‘Misallocated’ Global Capital Raises Climate Risk, UN Report Warns

(Bloomberg) -- The world’s leading climate finance experts and economists warn of a “persistent misallocation of global capital” as too much money continues to pour into fossil fuels and too little is channeled to clean energy.

In its latest assessment of global efforts to contain climate change, published Monday, the United Nations Intergovernmental Panel on Climate Change issued a stark alert that the world is on track to miss its target to limit global warming. Finance is both driving the problem and a “critical enabler” in the energy transition, the panel said.

The IPCC findings add more cause for alarm amid signs that the energy transition is backsliding, as some nations scramble for polluting alternatives to Russia’s gas in the wake of its invasion of Ukraine. Financing for coal-related projects is running at a rate that’s more than double last year’s pace. The world already faced “large macroeconomic headwinds” hampering climate finance “even before COVID-19,” said the IPCC authors. The war serves to compound these as the window to act narrows further.

The world stands at a tipping point or “pattern break” in the status quo, said Edward Mason, director at Generation Investment Management, a green finance firm co-founded by former U.S. Vice President Al Gore, referring to the war in Ukraine and its impacts on the energy transition. “We mustn’t lose sight of the bigger picture.”

Bankrolling destruction

For the world to meet its climate target requires a “substantial reduction in overall fossil-fuel use” that “will leave a substantial amount of fossil fuels unburned,” the IPCC said. And yet the finance sector continues to fund fossil-fuel development.

Over half of the 150 biggest financial institutions globally have no restrictions on financing oil and gas, and two-thirds of the world’s largest banks and asset managers are failing to set concrete climate targets for this decade, according to two separate analyses by NGOs. For their part, a whopping 83% of the world’s biggest polluting firms are yet to map a meaningful path to net-zero emissions, a leading investor alliance found.

Such shortcomings among financiers and corporations amount to a “systemic underpricing” of climate risk in the financial system, according to the IPCC. They also fly in the face of these finance firms’ public pledges, notably the Glasgow Financial Alliance for Net Zero. Launched at the COP26 climate summit last November, GFANZ members worth a combined $130 trillion committed to achieving net zero emissions by 2050 at the latest and delivering their fair share of 50% emissions reductions this decade.

“We often see these initiatives are made for marketing and not concrete action,” said Lucie Pinson, executive director of Reclaim Finance, an NGO that authored one of the studies. “Now is the time for financial institutions to show that their climate pledges were not pure greenwashing and that they are serious about taking action this year.”

Bloomberg Green wrote to 18 firms for comment on Reclaim Finance’s findings, including Allianz, AXA, Credit Suisse and UBS. Of those that responded, all reiterated their commitments to net zero and considered their policies to be in line with them. Most referred to their efforts to engage companies, rather than divest, which one asset manager described as “not the most impactful tool for investors” because “it limits the opportunity to impact positively on company behaviors.”

What’s clear is that there’s no time to kick the can down the road, said Christa Clapp, a co-author of the new IPCC report’s finance chapter. “Despite recent commitments, these high levels of public and private fossil-fuel financing continue to be a major concern,” she said.

A ‘critical enabler’

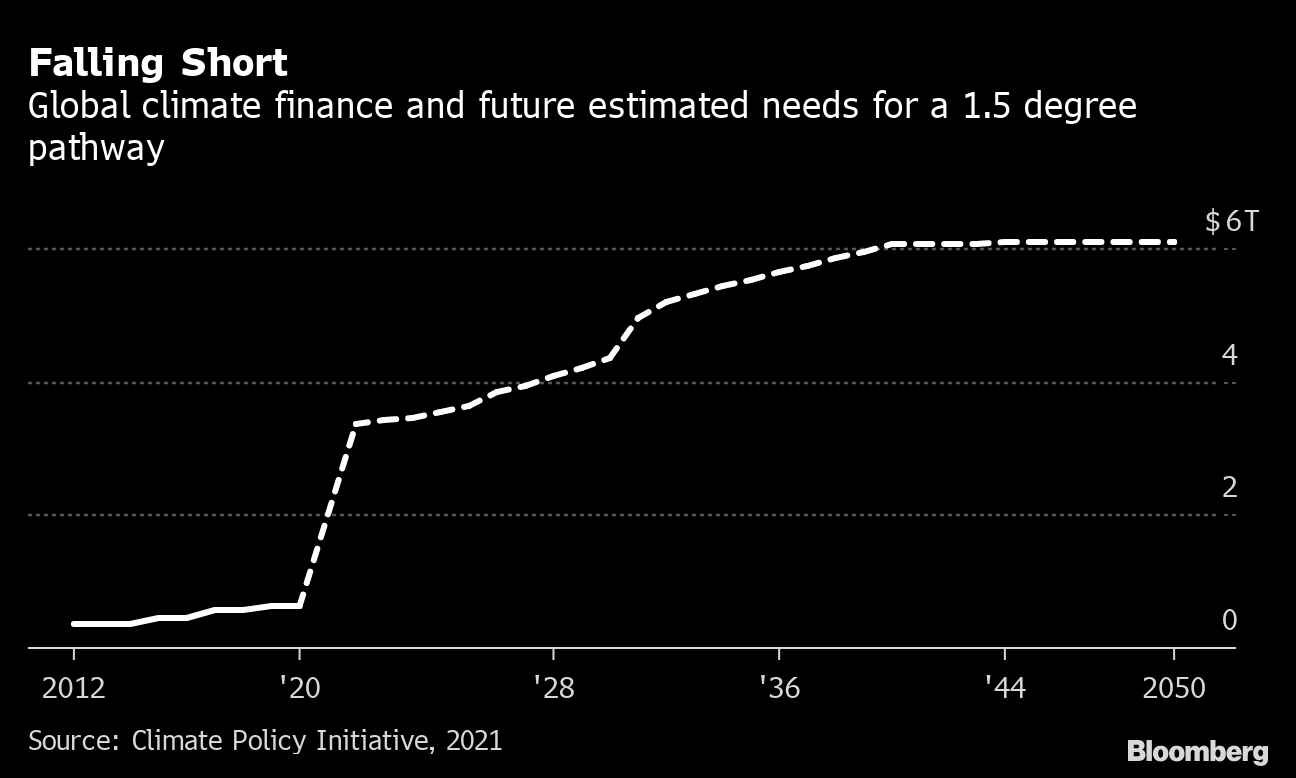

If too much finance is going to fossil fuels, far too little is being spent on tackling and adapting to climate change, particularly in developing countries. The gap between finance needs and availability is nothing new, said Clapp, but the “order of magnitude” has changed since the last such IPCC report in 2014.

Financing to prevent further climate change is falling short by up to a factor of six globally and eight for developing countries, the IPCC found. Money flows have increased over the past decade, but remain unevenly distributed across regions and sectors, and their growth has slowed.

Interspersed in the IPCC’s analysis are notes of optimism. In particular, “innovative financing approaches,” including green bonds and ESG-labeled products, could help reduce the underpricing of climate risk in markets.

The environmental-social-governance, or ESG, sector already encompasses $40 trillion in assets globally, and the label can be found on anything from an exchange-traded fund to a credit default swap. Such a panoply of products and claims has led to allegations of greenwashing, cited in the new report as a “challenge” to the efficacy of such approaches. While regulators globally are beginning to apply scrutiny, integrity efforts to date have centered on transparency and corporate disclosures, such as those developed by Task Force on Climate-related Disclosures. ESG strategies alone “do not yield meaningful social or environmental outcomes,” noted the IPCC authors, citing the need for stronger government policy and ultimately enhanced regulation.

Despite challenges in the scale, quality and urgency of climate finance needs, the report’s findings and their release in the context of the war present an opportunity. “Political will to expand renewables (and green hydrogen infrastructure at home and abroad) has been strengthened” by the war in Ukraine, said Eric Heymann, economist at Deutsche Bank Research.

“Can we let go of the hand brake [on climate finance]?” asked Christiana Figueres, the former executive secretary of the UN Framework Convention on Climate Change and a key negotiator of the Paris Agreement. “Yes, and we have to.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight