Oil Set for Weekly Loss as Slowdown Concerns Offset US Demand

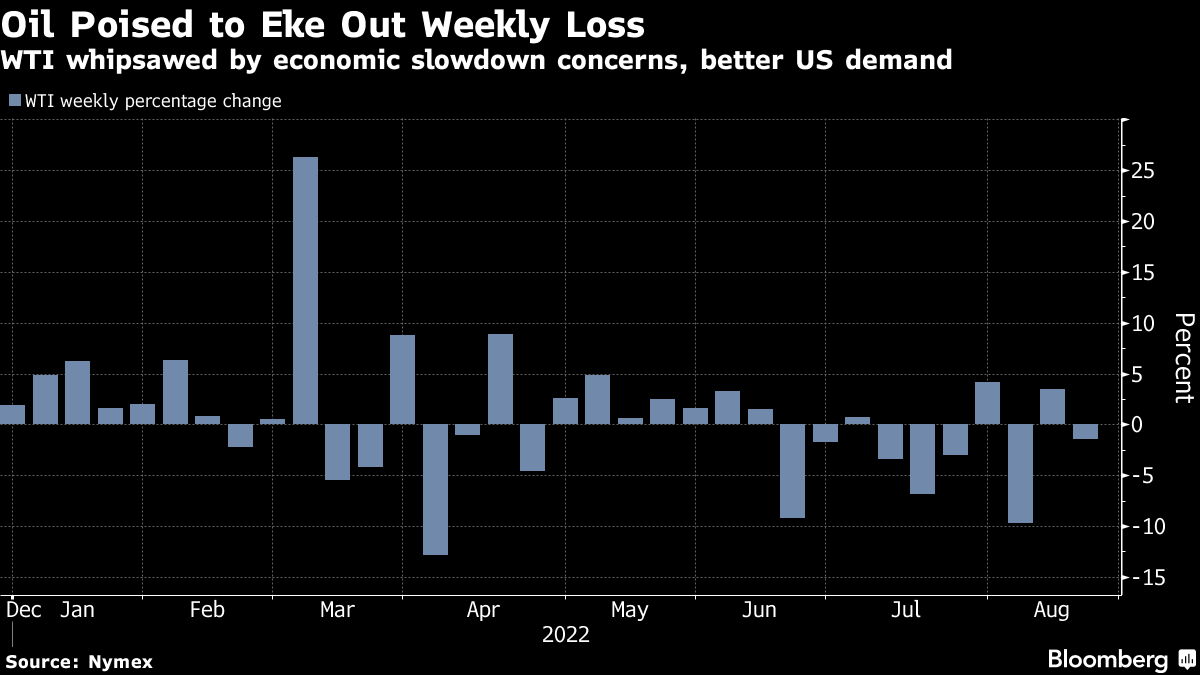

(Bloomberg) -- Oil is heading for a weekly loss as lingering concerns over an economic slowdown overshadowed signs of improving US demand.

West Texas Intermediate futures dipped toward $90 a barrel on Friday and are down around 2% for the week after another period of choppy trading. While US gasoline demand has picked up after pump prices tumbled, concerns about weakening economic growth continue to hang over the market.

Oil has given up all of the gains put on after Russia’s invasion of Ukraine and hit the lowest level in more than six months earlier this week before clawing back some losses. Traders are also watching for any progress on the Iranian nuclear deal, which could lead to more crude flows from the OPEC producer.

“Although weaker demand growth has eased supply concerns, limited spare oil production capacity is a concern for the rest of this year and 2023,” said Victor Shum, vice president of energy consulting at S&P Global Commodity Insights. Higher Iranian exports, weaker Chinese demand, or severe changes to Russian flows could alter the balance and lead to a sharp shift in prices, he added.

The market will also be digesting mixed policy signals from Federal Reserve officials on interest rates. St. Louis’s James Bullard urged another 75 basis-point move while Kansas City’s Esther George struck a more cautious tone, saying the pace of hikes is up for debate. The dollar has also strengthened this week, adding to headwinds for commodities.

The gap between prompt Brent crude futures and the second month contract -- a measure of the market’s reading of near term supply and demand tightness -- has narrowed significantly recently. The spread was 86 cents a barrel in backwardation, compared with $2.08 at the start the month

The new OPEC Secretary-General, Haitham Al-Ghais, said this week that global demand was healthy enough to absorb any additional flows from Iran should the deal come to fruition. He added that markets face a supply squeeze and spare production capacity is dwindling.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output