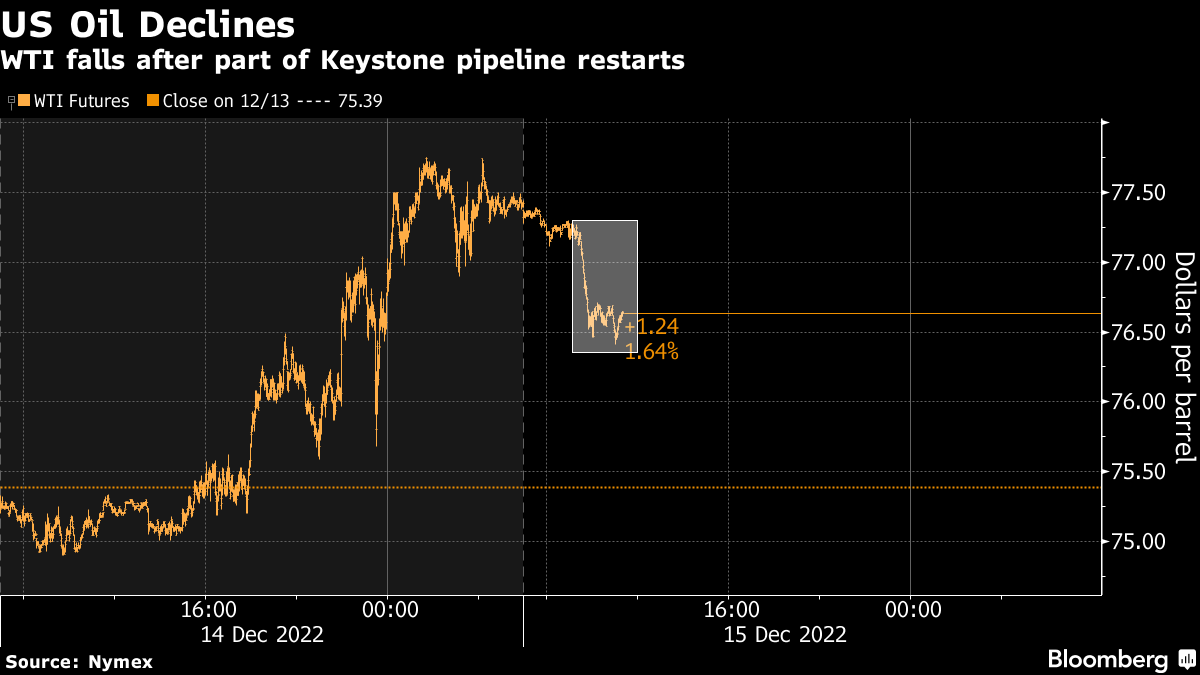

Oil Declines After Section of Major Keystone Pipeline Restarts

(Bloomberg) -- Oil slipped after rallying almost 9% over the previous three sessions as TC Energy Corp. restarted a section of the Keystone pipeline, allowing for some flows to resume on the major conduit.

West Texas Intermediate futures retreated below $77 a barrel, while global benchmark Brent crude declined. A section of the pipeline that extends from Hardisty, Alberta, to Wood River and Patoka, Illinois, was restarted and TC Energy is continuing repair and remediation on the affected segment.

The restart “may help to ease supply concerns as well and drive some near-term volatility,” said Yeap Jun Rong, a market strategist at IG Asia Pte. The long-term outlook still revolves around “global economic activities, which is seeing some face-off between hawkish Fed policies and China’s reopening.”

Oil is still on track to end 2022 marginally higher following a volatile period that’s been exacerbated by a persistent lack of liquidity. However, investors are juggling a mixed outlook for commodity demand, including the near-term impact of China’s end to Covid Zero, which has sparked a surge in infections.

The International Energy Agency said Wednesday that oil prices could rally next year as sanctions squeeze Russian supply, although OPEC and Goldman Sachs Group Inc. are cautious about demand in early 2023. The US Federal Reserve also raised interest rates again and warned they still have room to climb.

Prompt time spreads held in a bearish contango structure, although the gap has narrowed. The difference between the two nearest contracts for global benchmark Brent was 5 cents a barrel in contango, compared with 44 cents a week earlier.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight