BP Shuts Some U.K. Gas Stations Because of Truck Driver Shortage

(Bloomberg) -- BP Plc, the second-largest fuel retailer in the U.K., said it’s shutting some of gas stations because of a nationwide truck driver shortage that’s threatening to derail the country’s economic recovery.

The lack of drivers has already left supermarkets around the U.K. unable to fill their shelves. Britain is also suffering a gas and power supply crisis that’s putting companies out of business and threatening consumers with a hike in bills. The U.K.’s exit from the European Union has constrained the flow of workers from the continent and tightened the labor market.

“We are experiencing some fuel supply issues at some of our retail sites in the U.K. and unfortunately have therefore seen a handful of sites temporarily close due to a lack of both unleaded and diesel grades,” BP said in an emailed statement. “We continue to work with our haulier supplier to minimize any future disruption and to ensure efficient and effective deliveries to serve our customers.”

Exxon Mobil Corp. said separately that a “small number” of the 200 sites it operates for the supermarket Tesco Plc have been affected by the truck driver shortage. ITV News was first to report the move by BP, which has more than 1,200 U.K. service stations, serving more than 7 million customers a week.

There is no fuel shortage and people should continue buying as normal, Jamie Davies, a spokesman for Prime Minister Boris Johnson said.

“We have a very resilient and robust supply chain,” he said. “We obviously recognize the challenges faced by industry and have taken steps to support them. We acknowledge there are issues facing many industries across the U.K.”

Food Crisis

BP is the second-largest fuel retailer in the U.K. while Tesco is the largest, according to data from Statista. Others include Royal Dutch Shell Plc, Sainsbury’s Plc, Morrisons and Asda. Morrisons said it has no shortages while officials from the other companies didn’t immediately respond to requests for comment.

The shortage of drivers and other workers hamstrung the U.K. food industry earlier this year, with stores running low on basics like milk and bread, tens of thousands of extra pigs piling up on farms, and retailers warning that there will be shortages of some products at Christmas.

Business groups have been pushing the government for weeks to add truck drivers to a special visa program to ease the pressure. But ministers have refused to budge, arguing it’s up to companies to lure staff by offering better wages. The government has, however, eased the rules for obtaining licenses to drive trucks, increased testing capacity, and relaxed a limit on the hours that drivers are allowed to be behind the wheel.

Energy Crunch

The country’s gas and power crisis has an entirely separate set of causes. Low levels of wind power generation, depleted gas storage and restricted supplies from Russia have sent prices soaring, putting out of business companies that supplied about 1.5 million households.

Yet, in a sign of the complex supply chains that underpin the U.K. economy, the energy crisis has also ended up hammering the food industry.

High gas prices last week forced fertilizer maker CF Industries Holding Inc. to close two plants that make carbon dioxide as a byproduct. That posed an imminent threat to the food industry, which uses the gas to stun pigs and chickens for slaughter, as well as in packaging to extend shelf-life and the “dry ice” that keeps items frozen during delivery.

On Tuesday, the U.K. government said it will provide “limited financial support” to help the company restart its facilities.

Economic Fallout

Britain’s multiplying economic difficulties threaten to erase the euphoria that accompanied the end of coronavirus lockdowns and leave policy makers with a delicate balancing act.

The government has sought to dispel the idea that the U.K. Is heading to a winter of empty supermarket shelves and soaring prices, with Prime Minister Boris Johnson saying earlier this week that “Christmas is on,” but he’s under growing pressure to address the labor shortages and high energy prices that pose a growing threat to supply chains.

The opposition Labour Party is also seeking to weaponize a growing cost-of-living crisis as rising prices coincide with the government’s drive to remove pandemic support to workers and benefits claimants.

Chancellor of the Exchequer Rishi Sunak wrote a letter to Bank of England Governor Andrew Bailey on Thursday, in which he said that the recent period of above-target inflation is driven partially by “rising commodity prices, global supply bottlenecks and shortages.” Investors are bringing forward their bets on when the bank will hike interest rates.

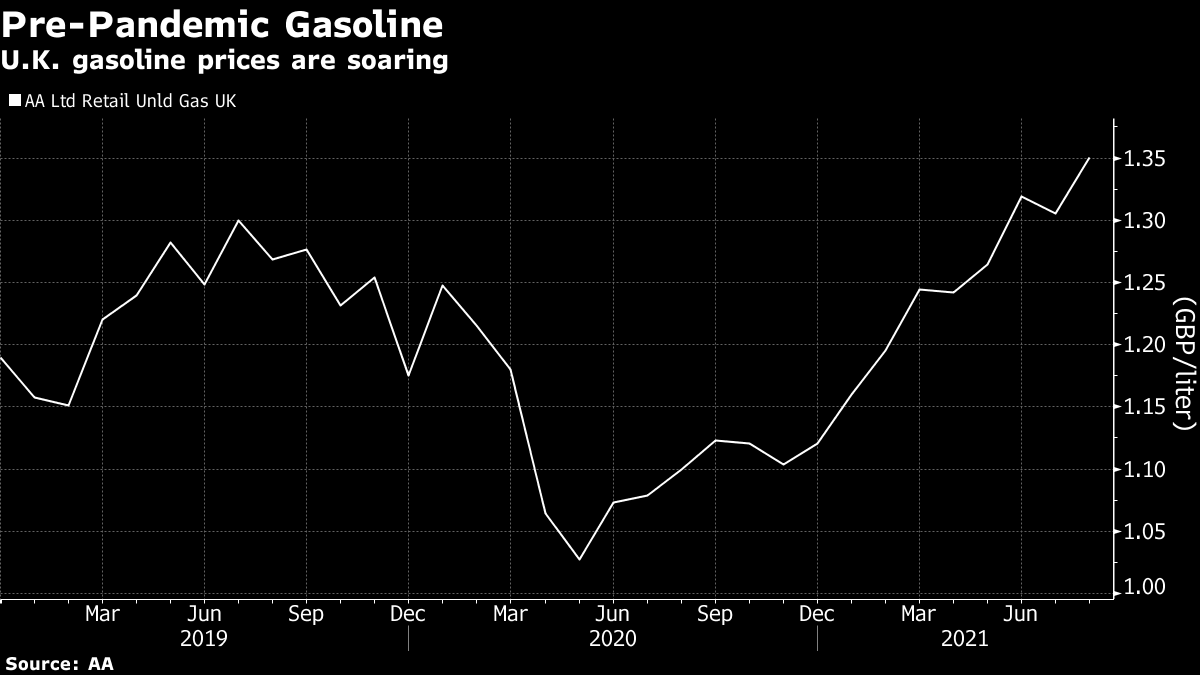

Traffic data suggests that gasoline and diesel demand in the U.K. has rebounded in September as some workers start to commute again, using their car rather than public transport. London, for example, saw last week the worst traffic congestion since the start of the pandemic, according to data from satellite-navigation company TomTom NV.

According to data from the Department for Transport, traffic in the U.K. hit last week the highest level since the pandemic began, with the average road use running at 3% above pre-pandemic level. Traffic of big trucks was particularly intense, running at 13% above pre-pandemic level.

(Updates with gasoline price chart, context throughout.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week