Oil Price Spike Risks Wider Market Swings Amid Inflation Fears

(Bloomberg) -- A spike in oil prices risks fanning wider moves across asset classes should inflation-sensitive investors believe the crude market will tighten further after OPEC+ failed to agree on a deal to increase production.

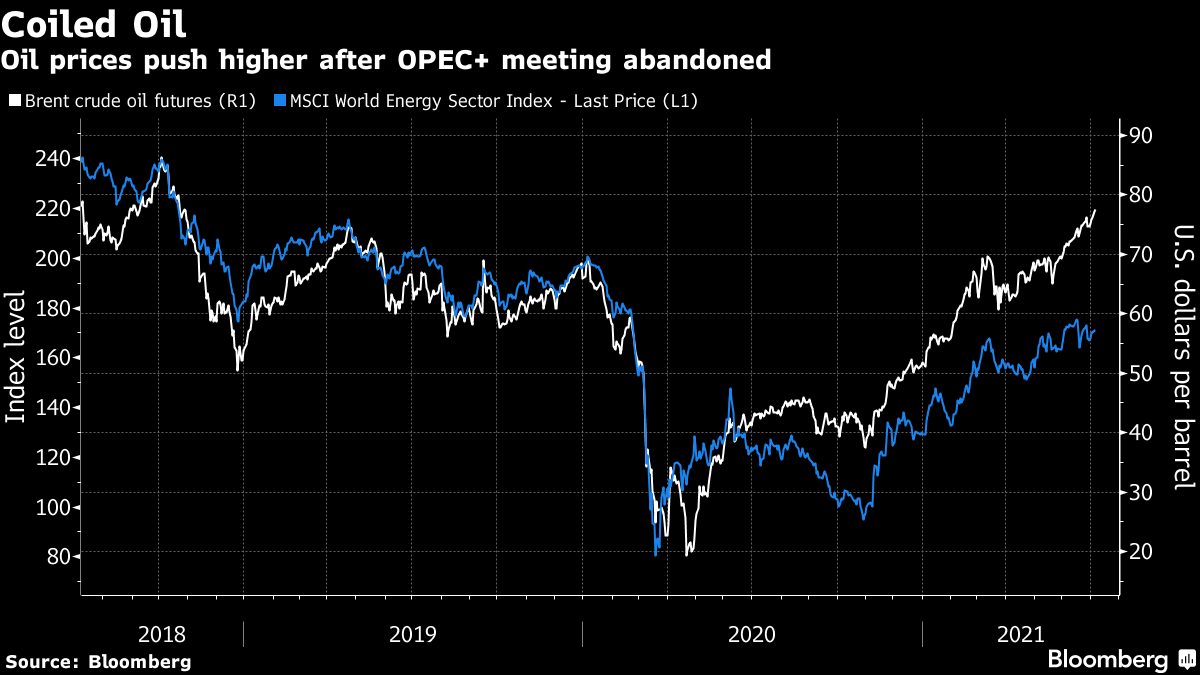

The surprise breakdown in talks means tighter supply conditions for crude and upward pressure on prices -- at least in the near term -- adding fuel to the wider inflationary concern that’s challenged central banks and roiled risk assets. Brent crude futures rose above $77 for the first time since 2018 this week, sending global energy shares higher.

Benchmark 10-year Treasury yields ticked two basis points higher Tuesday, after reopening from a holiday, and the yield curve steepened.

“The crude oil rally neatly encapsulates the broader reflation narrative,” said Ilya Spivak, head of greater Asia at DailyFX. A renewed surge could amplify the Federal Reserve’s sense of urgency to tighten monetary policy, leading to a “broad risk-off turn that pulls down shares, oil and other sentiment-sensitive assets,” he said.

After several days of tense talks, OPEC and its allies abandoned their Monday meeting. A disagreement over how to measure production cuts upended a tentative deal to boost output and swiftly devolved into an unusually personal and public spat between Saudi Arabia and the UAE.

OPEC+ in Crisis as Specter of Harmful Infighting Looms Again

Still, the relatively modest reaction in other markets so far suggest investors are also cautious over the longer-term implications of the OPEC+ crisis. If the UAE were to leave the cartel, there is a risk producers would ramp up supply and ultimately send crude oil lower.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight