Oil Rises After Four-Day Retreat as China Edges Toward Reopening

(Bloomberg) -- Oil rose after a four-day drop as investors weighed the impact of China’s moves to ease virus curbs against the risk of a slowdown in the US.

West Texas Intermediate climbed toward $73 a barrel after plunging more than 11% over the previous four sessions as a raft of US banks sounded the alarm on a possible recession. Among the latest, Citigroup Inc. Chief Executive Officer Jane Fraser flagged countries including the US rolling into recessionary environments. Those concerns have been tempered by positive signals from China, which is rolling back Covid curbs in a boost for energy consumption.

Oil has weakened this month, shedding all of the year’s once-substantial gains, as central banks tighten monetary policy and the macroeconomic outlook sours. Fresh curbs on crude from Russia meant to punish Moscow for the war in Ukraine have so far not disrupted trade substantially, although there is a growing blockage of oil tankers in waters off Turkey. In addition, market liquidity has been thinning out as the year-end approaches.

“Crude has been struggling amid demand worries,” said Ravindra Rao, head of commodity research at Kotak Securities Ltd. “But easing of curbs in China is creating hopes of demand revival.”

Until about a week ago, Chinese officials were still pledging to quash and eliminate Covid-19 from the world’s largest crude importer. But protests against the stringent rules seem to have hastened China’s pivot away from a policy that has been closely tied to President Xi Jinping.

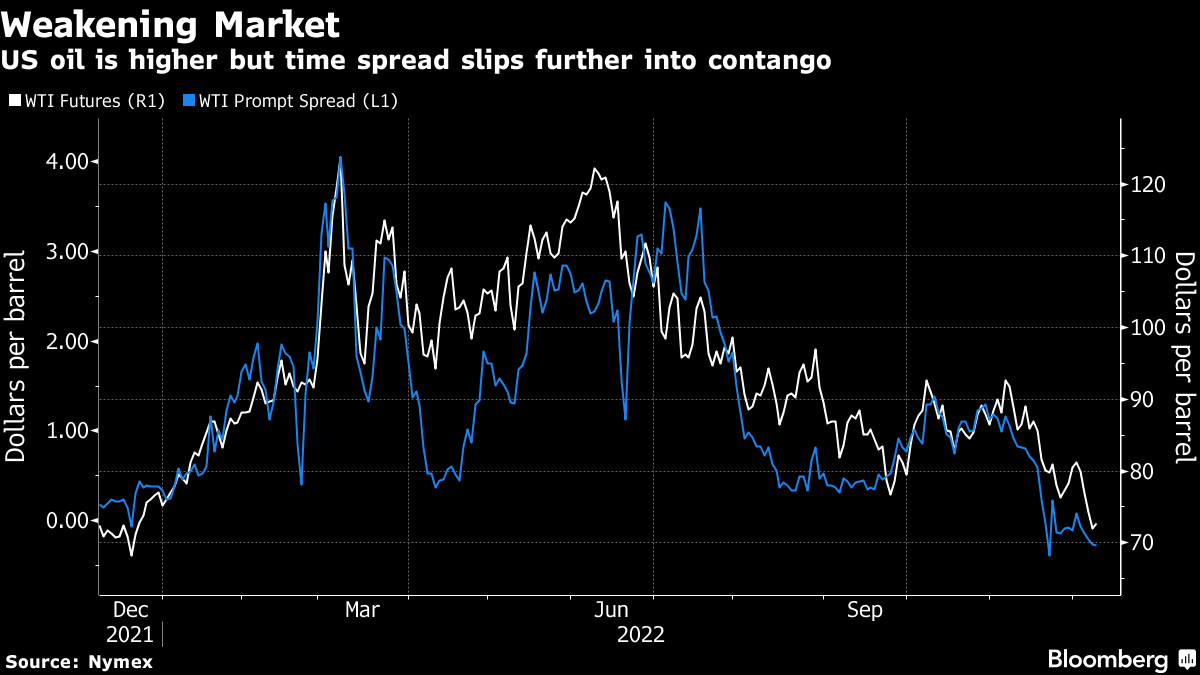

Key time spreads are indicating ample near-term supply. WTI’s prompt spread — the difference between the two nearest contracts — is slipping further into a bearish contango structure. The gap was 26 cents a barrel in contango compared with 91 cents in the opposite backwardated structure a month ago.

Adding to the downbeat mood, the US Energy Information Administration reported on Wednesday that distillate and gasoline inventories expanded last week, indicating weaker demand in the world’s largest economy. Still, the snapshot also showed another draw in nationwide crude inventories.

“Risks on the demand outlook remain a key overhang for oil prices, and the uncertainty on how far economic conditions may moderate could keep some investors shunning” the market, said Yeap Jun Rong, market strategist for IG Asia Pte. There’s been “some unwinding of previous bullish bets.”

The Biden Administration, meanwhile, is still weighing the impact of China’s reopening and the price cap on Russian supplies before moving to start replenishing depleted strategic petroleum reserves, according to Amos Hochstein, the State Department’s senior energy security adviser.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company