BOE’s Mann Says Global Inflation Today is Different from 1970s

(Bloomberg) --The world today is different to the inflation-wracked 1970s and as a result the Federal Reserve remains well placed to respond to evolving price pressures, said Catherine Mann, the newly-appointed Bank of England policy maker who was a former chief economist at Citigroup Inc.

“History is an important guide,” Mann told an Australian National University conference Monday by video, responding to a question on the similarities between the 1970s and today and whether the Fed should respond to the latest 5.4% surge in inflation. “We should always pay attention to historical data. But I think we ought to pay attention to some historical institutional differences as well.”

She set out four factors that distinguished today from the 1970s:

- The extent to which wages and prices were indexed to each other relatively more in the 1970s than now

- The “period of rapid change” in exchange rates and oil prices in the 1970s, and no history of anchored expectations for inflation then;

- The slope of the Phillips Curve, noting back then there was a “much stronger relationship” between wages and labor-market tightness than has been the case over the last 10-15 years; and

- The extent to which firms have pricing power and use that. Firms, she said, remember their inability to make price increases “stick” after the global financial crisis. Now, things are changing a little bit, but companies are reticent about raising prices.

“So I would say the Fed is not behind the curve, and they have the tools in order to address the inflation concerns as they develop,” she said.

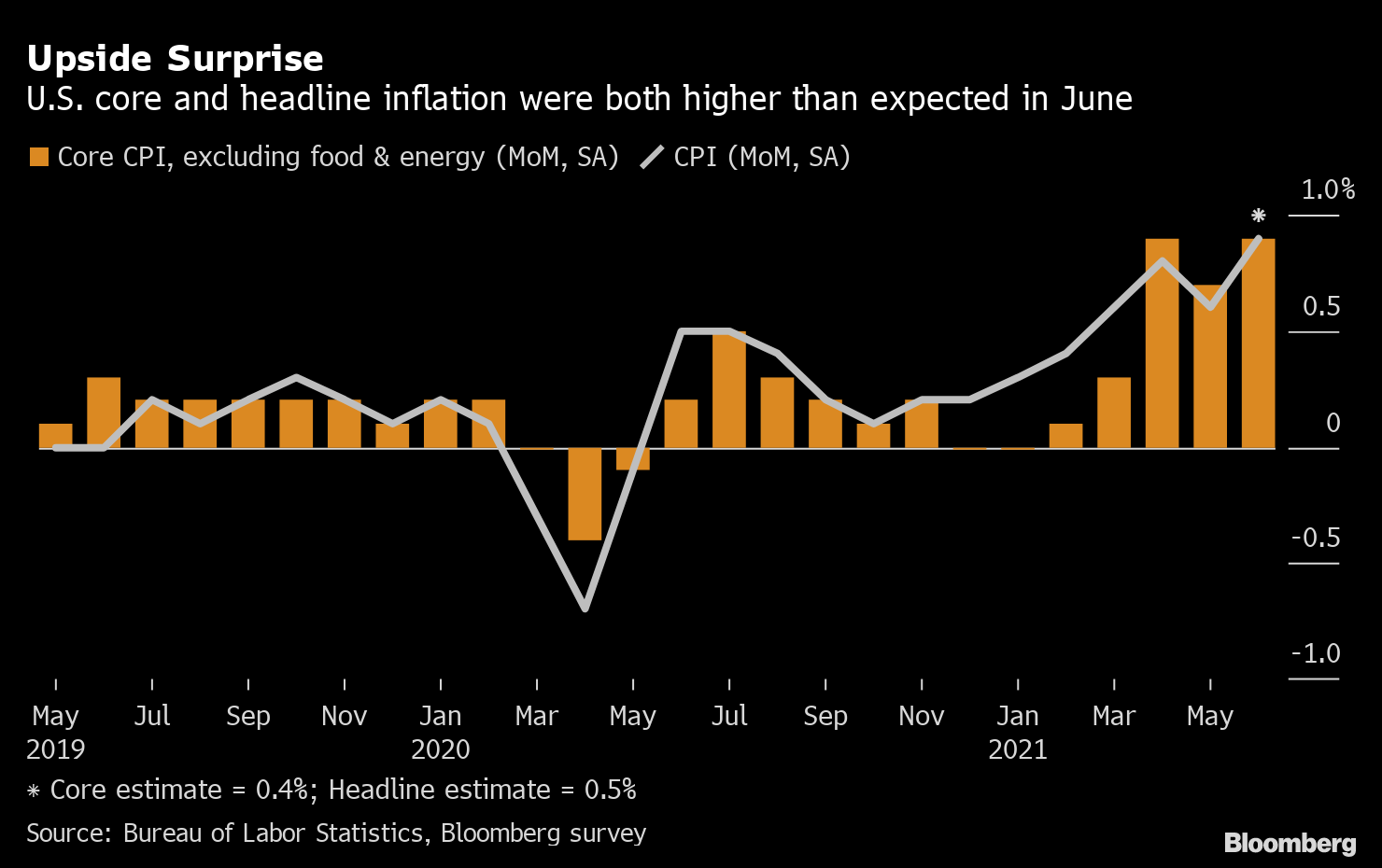

Fed Chair Jerome Powell argues that recent increases in inflation reflect disruptions linked to the U.S. economy reopening after the Covid-19 pandemic and are likely to prove transitory.

At the Jackson Hole conference late last month, he sounded a note of caution about employment levels and didn’t provide a specific timeline to start scaling back $120 billion-per-month in bond buying. August’s non-farm payrolls came in weaker than expected on Friday, prompting economists to see a decision to taper this month as off the table.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week