Russia Delivers Fifth Rate Hike in a Row, Leaves Room for More

(Bloomberg) --

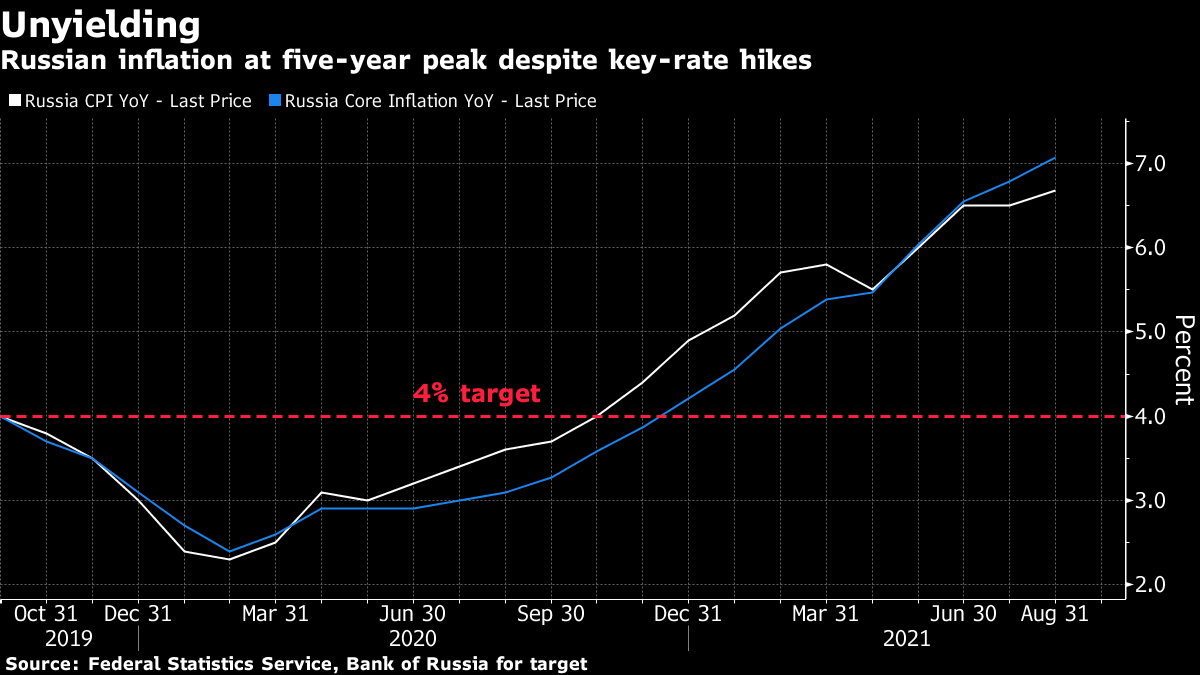

The Bank of Russia delivered a smaller-than-expected increase in its key interest rate, while leaving the door open to further tightening after inflation hit a five-year high last month.

The benchmark rate was raised by 25 basis points to 6.75% on Friday, the Bank of Russia said in a statement. The move followed the biggest rate increase since 2014 -- a full percentage point -- in July. Sixteen economists in a Bloomberg survey of 44 correctly forecast Friday’s move, while 27 expected a bigger move and one expected no change.

“Given high inflation expectations, the balance of risks for inflation is tilted to the upside,” the central bank said in its statement. “The Bank of Russia holds open the prospect of further key rate rises at its upcoming meetings.”

Bank of Russia Governor Elvira Nabiullina is easing the pace of monetary tightening as the economic recovery is losing steam. The central bank has now boosted rates by a total of 250 basis points this year in an effort to contain inflation, which is running well above target.

One of the most aggressive tightening paths in emerging markets has so far failed to rein in price growth, while data for August suggest Russia’s economic recovery may be faltering. Parliamentary elections next week are also complicating the picture, with President Vladimir Putin’s pledge of nearly 700 billion rubles ($9.6 billion) in new social spending adding to potential price pressures.

Ten-year bond yields trimmed their increase, trading up two basis points at 7.04%. The ruble kept an advance of 0.2% against the dollar, set for a third day of gains as crude oil rose and most emerging-market currencies advanced.

Inflation is set to accelerate further and peak in September at 6.9%, before slowing to about 6% by the end of the year, still well above the central bank’s 4% target, according to Goldman Sachs Group Inc. analyst Clemens Grafe.

Nabiullina will hold an online news briefing at 3 p.m. Moscow time. Follow our live blog here.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week