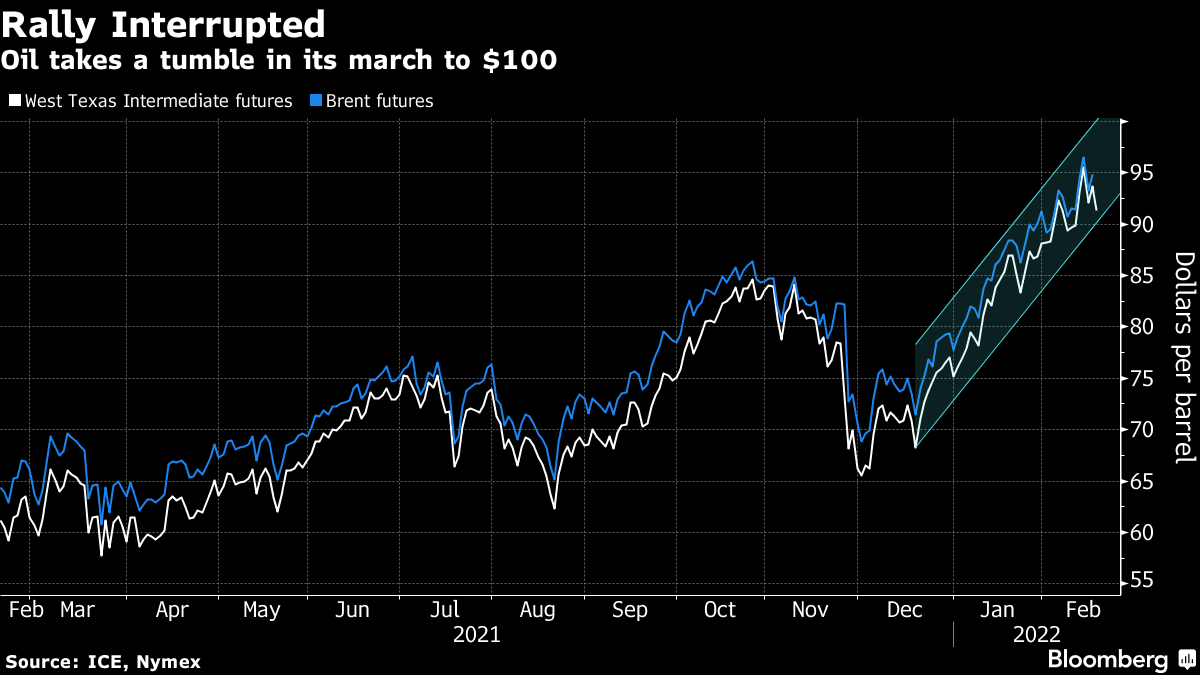

Oil Tumbles on Prospect Iranian Nuclear Deal May Be Within Sight

(Bloomberg) -- Oil tumbled on signs that an Iranian nuclear deal may be imminent, which could pave the way for a resumption of official flows from the Persian Gulf producer and ease tightness in the global market.

West Texas Intermediate fell more than 2% after closing above $93 a barrel Wednesday. Iran’s top negotiator, Ali Bagheri Kani, tweeted that efforts to restore the deal are “closer than ever” to agreement, although the U.S. State Department was more circumspect. Tehran appears to be taking steps in Asia for its official return to the market, with officials from state-owned National Iranian Oil Co. meeting South Korean refiners to discuss potential supply.

Russia has insisted that it’s serious about easing tensions over Ukraine, but the U.S. rejected that claim, saying Moscow is still building up troop levels near the border. An emergency summit of European leaders on the situation is set for later on Thursday. Moscow has repeatedly denied that it plans an invasion.

Crude rallied to the highest since 2014 this week as demand picked up and the Ukraine crisis added a risk premium. Should a deal with Iran be concluded, it could lead to a resumption of sanctions-free exports, augmenting global supplies. Still, obstacles to an agreement remain substantial, with major differences on what’s required to roll back Iranian nuclear advances.

“Positive developments in the U.S.-Iran nuclear negotiations are helping to calm oil prices,” Rystad Energy AS Senior Vice President Claudio Galimberti said in a note. “Although not a done deal yet, prices are sliding on news of progress and broad consensus in the talks as it could ultimately see up to 900,000 barrels a day of crude added to the market by December this year.”

The reintroduction of sanctions-free Iranian shipments, as well as clearing crude that Tehran has stockpiled, would cool a market that’s been transfixed by the possibility futures could hit $100 a barrel. Brent’s prompt spread -- the difference between its two nearest contracts and one gauge of tightness -- eased to $2.26 a barrel in backwardation from as much as $2.57 a day earlier.

The hurdles that remain before a Iranian nuclear deal can be concluded were also highlighted in the negotiator’s tweet. “Nothing is agreed until everything is agreed, though,” it added. “Our negotiating partners need to be realistic, avoid intransigence and heed lessons of past 4yrs.”

There have been further signs this week that oil consumption has been outpacing supply. On Wednesday, data showed inventories at the key U.S. storage hub at Cushing, Oklahoma, sank to the lowest since 2018. Dated Brent, the price of cargoes bought and sold in the North Sea, reached $100.80 a barrel for the first time since 2014.

Energy consumption is being fired up as economies power back from the impact of the pandemic. Europe is leaving anti-virus curbs behind, with Germany and Greece poised to become the latest in the region to unwind regulations.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output