West Texas Crude Tops $70 With Demand and Ida’s Impact in Focus

(Bloomberg) -- Oil futures in New York topped $70 a barrel for the first time in nearly a month, with investors wagering that the market can absorb additional supply hikes from OPEC+ and the U.S. Gulf still grappling with Hurricane Ida’s impact.

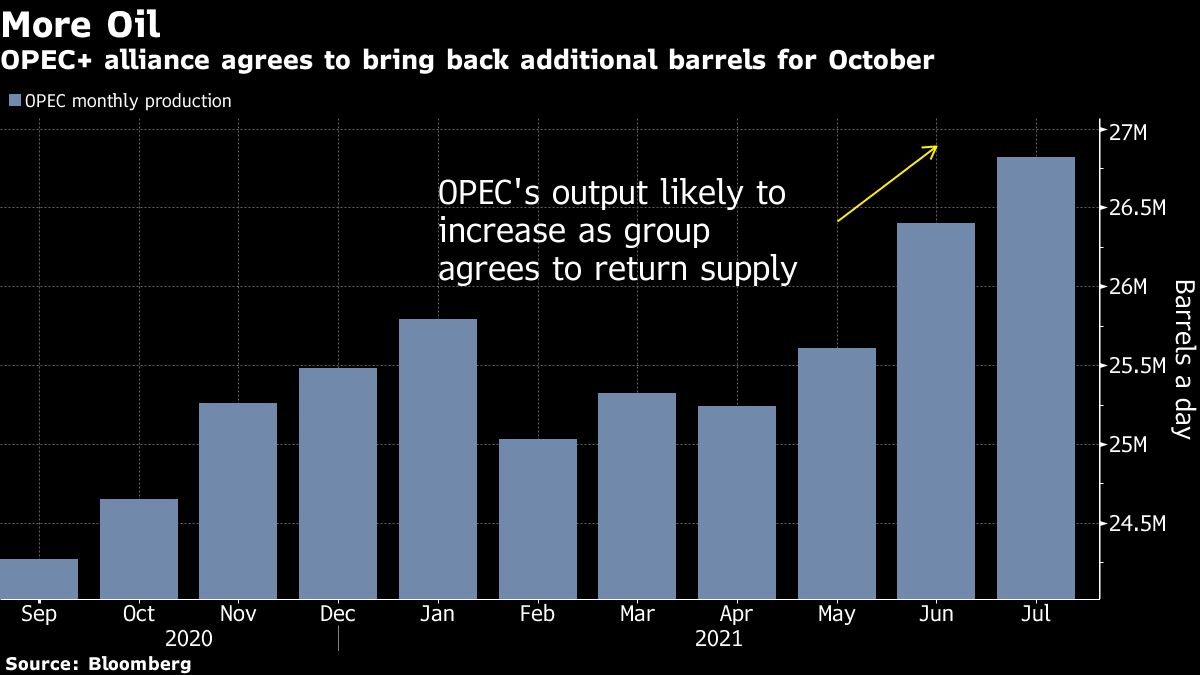

West Texas Intermediate futures gained as much as 2.8% Thursday. Following a swift meeting on Wednesday, ministers from the Organization of Petroleum Exporting Countries and its allies ratified a 400,000 barrel-a-day increase scheduled for October. Oil also rose in sympathy with a broader market rally and a weaker dollar.

After an OPEC+ meeting without surprises, oil prices are rising as the crude stock draw has raised confidence in the market, Rystad Energy’s head of oil markets Bjornar Tonhaugen wrote in a note. A weak U.S. dollar is also making commodities more inviting to investors, he added.

Crude has rallied about 40% this year as consumption bounced back from the impact of the coronavirus pandemic, although the bulk of the gains came in the first half. Against that backdrop, OPEC+ has been gradually restoring more of the supply it suspended last year when the global health crisis erupted.

“Prices should be higher going into year end,” Energy Aspects head of research Amrita Sen said in a Bloomberg TV interview. High natural gas prices could boost demand for fuel oil in the winter, she said, while Hurricane Ida means “we have lost an enormous amount of hydrocarbon production.”

Most processors that were hit by Hurricane Ida escaped major damage and are expected to be back online within three weeks, according to IHS Markit. Meanwhile the U.S. government reported that nationwide crude stockpiles sank 7.2 million barrels last week to the lowest level in almost two years. Total oil products supplied, a proxy for demand, hit the highest in data going back to 1990.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad