Saudi Arabia Sees Four Revenue Scenarios Amid Oil Uncertainty

(Bloomberg) -- Saudi Arabia’s budget statement includes three different scenarios alongside its main projections for 2022, as the world’s largest oil exporter plots different revenue possibilities.

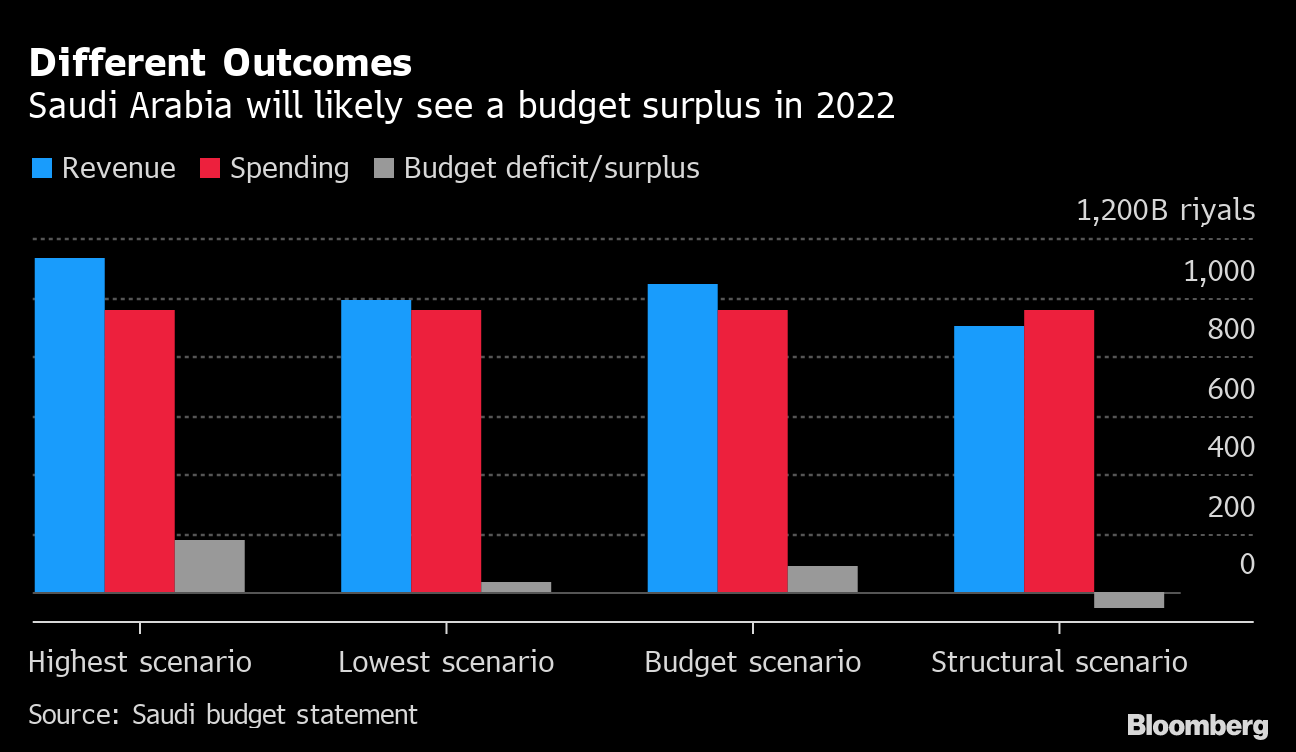

The scenarios suggest the G20 economy, which in the past raised expenditure in times of surging crude prices, could be increasingly moving away from that model. Spending stays the same - 955 billion riyals ($255 billion) - in all four scenarios, regardless of income fluctuations.

Saudi Arabia Sees 2022 Budget Surplus, First in Eight Years

The main budget forecast released on Sunday see a surplus of 90 billion riyals ($24 billion), the first in eight years. It considers three other possibilities at a time when global uncertainty surrounding Covid-19 has made economic predictions worldwide more challenging and led to volatility in the oil market.

The kingdom and its Gulf neighbors, which get most of their income from oil, generally spend more during past oil booms. In recent years, they’ve become more restrained. Saudi officials plan to cut spending for the next two years before increasing it slightly in 2024.

Three of of the four scenarios in the Saudi budget statement predict the kingdom will have a fiscal balance surplus next year. There’s a “structural scenario” which doesn’t take into account fluctuations in global markets and scenarios with lower and higher revenues than the main budget prediction.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad