Oil Ticks Higher as Traders Count Down Final Hours to OPEC+ Meet

(Bloomberg) -- Oil rose as September opened, with traders counting down the hours until an OPEC+ meeting that should result in a further rise in output.

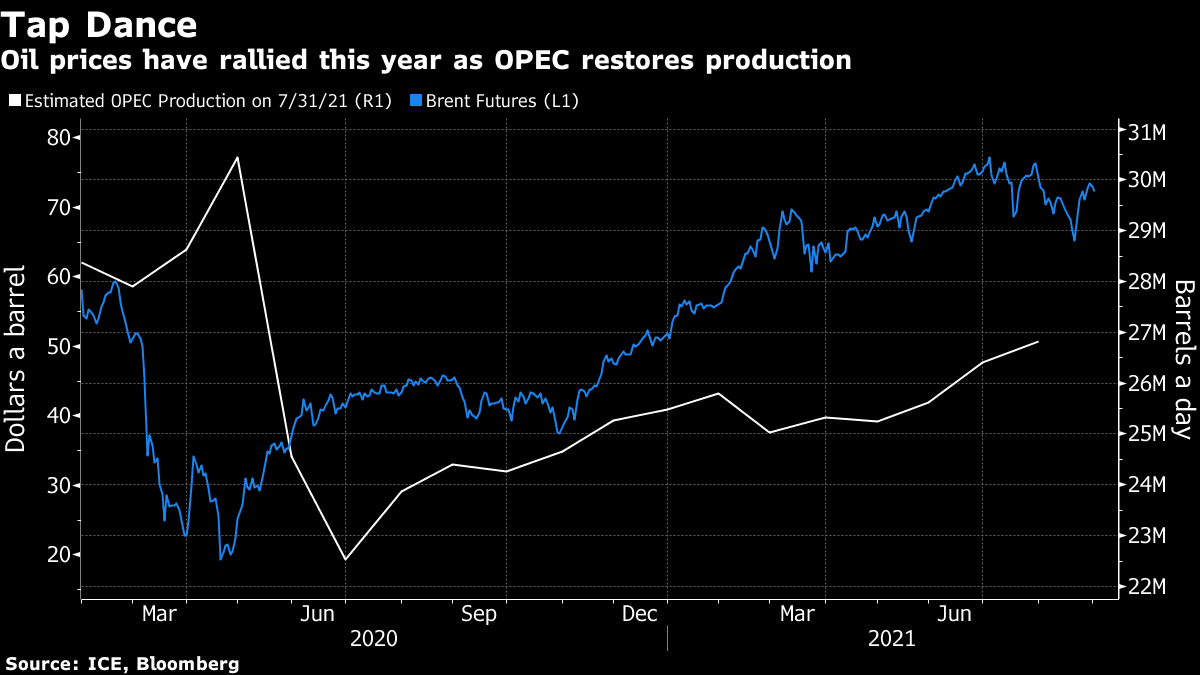

West Texas Intermediate was up 1% after losing more than 7% in August, the biggest monthly decline this year. The Organization of Petroleum Exporting Countries and its allies including Russia are expected to ratify a plan to add 400,000 barrels a day in October, wagering that the market can absorb the extra flows as demand recovers from the coronavirus pandemic.

Traders were also assessing figures that pointed to a climb in crude inventories in Cushing, Oklahoma. The industry-funded American Petroleum Institute reported holdings at the key hub rose more than 2 million barrels last week, according to people familiar with the figures. Gasoline stockpiles also gained, although there was a draw in nationwide crude inventories, the data showed, ahead of a government breakdown later on Wednesday.

After rallying in the first half, crude’s surge stalled over the past two months amid concern about the spread of the delta variant and a rebound in the U.S. dollar. OPEC+ has been gradually restoring the supply it took offline last year as the pandemic broke out, crushing consumption. The alliance projects that global inventories will continue to drop this year even as it loosens the taps.

“The market is likely to remain volatile -- we not only have the OPEC meeting, hurricane season is also upon us,” said Howie Lee, Singapore-based economist at Oversea-Chinese Banking Corp. “Brent is still expected to trend within $70 to $75 for now, but the near-term volatility means it may overshoot on both ends momentarily in the coming week or two.”

In the U.S., the restoration of supplies and refining continues in the Gulf of Mexico and Louisiana after the severe buffeting delivered by Hurricane Ida at the weekend. Port Fourchon, America’s biggest base supporting the region’s offshore industry, appears to have largely withstood the storm.

Brent’s prompt timespread was 63 cents a barrel in backwardation. While that’s a bullish pattern -- with near-dated prices trading above those further out -- it is down from 97 cents a week ago.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output