China Factory Inflation Slows in November From 26-Year High

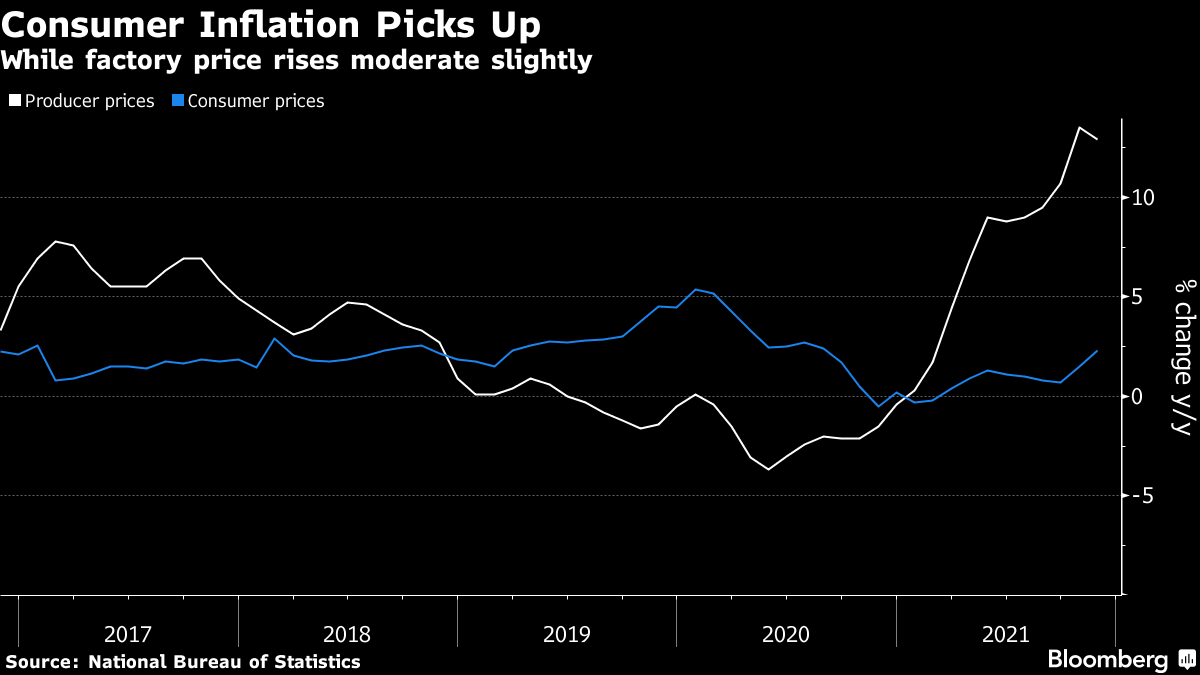

(Bloomberg) -- China's factory inflation moderated in November from a 26-year high, with the slowdown providing more room for policymakers to support the economy.

The producer price index rose 12.9% from a year earlier, above economists forecasts of a 12.1% gain, data from the National Bureau of Statistics showed Thursday. The consumer price index increased 2.3%, the fastest pace since August 2020 but below the projected 2.5% gain.

The slowdown is a sign that the government's efforts to tame soaring commodity prices and deal with power shortages over the past few months are having an effect. If the price pressures continue to abate, it may provide more room for the central bank to add stimulus.

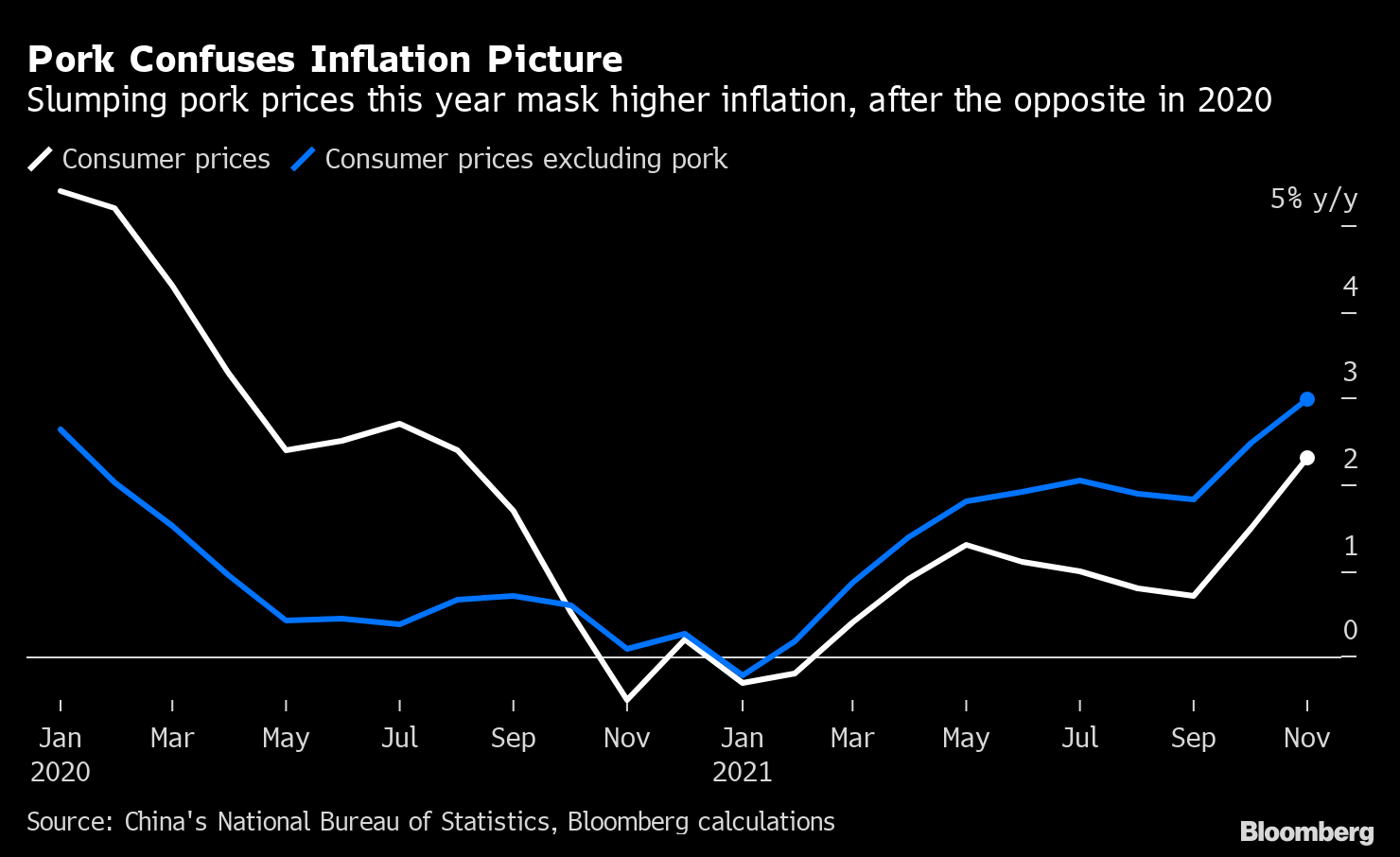

There is more space for monetary policy, as consumer inflation will likely stay mild in the first half of next year before rising further in the second half, said Bruce Pang, head of macro and strategy research at China Renaissance Securities Hong Kong Ltd. Factory inflation will probably continue slowing in the coming months, while falling oil prices could balance out the impact of rebounding pork prices on consumer inflation, he said.

Pricier Food

Consumer inflation sped up, with much of that pickup driven by more expensive food. Vegetable prices jumped 30.6% in the month, although wholesale prices have started to come down. Meanwhile pork prices were much lower than this time last year, dropping 32.7%. Without that decline, consumer prices would have risen 3%.

Â Â

Â

However, the cost of pork has started to rise again, with wholesale prices up almost 50% from the low in October.

As policies to stabilize prices and ensure supply have stepped up, the rapid surge in coal, metal and other energy and raw material prices has been initially contained, leading to a slowdown in PPI, Dong Lijuan, senior statistician at the NBS, said in a statement accompanying the release.

Core CPI, which excludes more volatile food and energy prices, rose 1.2%, as sporadic Covid-19 outbreaks likely continue to weigh on services consumption.

What Bloombergs Economists Say...

The data wont stand in the way of further easing by the central bank, which we think continues to place a greater priority on supporting growth.

Eric Zhu, economist

See here for full report

The central bank acted to release 1.2 trillion yuan ($189 billion) into the economy, announcing Monday it would reduce most banks reserve requirement ratio by 0.5 percentage point from next week. While the central bank said this wasn't the start of an easing cycle, financial markets are showing some expectation of further action.

The Communist Party's top leaders also indicated earlier this week that their focus for the coming year is stabilizing macroeconomic conditions and signaled an easing of some property curbs next year, as a real estate downturn and sporadic virus outbreaks weigh on the economic outlook.

(Updates with more details throughout.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight