Oil Erases Gains as EU Ratchets Up Sanctions Against Russia

(Bloomberg) -- Oil erased gains in choppy trade as a surging dollar offset expectations for tighter supplies after the European Union said it was working on more sanctions on Russia, including oil imports.

West Texas Intermediate fell below $103 after earlier advancing to above $105 a barrel. European Commission President Ursula Von Der Leyen said Tuesday the group is working on further measures that will include sanctions on oil imports. Germany’s foreign affairs minister said the bloc will exit Russian fossil fuels, starting with coal.

Rising energy prices are a key factor in surging inflation across countries and U.S. Federal Reserve Governor Lael Brainard said the U.S. central bank will continue to tighten policy methodically and shrink its balance sheet at a rapid pace as soon as May. Oil’s gains were capped after a jump in the dollar following the news. A stronger dollar makes crude more expensive for holders of other currencies.

Oil rallied to the highest level since 2008 in the first quarter as Russia’s invasion disrupted supplies in an already tight market faced with roaring demand and dwindling stockpiles. The U.S. and U.K. already moved to ban Russian oil, and mounting civilian casualties in Ukraine are piling pressure on governments to take further steps against Russia.

Also See: EU to Propose Banning Russian Coal Imports After Atrocities

The “EU and the U.S. have been struggling with Russian energy exports,” said Bjarne Schieldrop, chief commodities analyst at SEB AB. “They want to sanction Russian energy, but the market needs the energy, and the EU especially so, with respect to natural gas and oil products.”

With the war in Ukraine in its second month, Russia faces allegations its troops massacred civilians in Bucha and other towns, an accusation Moscow denies.

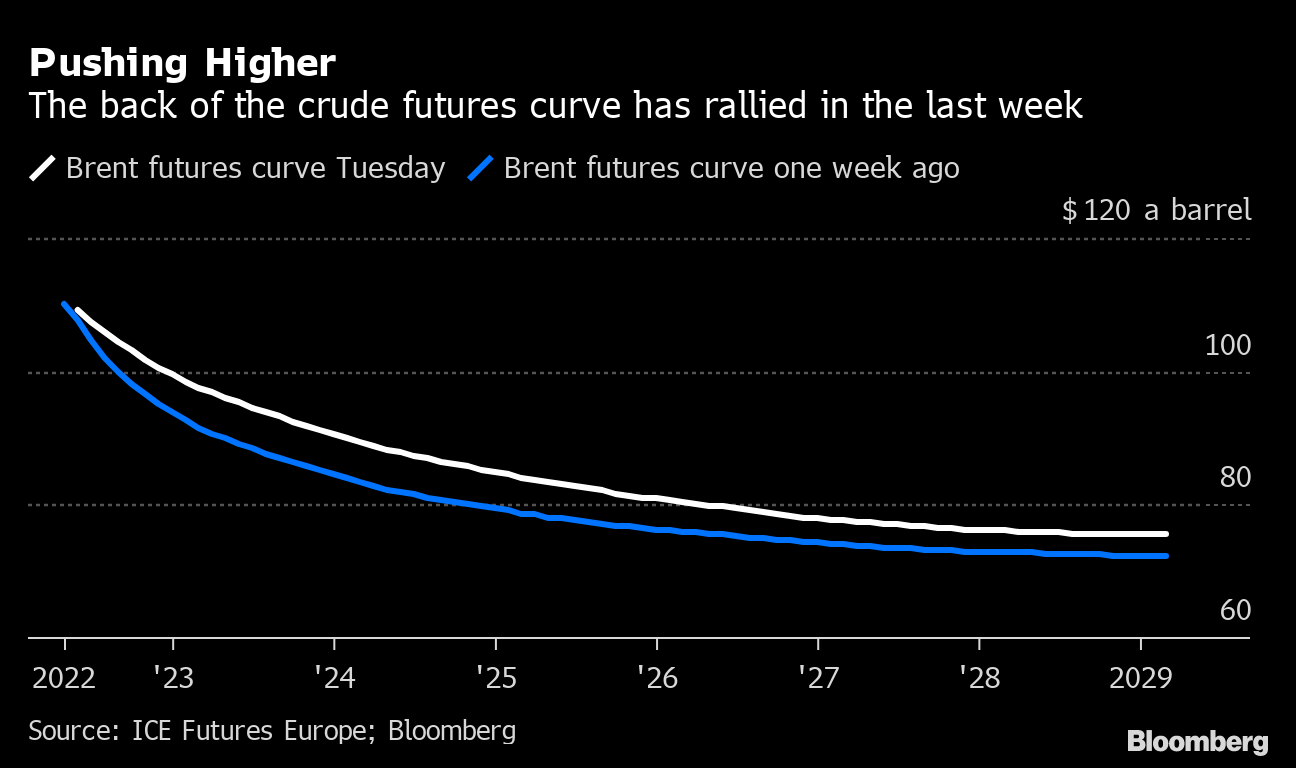

The possibility of new curbs is offsetting the impact in the global crude market of a vast release from the U.S. Strategic Petroleum Reserves (SPR,) beginning in May, in a bid to tame prices. Other countries have said they’ll also make drawdowns. That move has reshaped the oil futures curve, keeping a lid on nearby prices but lifting those further into the future.

“Many who were long oil got out in the last week or so on the basis that the SPR was just too much for the market to handle without some real evidence of dropping Russian crude exports,” said Scott Shelton, an energy specialist at TP ICAP Group Plc.

In one sign of tightness, Saudi Arabia raised selling prices for all regions. Saudi Aramco increased its Arab Light crude for next month’s shipments to Asia to $9.35 a barrel above the benchmark it uses, a record differential.

Many Western companies aren’t taking Russian crude, although discounted exports are going to buyers in Asia, including China and India. On Monday, commodity trader Trafigura Group offered to sell a cargo of Russia’s Urals grade at a record discount, but there were no bids.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight