Oil Extends Omicron Relief Rally With Demand Concerns Easing

(Bloomberg) -- Oil extended gains as initial studies showed existing vaccines are effective against the omicron variant of the virus, easing demand fears.

Futures in New York rose toward $73 a barrel on Thursday after jumping more than 9% over the prior three sessions on optimism that the new strain won’t derail the economic recovery. Pfizer Inc. and BioNTech SE said lab studies show a third dose of their vaccine may be needed to neutralize omicron.

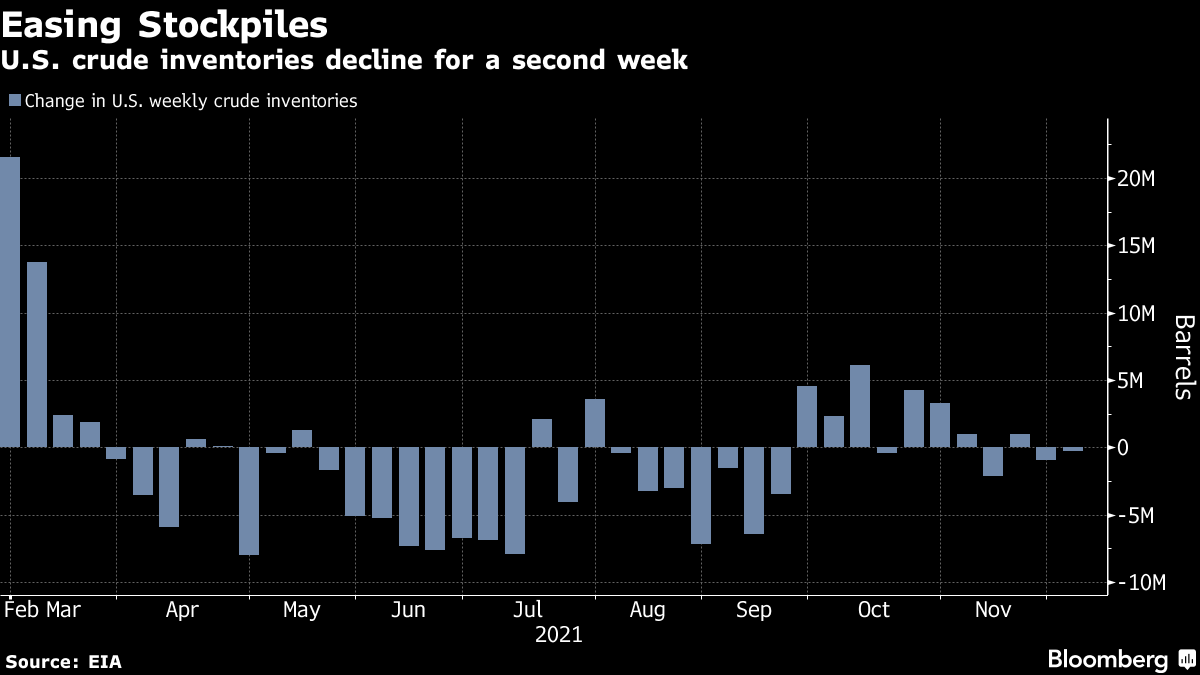

U.S. crude stockpiles, meanwhile, dropped by a modest 241,000 barrels last week for a second weekly draw, according to government data. Inventories of gasoline and distillates, a category that includes diesel, rose.

Oil has rebounded after falling for six weeks, in part due to major consumers signaling they would release strategic crude reserves to tame energy prices and the emergence of omicron. While demand hasn’t taken a big hit from the new variant, some nations have implemented restrictions on air travel and U.K. Prime Minister Boris Johnson has tightened pandemic rules.

“Market participants are starting to realize that the two virus variants -- omicron and delta -- are likely different in terms of lethality,” said Will Sungchil Yun, a Seoul-based senior commodities analyst at VI Investment Corp. “Once we’re past those concerns surrounding demand, oil will probably continue to trade in the $70s range.”

Researchers said they observed a 25-fold reduction in neutralizing antibodies to fight omicron with a third dose of the Pfizer/BioNTech vaccine. The findings indicated that two doses “may not be sufficient” to protect against infection.

U.S. gasoline stockpiles expanded by 3.88 million barrels last week, according to the Energy Information Administration. Distillate inventories rose by 2.73 million barrels, while crude supplies at the key storage hub of Cushing climbed for a fourth week above 30 million barrels, the EIA said.

China’s factory inflation, meanwhile, moderated in November from a 26-year high, with the slowdown providing more room for policymakers to support the economy. The easing is a sign that efforts to tame soaring commodity prices and deal with power shortages over the past few months are having an effect.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output