Oil Extends Drop in Thin Trading as Fears Over Covid Wave Mount

(Bloomberg) -- Oil extended losses on concerns that China’s rapid dismantling of its Covid Zero policy could lead to a surge in cases across the world.

West Texas Intermediate fell toward $78 a barrel after closing 0.7% lower on Wednesday. The US will require airline passengers from China to show negative virus tests, while Italy will begin testing arrivals from the Asian nation. That’s overshadowing optimism over a longer-term demand recovery in China.

See also: Stocks Sink on Fresh Covid Threat to World Economy: Markets Wrap

“The removal of travel restrictions could precipitate another global outbreak,” said John Driscoll, director of JTD Energy Services Pte in Singapore. “It raises the potential of a demand hit and flattening prices.”

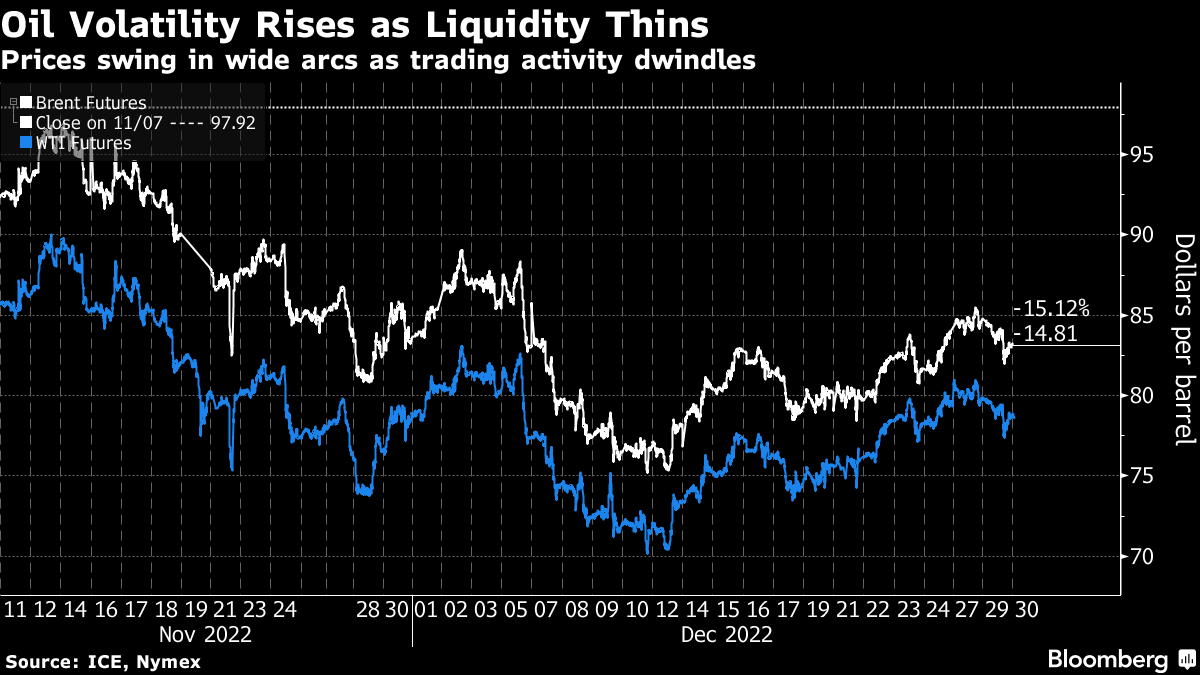

Crude is heading for the first back-to-back quarterly loss since 2019 after a volatile year that saw futures surge following Russia’s invasion of Ukraine before retreating as concerns over a global economic slowdown mounted. A lack of liquidity has exacerbated price swings this year.

Meanwhile, the industry-funded American Petroleum Institute reported US commercial crude inventories fell by 1.3 million barrels last week, according to Dow Jones. Stockpiles at the storage hub at Cushing, Oklahoma, also shrunk, although gasoline and distillate supplies expanded.

Moscow this week banned exports of Russian crude oil and refined products to foreign buyers that adhere to the price cap. But while it’s so far looked in line with previous pledges and won’t disrupt global supply, the Kremlin has left itself room for a tougher stance in its decree.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company