Oil’s Modest Annual Gain Belies a Year of Staggering Volatility

(Bloomberg) -- Oil ended a volatile year modestly higher as investors look ahead to a potential rebound in Chinese demand next year.

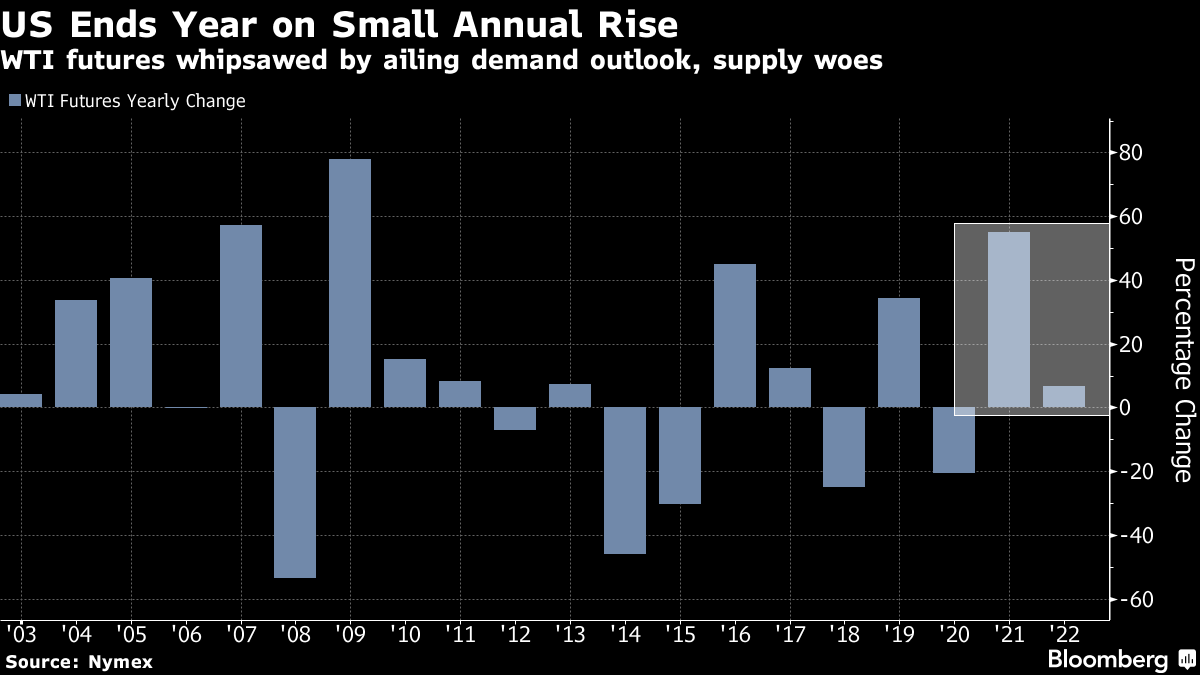

West Texas Intermediate futures staged a last-minute rally in the final session of the year to settle above $80, marking a 4% annual gain. The finish was a far cry from the triple digits seen earlier this year after Russia’s invasion of Ukraine upended global supplies and sent prices soaring.

The global Brent benchmark traded in a $64 range, the largest since 2008, and at times experienced the biggest weekly swings on record. Such stomach-churning volatility proved too much for many traders, curbing liquidity and further driving sharp swings. At its peak, oil futures traded past $139, but the gains largely evaporated given concerns that central bank efforts to curb inflation will bite into growth and uncertainty over China’s demand prospects.

China is currently tackling surging virus cases and fears are mounting about a fresh global outbreak, but there’s optimism demand will eventually rebound in the world’s top crude importer.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight