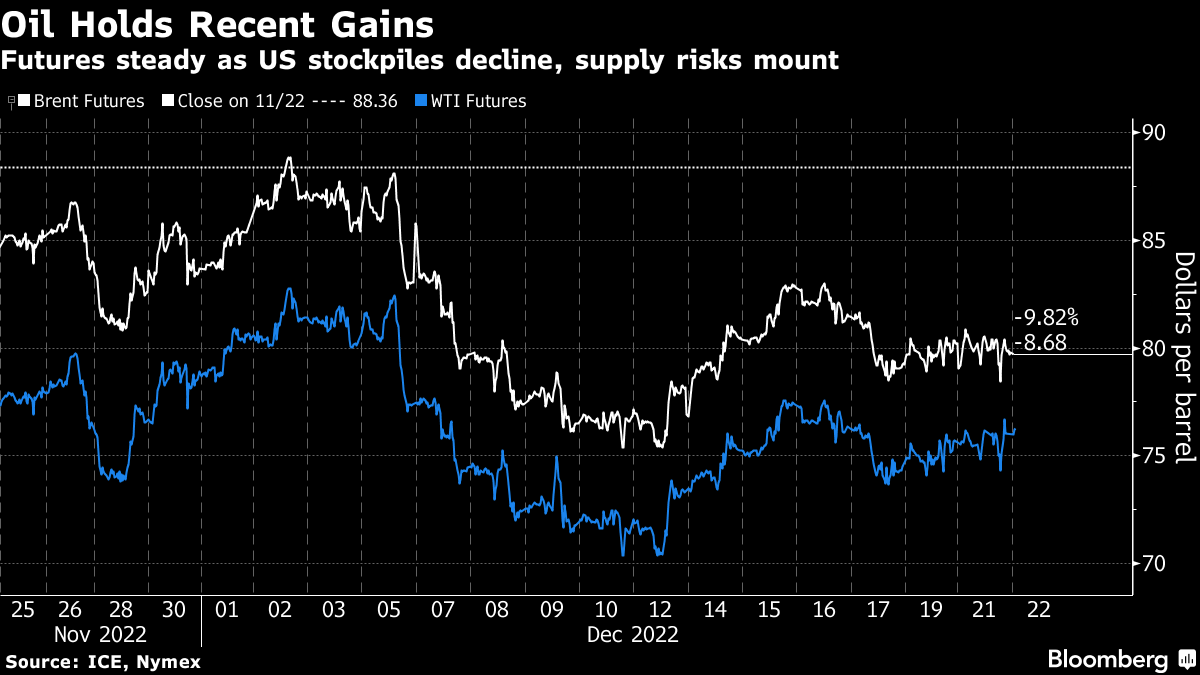

Oil Holds Two-Day Gain on US Stockpile Decline, Risks to Supply

(Bloomberg) -- Oil held a two-day gain as a report showing a drop in US stockpiles and threats to supply countered concerns about a slowdown.

West Texas Intermediate for February delivery traded above $76 a barrel after rising more than 2% in the week’s first two sessions amid declining liquidity. The American Petroleum Institute said US crude inventories shrank by 3.1 million barrels last week, according to people familiar with the data.

Russia’s seaborne oil shipments collapsed in the first week of Group-of-Seven sanctions targeting Moscow’s petroleum revenues, a potential source of alarm for governments around the world. In North America, meanwhile, TC Energy Corp. pushed back the full return of its Keystone pipeline by a week.

Crude remains on track for the first back-to-back quarterly decline since 2019 as further tightening by leading central banks risks tipping the US and European Union into recessions. Traders are also tracking the impact of China’s easing of harsh virus restrictions, and a warning from Saudi Arabia that the Organization of Petroleum Exporting Countries and its allies would remain proactive and pre-emptive in managing the global oil market.

“It’s a holding pattern for crude, which is not surprising, going into the year-end holiday season with thin liquidity,” said Vandana Hari, founder of Vanda Insights. “The consistent theme remains growing global economic worries.”

Oil’s gain on Tuesday was aided by a drop in the dollar following a hawkish shift by the Bank of Japan. The Bloomberg Dollar Spot Index was steady after the prior session’s decline, making commodities priced in the US currency more attractive for overseas buyers.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output