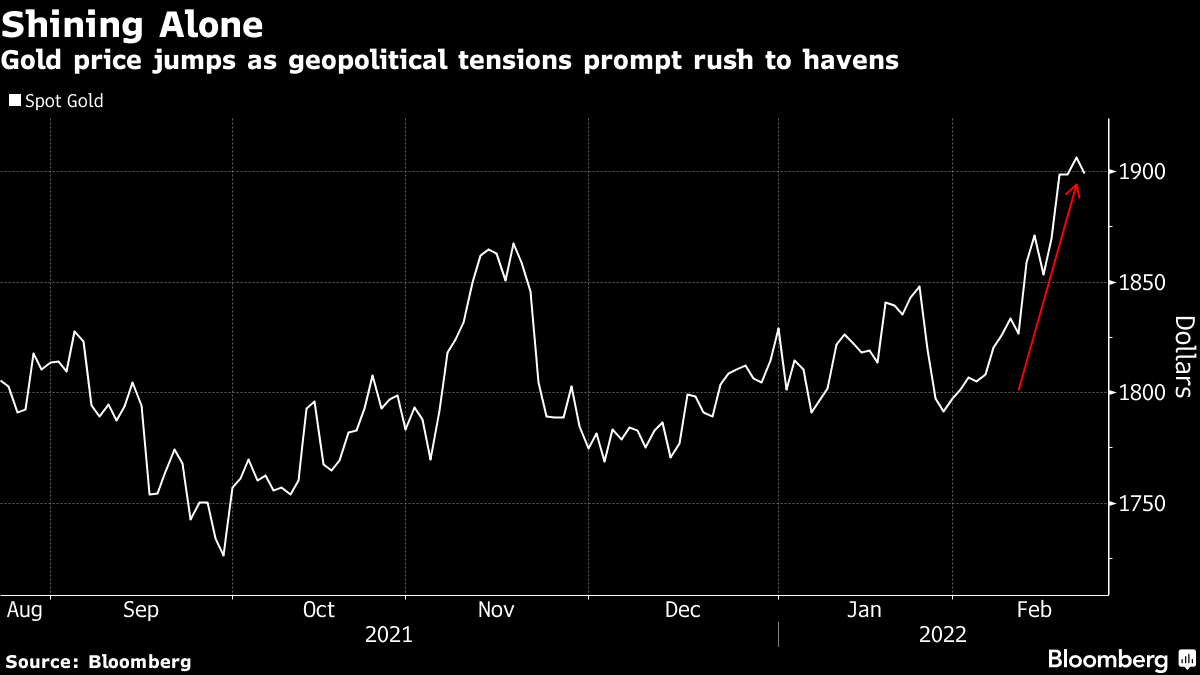

Gold Standard

Spot gold prices have soared in February as investors sought safer investments. Bullion is just shy of hitting the highest level since June 2021.

(Updates prices throughout)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week