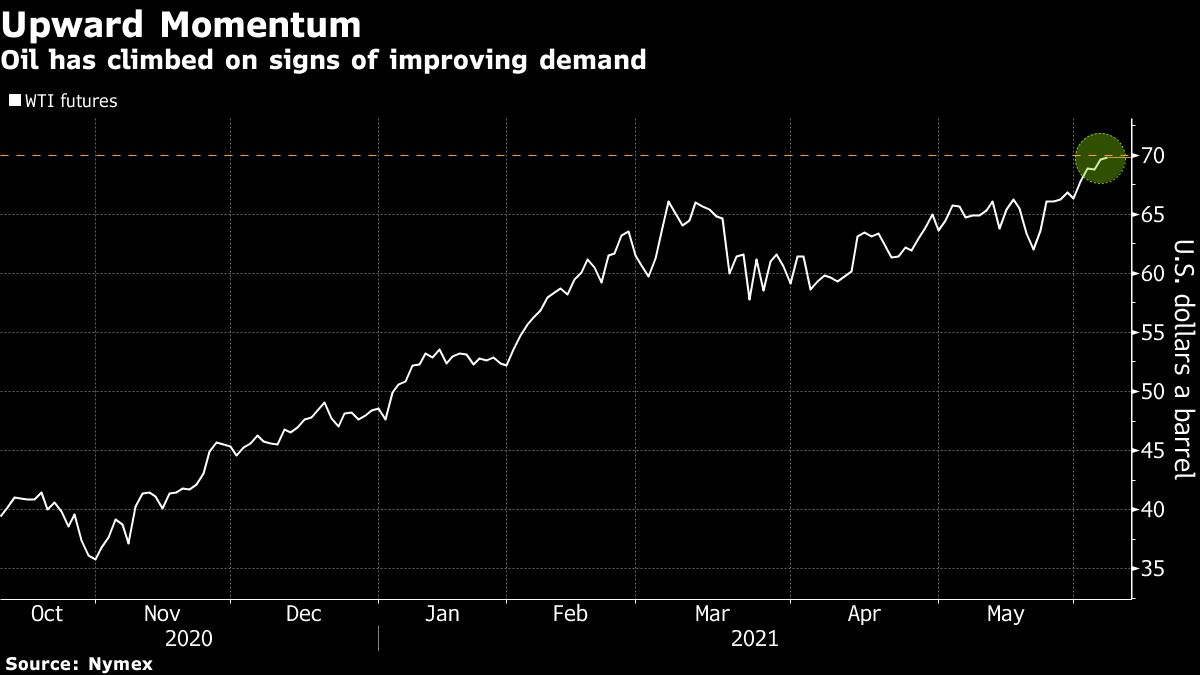

Oil Dips After Topping $70 as Investors Assess Demand Outlook

(Bloomberg) -- Oil slipped after hitting $70 a barrel for the first time since October 2018 as a rally driven by signs of a tightening market stalled.

Futures dropped 0.3% in New York after rising as much as 0.6% earlier following a second weekly gain. Despite oil easing on Monday, the outlook for demand remains bullish as vaccination rates accelerate, driving greater mobility. OPEC+ appears in control of crude prices, with U.S. production lagging pre-pandemic levels, according to Mike Muller, Vitol Group’s head of Asia.

A robust rebound from the virus in the U.S., China and Europe has driven prices more than 40% higher this year, although the Covid-19 comeback in Asia is a reminder that the recovery will be uneven. Russia’s Rosneft PJSC, meanwhile, warned of an impending shortfall in supply as global producers increasingly channel funds into a “hasty” energy transition.

“The focus remains on demand, with traffic data suggesting the summer driving season should be positive,” said Daniel Hynes, senior commodities strategist at Australia and New Zealand Banking Group Ltd. “The market should tighten up even further over coming weeks.”

The market has firmed in a bullish structure. The prompt timespread for Brent is 41 cents in backwardation -- where near-dated prices are more expensive than later-dated ones. That compares with 37 cents a week earlier.

The decline in U.S. drilling and output makes OPEC+’s job of managing markets easier, Vitol’s Muller said at a conference on Sunday. Given delays in talks between Tehran and world powers on reviving a nuclear deal, it’s less likely more Iranian supply will hit the market before the fourth quarter, he added.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output