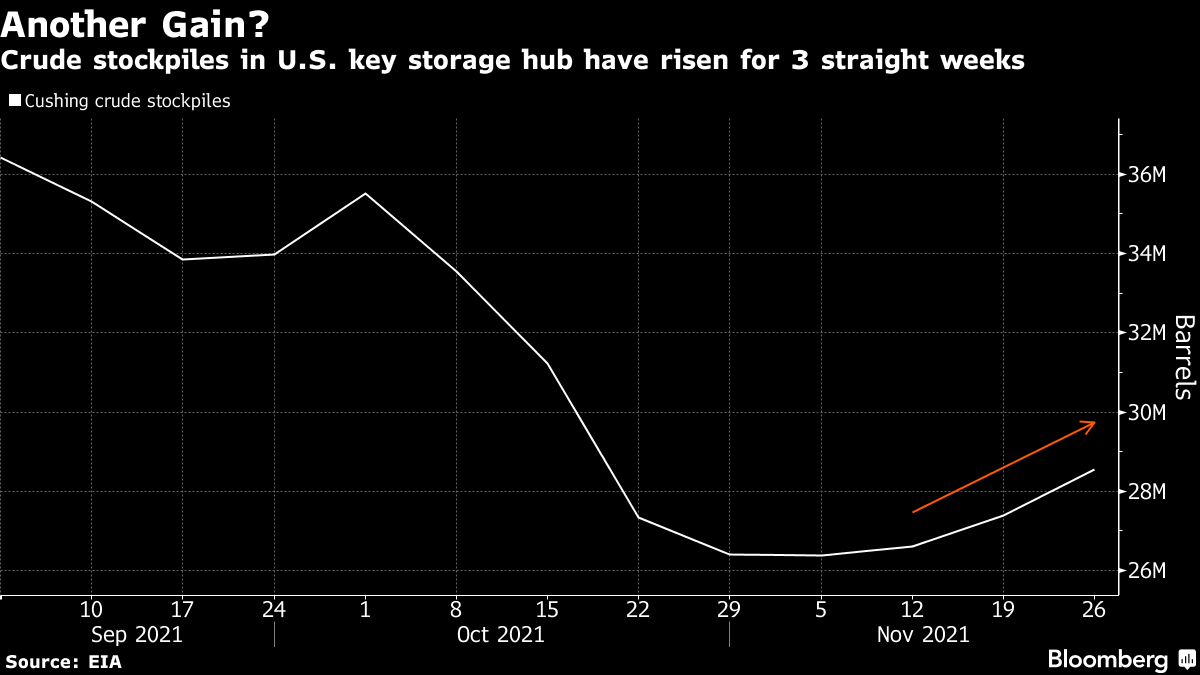

Oil Steadies After Two-Day Rally as Report Signals Cushing Gain

(Bloomberg) -- Oil steadied after a two-day rally as an industry report pointed to the biggest gain in stockpiles at a key U.S. storage hub since February.

Futures in New York traded near $72 a barrel after closing 3.7% higher on Tuesday. The American Petroleum reported crude inventories at Cushing rose by 2.4 million barrels last week, according to people familiar with the figures. That would be a fourth weekly gain and the largest increase since the week ended Feb. 19 if confirmed by government data due later on Wednesday.

Crude has surged more than 8% over the past two sessions -- rising along with other financial assets -- on cautious optimism that the omicron virus variant is unlikely to derail the global economic recovery. There's few deaths from the new strain so far and little sign of a major impact on oil demand.

Â Â

Â

"The outlook still has plenty of challenges ahead," said Daniel Hynes, a senior commodities strategist at Australia and New Zealand Banking Group Ltd. in Sydney. "We remain bullish but there are risks to this view in the next few weeks, particularly around China."

China continues to tackle sporadic outbreaks, with one eastern city locking down on a district to curb the spread. Omicron has led to some restrictions on air travel, and researchers in South Africa said the strain's ability to evade vaccine and infection-induced immunity is "robust but not complete." They added that booster shots would likely reduce chances of infection.

U.S. crude inventories fell by 3.1 million barrels last week, the API said. That would be the largest draw since September if confirmed by the Energy Information Administration. The EIA is expected to report stockpiles fell by 1.5 million barrels, according to the median estimate in a Bloomberg survey.

Over the past week some traders have bet on the small chance that WTI's discount to Brent will surge past $10 a barrel next year. The long-shot wager is a signal that some market participants believe the Biden administration could intervene in the market again to bring down prices following a pledge to sell crude inventories from strategic reserves.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company