Oil Gains as Week Opens on Libyan Disruption, Russia’s Warning

(Bloomberg) -- Oil climbed as supplies from Libya were interrupted and Russia warned of the potential for record prices if more nations ban its energy.

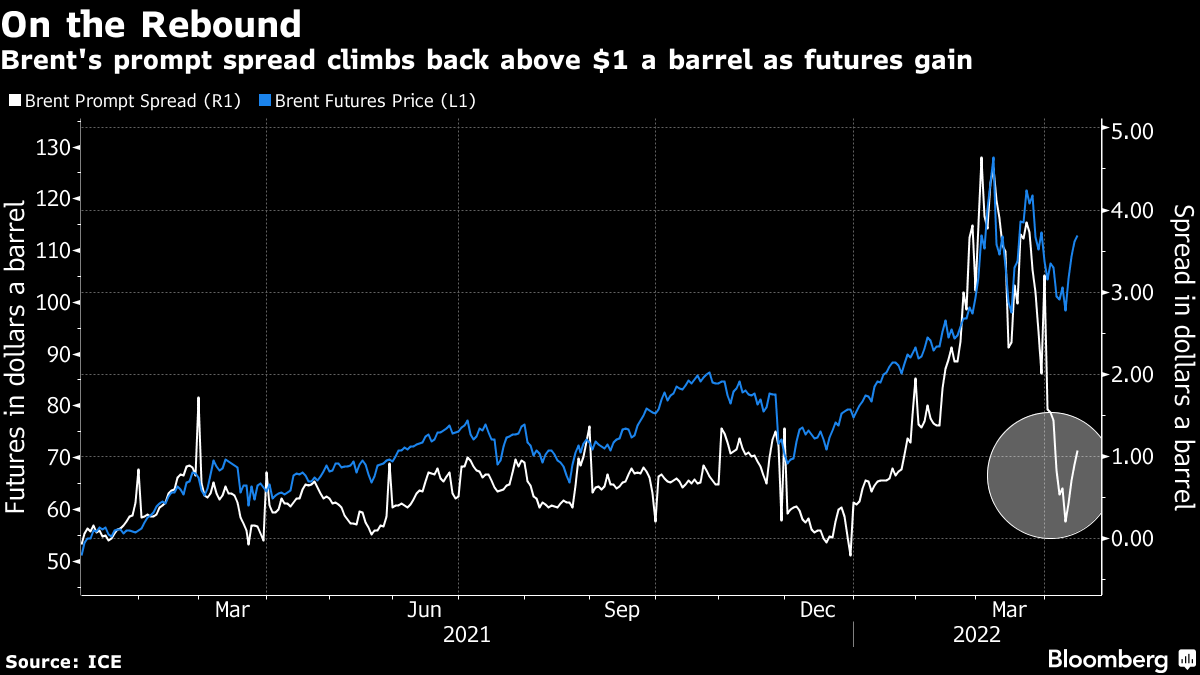

West Texas Intermediate traded above $107 a barrel after rallying last week by the most in two months. Two Libyan ports have been forced to stop loading oil after protests against Prime Minister Abdul Hamid Dbeibah, with output halted at El Feel, a 65,000-barrel-a-day field. Crude’s market structure moved deeper into a bullish pattern, with Brent’s prompt spread back above $1 a barrel.

Russia’s Deputy Prime Minister Alexander Novak said if more nations banned Russian energy flows, prices may “significantly exceed” historic highs. The U.S. and U.K. have moved to bar crude from the country after Moscow’s invasion of Ukraine, and there’s pressure for the European Union to follow.

Oil has rallied this year as the war in Ukraine disrupted an already-tight market, with some traders shunning Russian crude. The surge spurred the U.S. and allies to announce the release of millions of barrels from strategic reserves to quell inflationary pressures. OPEC and its partners have declined to raise the pace at which they’re restoring output shuttered during the pandemic.

“Prices are higher, with global supply shortages outweighing concerns about slower demand in China,” said Stephen Innes, managing partner at SPI Asset Management Pte. With no end to the war in sight, more trading houses are looking to self-sanction, with term contracts not getting rolled over, he said.

In a weekend phone call, Russian President Vladimir Putin and Saudi Crown Prince Mohammed bin Salman gave a “positive assessment” of their efforts to stabilize the oil market, suggesting that no change in production policy is likely. The two nations lead the alliance that groups the Organization of Petroleum Exporting Countries and its partners, known as OPEC+.

Traders were also monitoring the impact of anti-virus curbs in China, which has ordered a slew of lockdowns including in Shanghai. While the commercial hub has plans to allow people to return to workplaces, there’s no firm timetable to do so. The city reported its first Covid-19 fatalities from the current outbreak.

Crude markets are backwardated, a bullish pattern marked by near-term prices above longer-dated ones. Brent’s prompt spread -- the gap between its two nearest contracts -- was $1.13 a barrel in backwardation, up from 21 cents a week ago.

Oil’s surge this year has been part of a wider advance in energy commodities that’s seen prices extend gains even as the outlook for global economic growth dims. On Monday, U.S. natural gas prices hit the highest level in more than 13 years as robust demand tests drillers’ ability to expand supplies.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output