U.K. Energy Crisis Deepens as Fire Knocks Out Key Cable

(Bloomberg) --

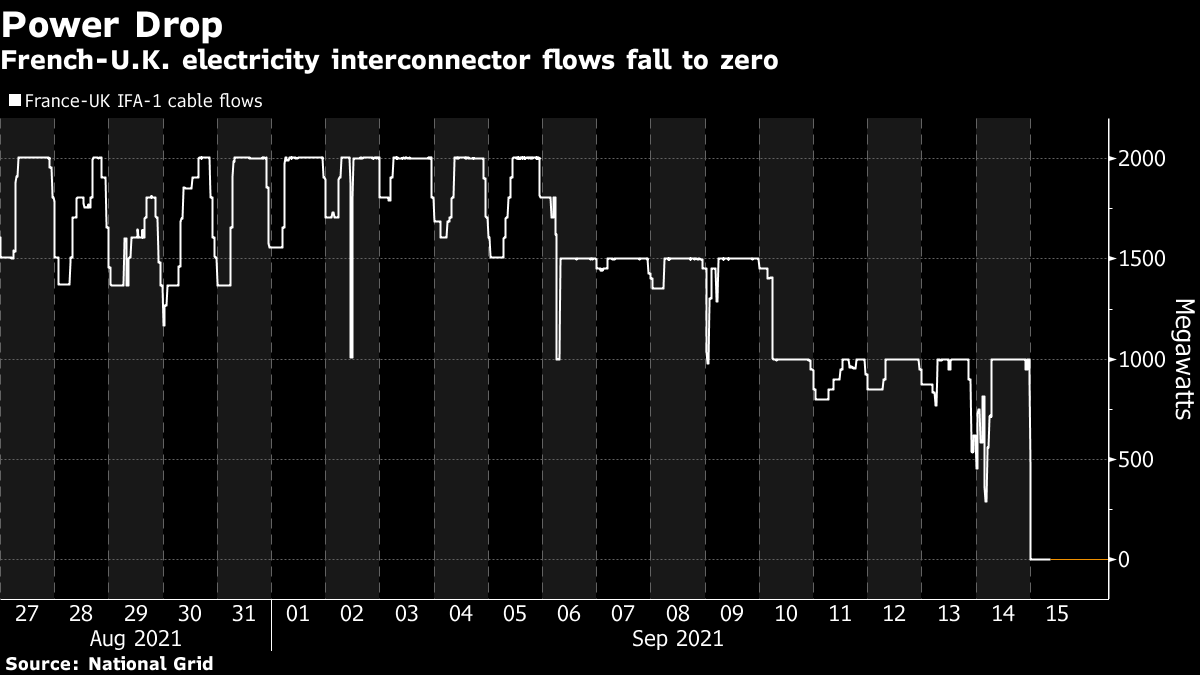

The U.K.’s energy crisis worsened as a fire shut down a major cable bringing power from France, adding to the risk of economic disruption as Britain heads into winter.

Gas and power prices jumped as the U.K. grid operator said the cable will be out for at least a month. Firefighters have been battling the blaze at a converter station since the middle of the night, and are expected to remain there for some time yet.

The timing couldn’t be worse: Britain is already struggling with shortages, with gas and power prices breaking records day after day. The energy crunch is fueling concerns about inflation and a potential hit to businesses just as the economy emerges from the worst impact of the pandemic.

“This is a major event,” said Phil Hewitt, executive director at Enappsys Ltd., a consultant.

Read more: U.K.’s Record-Breaking Energy Crunch Explained in Five Charts

Britain is a net importer of power, with France its biggest supplier via two cables that run across the English Channel. One of those was knocked out by the fire, according to National Grid, and it will be out of action until at least Oct. 13. The lost capacity is the equivalent of about two nuclear power stations.

The fire started in the converter hall and has spread through the building, National Grid said. The cable that’s down -- known as IFA-1 cable -- has capacity of 2,000 megawatts. A second cable with capacity of 1,000 megawatts -- is currently unaffected. The cause is still being investigated. A person familiar with the matter said the fire has caused severe damage. At about 4 p.m. local time there were still four fire engines at the site.

The U.K. could face electricity shortages as soon as today if just one large power station suffered an unplanned outage, said Tom Edwards consultant at Cornwall Insight.

“We could start seeing problems from 5 o’clock,” Edwards said. “If anything goes wrong we might not have anything left.”

The U.K.’s crunch is part of broader energy crisis in Europe, which has prompted governments to start taking action to ease the impact on consumers. Spain, Greece, France and Italy are all considering or enacting measures as households brace for a surge in bills. Goldman Sachs has warned of the risk of blackouts for industry.

U.K. gas futures surged as much as 18% on Wednesday to a record 194.94 pence a therm. Day-ahead power reached a record 422.46 pounds a megawatt-hour in an auction on Epex Spot SE. Intraday prices for this evening were trading as high as 2,299.99 pounds a megawatt-hour on Epex Spot SE.

Windless weather has also left the U.K. without a major source of power -- increasing reliance on gas. Nuclear outages are adding to the shortage and coal sites have been decommissioned, removing backup capacity.

According to a person familiar with U.K. thinking, the government isn’t worried about consumers for now as they are protected by a cap on prices -- until April. Heavy industry could be more of a worry, though no companies have yet raised concerns with the government, the person said.

A broader crunch is hitting Europe too, with the continent running out to refill gas storage sites ahead of the winter. Flows from top suppliers Russia and Norway have been limited, and there’s a competition with Asia to snag liquefied natural gas cargoes. Traders betting that the controversial Nord Stream 2 pipeline linking Russia to Germany would start in the fourth quarter are likely to be disappointed.

Gas prices are also surging as a tropical storm in the U.S. threatens to disrupt LNG exports.

“The delays to Nord Stream 2 into 2022 are all too real, and to add insult to injury the poor renewable generation outlook is further exacerbated by supply disruptions to the key France-U.K. power interconnector,”said Tim Partridge, head of energy trading at DB Group. “The impending tropical storm in the U.S. around key oil and gas facilities is just the cherry on the cake.”

The surge in the cost of carbon emissions -- traded on exchanges in Europe and the U.K. -- is also pushing up the cost of producing electricity. There’s some concern the crisis could cause a backlash against measures aimed at converting economies to greener fuels.

National Grid sounded an early warning back in July that the U.K.’s ability to meet peak demand would be smaller this year. In one scenario they modeled -- with one interconnector knocked out and high demand -- margins would be the tightest in years.

“With margins already tight for this winter,” the outage will “tighten those margins further, resulting in higher U.K. power prices,” said Adam Lewis, partner at Hartree Partners LP. “This is also likely to tighten the U.K. gas markets as the U.K. will need to substitute imports with its own generation.”

(updates with fire status)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output