Oil Rises Amid Stockpile Decline and Fed Inflation Confidence

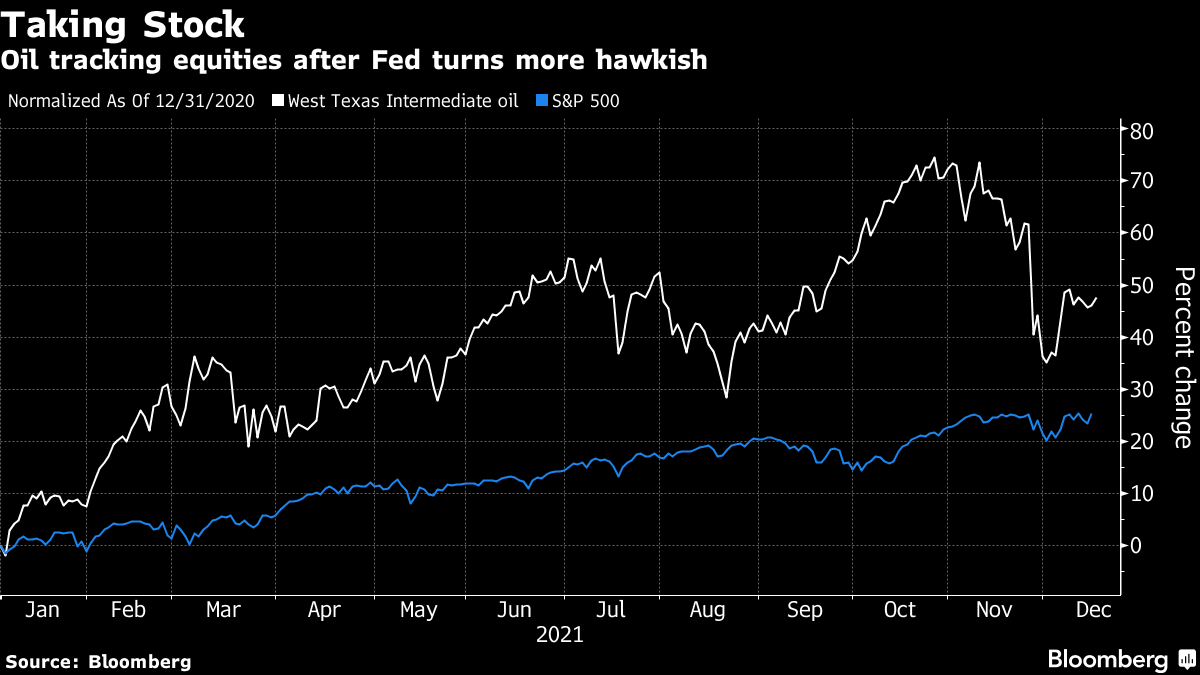

(Bloomberg) -- Oil rose after U.S. crude stockpiles fell the most since September and a more hawkish Federal Reserve reassured investors it can tame inflation without derailing growth.

West Texas Intermediate futures traded 0.8% higher near $71 a barrel, after the U.S. Energy Department on Wednesday reported a 4.58 million-barrel slump in inventories, while the Fed’s move to cool inflation by winding down its asset-buying program early propelled the S&P 500 to near an all-time high.

Crude pared some of its gains on Thursday after the Bank of England unexpectedly raised interest rates for the first time since the pandemic struck.

Conflicting signals on demand and supply have seen oil swing between gains and losses this week. While the outlook for consumption appears to be deteriorating as China, the biggest oil importer, limits holiday travel to try and contain omicron, the picture looks more positive in the U.S. The International Energy Agency said this week that the market was already in surplus, but Vitol Group, the world’s largest independent oil trader, said it expects prices to rise next year due to a lack of new investment in production.

Read more: Top Oil Trader Vitol Expects High Prices, Volatility in 2022

U.S. crude stockpiles declined by 4.58 million barrels last week, the Energy Information Administration reported Wednesday, in a positive sign for consumption in the world’s largest economy. Exports climbed back above 3 million barrels a day with traders pushing barrels out of the country to avoid the impact of year-end taxes on inventories.

“On the one hand we had extremely positive data from the EIA report yesterday, strong implied oil demand, and large inventory draws across crude and oil product,” said Giovanni Staunovo, a commodity analyst at UBS Group AG. “And the other element was the Fed, which has supported all risk assets on Thursday.”

Surging U.S. gasoline demand before the holiday season suggested concerns about the new virus variant weren’t keeping drivers off the roads. Global onshore crude inventories are also dropping, led by draws in Europe, according to data from consultant Kayrros.

“It will all depend on Omicron and possible lockdowns,” said Hans van Cleef, a senior energy economist at ABN Amro. “But with the holidays coming, and people will gather together, hopefully these boosters will help and prevent a rapid rise of the infections. But risk of more infections is high and therefore my short term guess would be for lower prices instead of higher.”

Meanwhile, the physical crude market in Asia softened as a crackdown on China’s private processors and weaker refining margins crimped demand. The spot premium of Russia’s ESPO to the Dubai benchmark slipped to the least since August, while Sokol and Al-Shaheen’s also dropped over the past month.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output