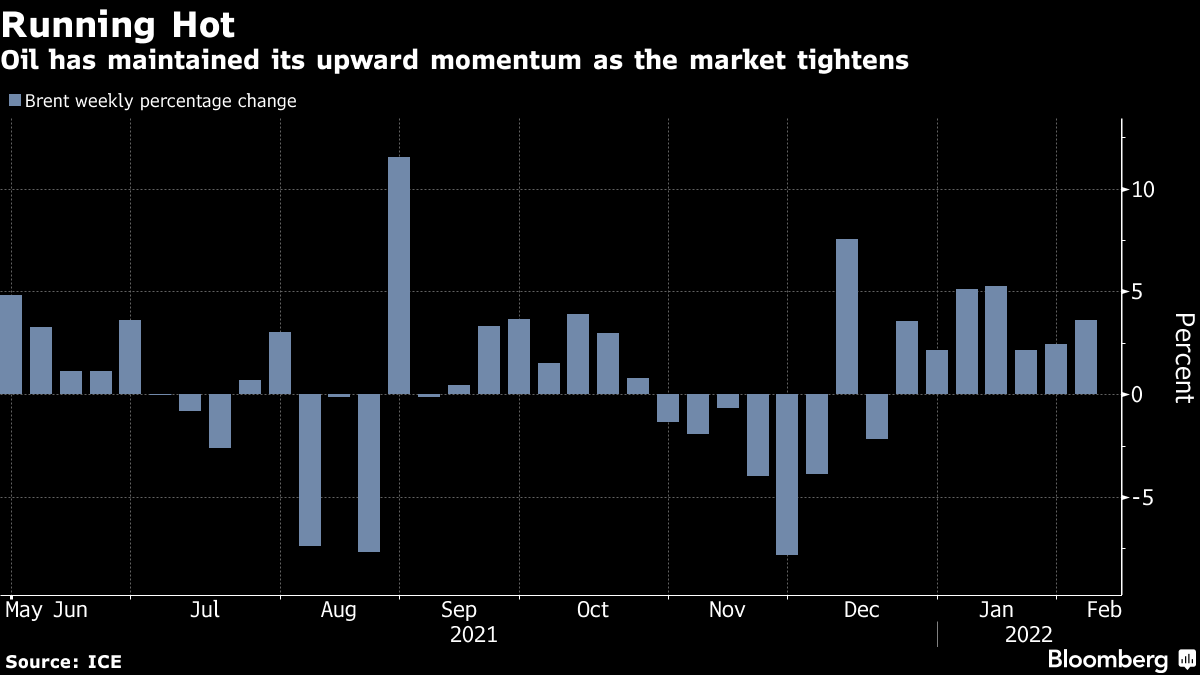

Oil Fluctuates as Red-Hot Rally Cools After Seven Weekly Gains

(Bloomberg) -- Brent oil fluctuated in Asian trading following a run of seven weekly gains thats pushed crude to the highest level since 2014.

Futures in London swung between gains and losses after climbing as high as $94 a barrel. Oils market structure is flashing signs of tighter supplies and inventories at key storage hubs are falling. Saudi Arabia signaled confidence in the outlook for robust demand continuing by raising its crude prices for customers in Asia, the U.S. and Europe for March.

The tight oil market is being reflected at the pump. In the U.S., the average price of gasoline rose to the highest level in more than seven years, according to data. That poses a fresh challenge to President Joe Biden as he tries to combat surging energy costs.

See also: Gasoline Prices Aren't Dropping Anytime Soon: Julian Lee

Â Â

Â

Oil has rallied on improving demand and supply outages, putting $100 within reach and raising concerns about inflation. Thereas also a geopolitical risk premium in the price as Russia amasses troops near its border with Ukraine, although President Vladimir Putin has said he has no plans to invade.

Meanwhile, the prospect of Iranian crude returning took a small step forward last week. U.S. Secretary of State Antony Blinken signed several sanctions waivers related to Irans civilian nuclear activities, according to an Associated Press report that cited documents. However, Iran said it still needs guarantees from Washington in order to revive a nuclear deal with world powers.

Demand for petrol-based products is soaring, while OPEC and U.S. shale supply remain constrained, said Stephen Innes, managing partner at SPI Asset Management Pte. “Having Iran back in the supply mix would have a significant and lasting impact on oil prices. It would likely stop the soaring price rally.

OPEC+ last week agreed to boost output by 400,000 barrels a day in March, but the group is struggling to fulfill its supply pledges. One of Libya's biggest oil companies was recently forced to cut output due to a lack of storage capacity caused by the inability to perform maintenance on tanks.

U.S. supply has also been trimmed. The extreme cold thats descended across Texas prompted some oil producers in the Permian Basin to halt a small part of their output as icy roads disrupt critical trucking operations. A power outage Friday also knocked out production at two major refineries in Texas, though a plant operated by Valero Energy Corp. has begun restarting units.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight