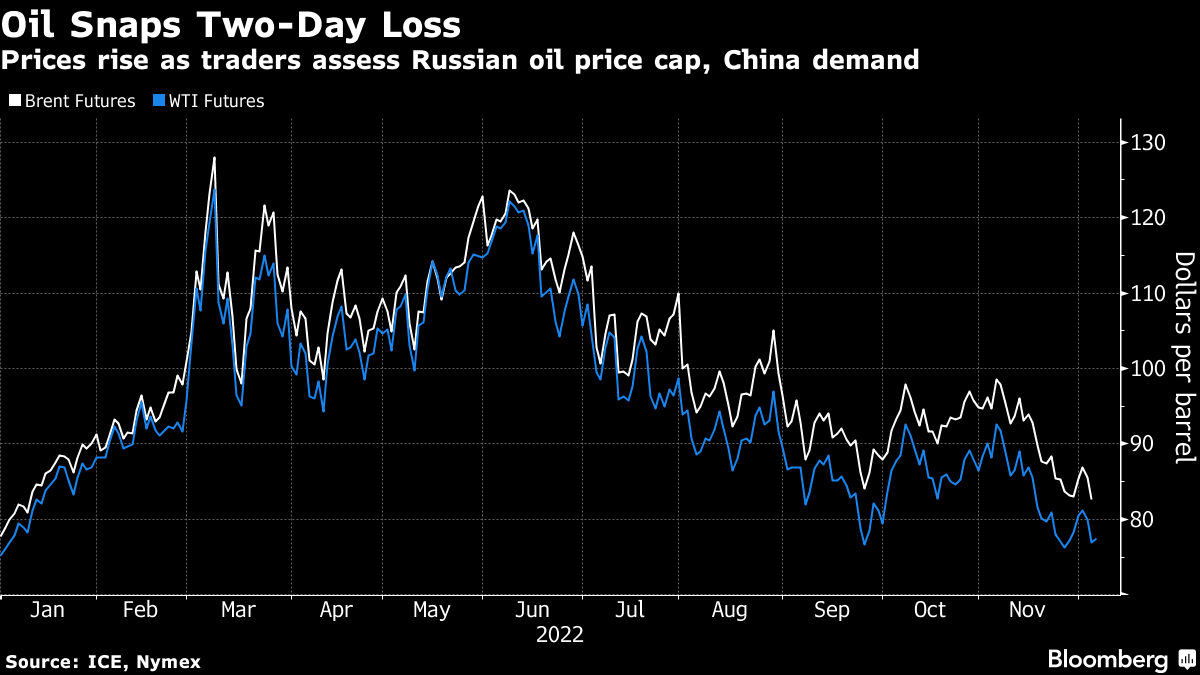

Oil Resumes Advance as China’s Covid Pivot Aids Demand Outlook

(Bloomberg) -- Oil rose after a two-day drop on more signs China is moving away from its strict Covid Zero policy, and as investors assessed the implications for global flows from the price cap imposed on Russian crude.

West Texas Intermediate climbed toward $78 a barrel following a roller-coaster session on Monday, when a broad shift away from risk assets saw prices close down 3.8% after earlier gains. The city of Beijing will scrap Covid testing requirements at public venues following similar moves in other centers, bolstering the outlook for demand in the world’s largest crude importer.

The market is weighing the long-term impact of the latest round of restrictions placed on Russian crude by the European Union and Group of Seven to punish Moscow for the war in Ukraine. These include limits on insurance and a $60-a-barrel cap on Russian oil. So far, although some ships are stuck near Turkey in part due to the changes, there’s been no widespread disruption.

Oil has rebounded since hitting the lowest level since late 2021 last week as demand prospects brightened, especially in China. Authorities have been gradually scaling back virus restrictions following rare protests. That contributed to a decision by the Organization of Petroleum Exporting Countries and its allies to stand pat on output policy at the weekend.

The US-led cap — which has been rejected by Moscow — is meant reduce Russian revenues from crude sales, yet at the same time keep the nation’s shipments flowing to buyers outside the EU and G-7. The $60-a-barrel figure is above the price of Russia’s key Urals grade.

There’s uncertainty over “how quickly China relaxes Covid measures and the full impact of the EU ban and G-7 price cap,” said Warren Patterson, head of commodities strategy at ING Groep NV in Singapore. “For now though, given that the G-7 price cap is above where Urals are trading, we expect it to have little direct impact.”

Saudi Arabia, meanwhile, lowered most oil prices for Asia, including for its flagship Arab Light grade, in a sign demand remains fragile. The move was largely in line with refiners’ and traders’ predictions, according to a Bloomberg survey, and takes the price to its lowest level since March.

Oil’s time spreads have continued to weaken, signaling ample near-term supply. WTI’s six-month spread was 37 cents a barrel in contango, a bearish pattern, compared with 64 cents a barrel in the opposite backwardated structure a week ago.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output