Oil Fluctuates as Economic Slowdown Weighed Against US Demand

(Bloomberg) -- Oil fluctuated as investors weighed lingering concerns about an economic slowdown against bullish signals from the US and OPEC.

West Texas Intermediate traded near $88 a barrel after closing 1.8% higher on Wednesday following a choppy session. Futures are on track for a weekly loss as fears over a downturn continue to hang over the market. The potential for a nuclear deal and more oil from Iran have added to the bearish sentiment.

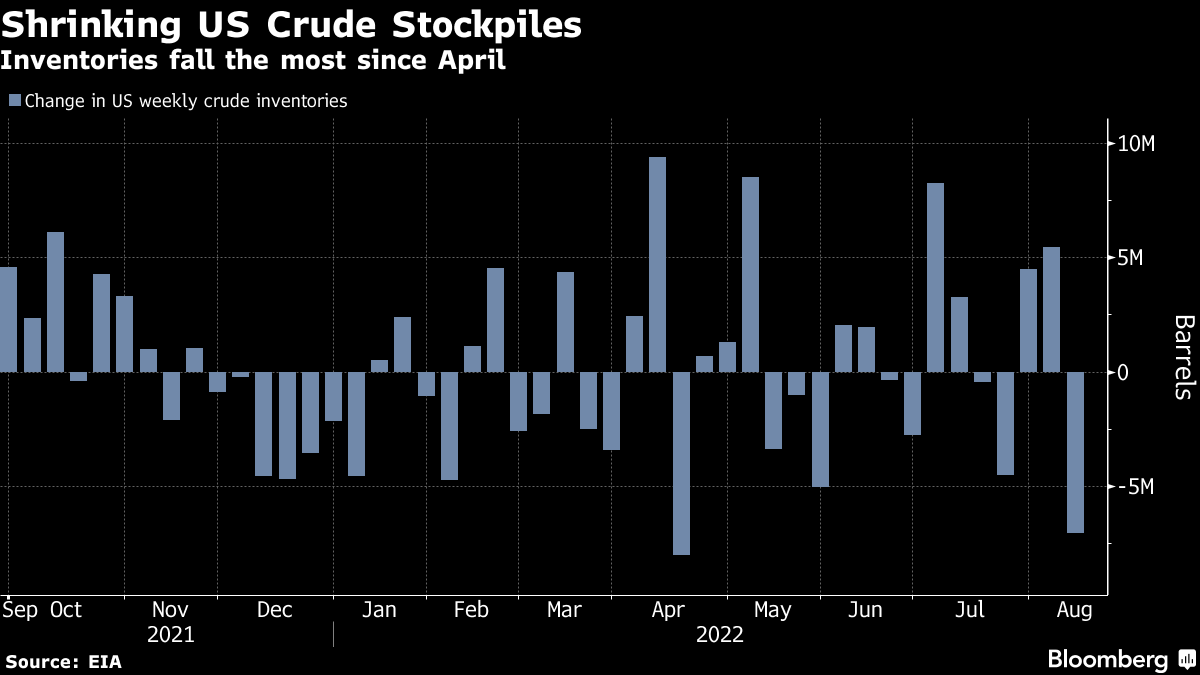

A bullish Energy Information Administration report offset some of the gloom, however. US crude stockpiles sank by 7.06 million barrels last week, exports rose to a record and gasoline demand climbed to the highest this year.

Crude is trading near the lowest level in more than six months after giving up all of the gains made after Russia’s invasion of Ukraine, with time spreads signaling market tightness is easing. Still, OPEC’s new Secretary-General Haitham Al Ghais said spare production capacity was “becoming scarce” and that he was confident demand will increase this year.

“The market appears to be slightly too bearish on the demand side,” said Daniel Hynes, senior commodity analyst at Australia & New Zealand Banking Group Ltd. “While we may see demand fall back on a seasonal basis, things are looking much tighter in the fourth quarter.”

US crude exports reached 5 million barrels a day last week, surpassing a high set barely a month ago, EIA data show. The four-week average of gasoline supplied -- a proxy for demand -- rose to about 9.1 million barrels a day, coinciding with the longest streak of declines in pump prices since 2018.

While the market is backwardated, a bullish pattern marked by near-term prices commanding a premium to later-dated ones, the gap has narrowed significantly. Brent’s prompt spread was 62 cents in backwardation, compared with $2.08 at the start the month.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight