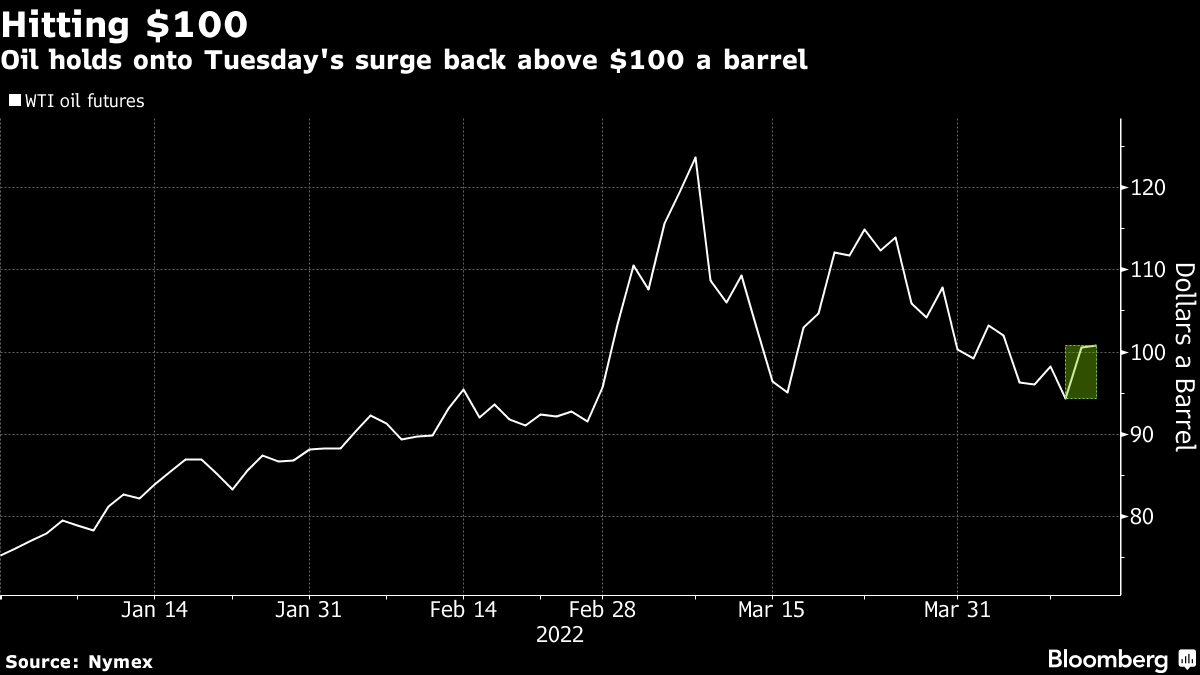

Oil Extends Advance Above $100 With Focus on China Demand

(Bloomberg) -- Oil edged above $100 as traders assessed a mixed bag of indicators from the International Energy Agency, which lowered its global-growth estimates because of China’s renewed lockdowns but also showed OPEC and its members struggled to increase supply.

West Texas Intermediate traded near $102 on Wednesday. The IEA cut its forecast for the world’s crude needs this year after Beijing reimposed lockdowns to contain the spread of Covid-19. Markets continue to remain tight as OPEC+ members have only managed to provide 10% of supply increases for march, according to the IEA report.

“The market does look more balanced, but we have to remember that oil demand continues to grow this year,” given the recovery from Covid-19, Toril Bosoni, head of the IEA’s oil market division said in a Bloomberg TV interview. “With all the uncertainty on both the demand and the supply side, the SPR releases go some way to create comfort for the market.”

Oil temporarily pared some of its gains as U.S. crude stockpiles rose 9.38 million barrels, the largest build in over a year, though much of that build was attributed to moving inventories over from the Strategic Petroleum Reserve.

Meanwhile, China’s cabinet said it would cut banks’ reserve requirement ratio in a further sign that the country’s central bank is likely to add monetary stimulus to boost the economy, according to state-run TV.

Even before the war, the oil market was robust as the recovery in demand from Covid-19 helped to drain inventories. With the war in Europe rippling through global markets and fanning inflation, governments recently announced plans to tap strategic oil stockpiles.

For now, the market’s focus is squarely on developments in Russian production and Chinese demand. While there are no signs Russian exports are starting to crumble just yet, Indian refiners are among the few remaining buyers. However, they aren’t seeing the record discounts being offered in Europe.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company