Oil Steadies Ahead of OPEC+ Producers Meeting on Supply Policy

(Bloomberg) -- Oil was steady ahead of an OPEC+ meeting on Monday to discuss production policy amid a rapidly tightening market.

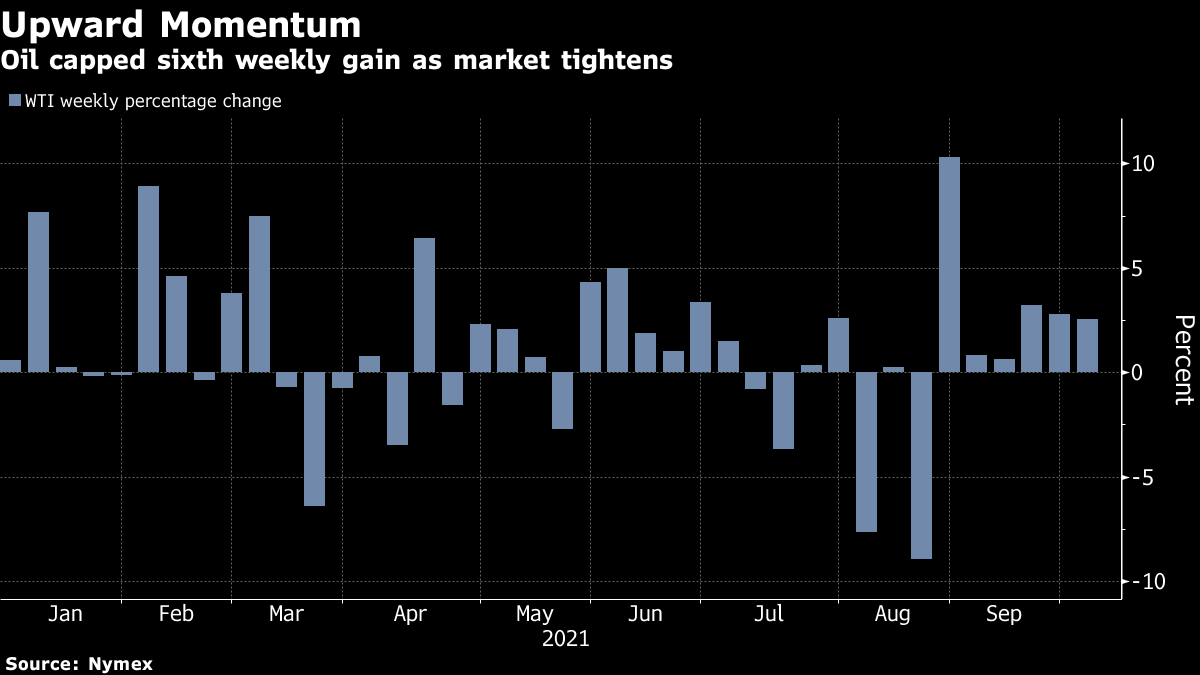

Futures in New York traded near $76 a barrel after capping a sixth weekly gain on Friday. The alliance, led by Saudi Arabia and Russia, may have to consider raising output in November by more than its planned 400,000 barrels a day, according to some market watchers. OPEC’s own modeling is showing demand will outstrip supply over the next two months.

See also: Saudis Triumph in Oil Market With Comeback From Covid Crisis

The market has tightened significantly recently following a robust rebound in demand from economies recovering from the pandemic and a supply disruption in the Gulf of Mexico due to Hurricane Ida. Surging natural gas prices ahead of winter have also raised the prospect of higher volumes of oil products being consumed in power generation, potentially boosting overall demand.

“An OPEC+ decision to add more supply to the market than planned could calm prices down,” said Vandana Hari, founder of Vanda Insights in Singapore. “But it is by no means a slam dunk. Such a proposal could spark off plenty of debate and disagreement, especially as crude backed off from $80.”

OPEC+ production policy will be the main factor influencing oil prices over the coming months, according to Vitol Group. There’s little chance of Iranian barrels returning this year and U.S. shale producers aren’t investing enough to raise output quickly, Mike Muller, the head of Asia for Vitol, said on a Sunday webinar hosted by Dubai-based consultancy Gulf Intelligence.

See also: OPEC+ Should Worry About Shortfalls, Not Surpluses: Julian Lee

Fuel switching due to high coal and gas prices is likely to see oil demand rise by 500,000 barrels a day this winter, Sri Paravaikkarasu, head of Asia oil at FGE, said during a Bloomberg Television interview. A cold winter could see consumption climb by a further 200,000 to 300,000 barrels a day, she added.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output