Oil Gains as U.S. Supply Drop Reinforces Tighter Crude Market

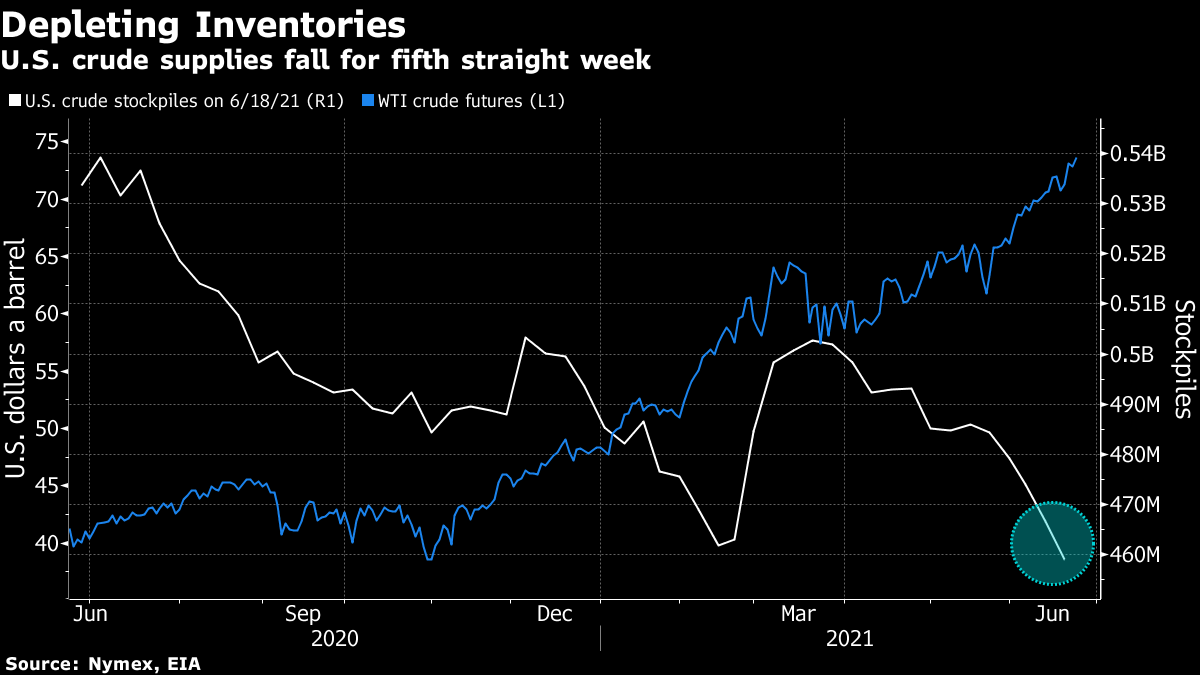

(Bloomberg) -- Oil clung to gains with a fifth straight weekly decline in U.S. crude supplies pointing to a rapidly tightening market.

Futures rose as much as 1.9% in New York on Wednesday, while Brent crude held above $75 a barrel. Domestic crude supplies tumbled by more than 7 million barrels, according to a U.S. government report. Gasoline inventories posted the biggest drop since early March, while supplies at the nation’s biggest storage hub at Cushing, Oklahoma, slid to the lowest since March 2020.

“We’re starting to see the impacts of the summer driving season in the U.S., and it’s shaping a strong one as we expected,” said Brian Kessens, a portfolio manager at Tortoise, a firm that manages roughly $8 billion in energy-related assets.

Stockpile declines in the U.S. are the latest sign of a tightening global crude market as fuel demand bounces back from the pandemic. Stalled nuclear talks have also deferred the prospect of renewed Iranian supplies, keeping benchmark crude prices supported. However, OPEC+ is scheduled to meet next week to discuss its production policy and some nations, most notably Russia, are considering backing an increase in output.

In the U.S., restrictions due to Covid-19 are being lifted with the rollout of vaccines and a low number of daily cases, which is combining with the summer-travel season to aid demand for U.S. oil, according to a Bloomberg Intelligence report. There is potential for an increase in U.S. oil exports, even if OPEC+ continues to add barrels to the global market, it said.

Still, the demand recovery in Asia offers a mixed picture. Daily average driving activity in India went up significantly in June from the prior month as the country emerges from a deadly coronavirus surge. But driving activity in Taiwan, Vietnam and Malaysia fell from May because of coronavirus restrictions.

Meanwhile, the Energy Information Administration report showed U.S. crude production ticked lower.

“There has to be an incentive for U.S. producers to bring back production, and that’s going to be a higher price,” he said.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output