Gas Lobby Warns of Price Shocks Without Investment in New Supply

(Bloomberg) -- The world’s natural gas supply will slump in the coming decades without fresh investment, leading to more severe and frequent price shocks than those of the past two years, a lobby group said.

Despite enduring demand for gas as a bridge fuel in the energy transition, supply is expected to crash following a 58% cut in investment from 2014 to 2020, the International Gas Union said. While spending has since edged up, differing forecasts for consumption and ambitious net zero policies hamper future planning.

“Restoring a sustainable balance in the global gas market is imperative and requires addressing the existing supply shortfall,” the IGU said in a report prepared with consultants Rystad Energy AS and Italian gas-grid operator Snam SpA. Investments are needed “to cope with natural supply decline, global demand dynamics, and likely growth in several regions.”

Countries in Europe have scrambled to secure new gas supplies after Russia’s invasion of Ukraine upended markets and prompted nations to prioritize energy security over green targets. Confidence in the fuel’s lasting appeal was evident in two long-term liquefied natural gas deals struck with Qatar this month.

Still, “uncertainty over the LNG market’s future trajectory and the role of gas in the energy transition continues to weigh heavily on — and in some cases delay — investment decisions,” the IGU said. “The level of future natural gas supply has been largely left to chance.”

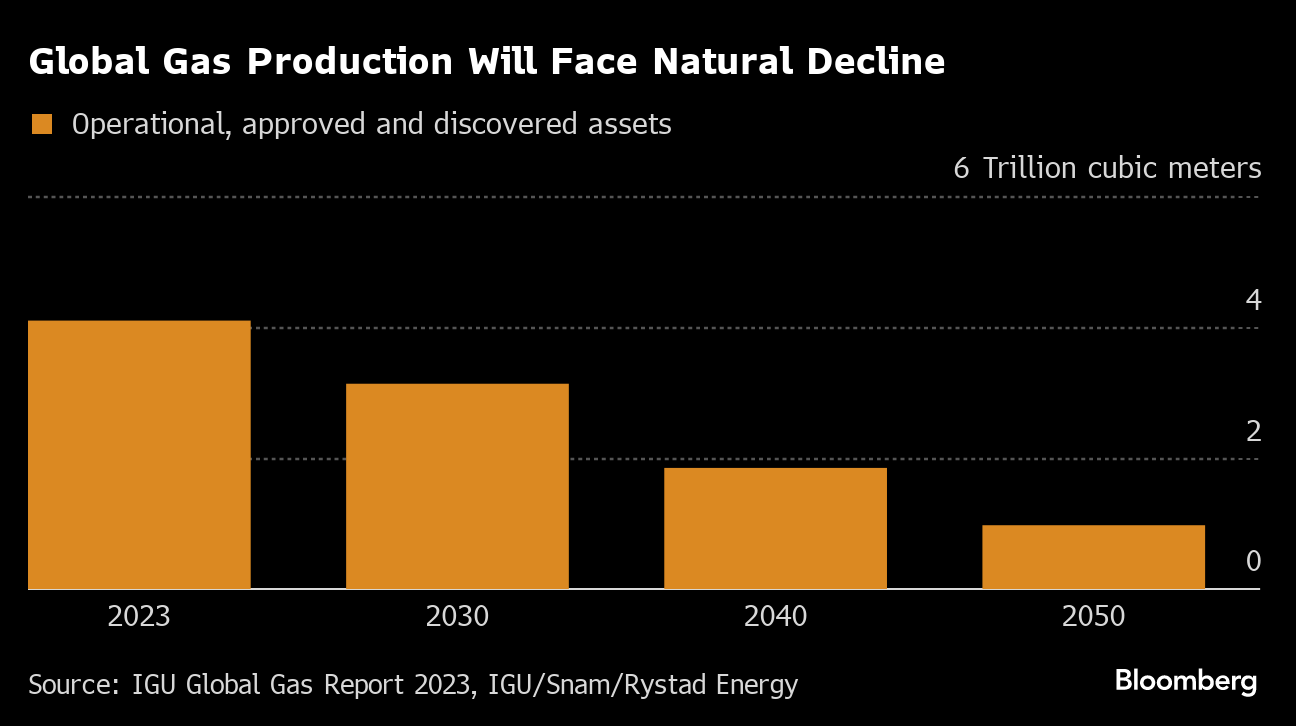

Existing and approved gas production worldwide will reach about 4.1 trillion cubic meters this year, before sliding to an estimated 3.1 trillion in 2030 as fields mature. Output is seen shrinking to just under 1 trillion cubic meters by midcentury, the report showed.

The surge in large-scale investments in renewables may make it challenging to obtain adequate capital for gas projects, even as most demand scenarios call for additional exploration.

Balancing these needs “adds risk to both existing and future energy systems and calls for sound policies and incentive-based frameworks,” the IGU said. “There are challenges and significant uncertainty on how future gas projects will be developed and maintained.”

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Slovakia Plans Talks on Gas Transit Via Ukraine Starting Next Week

Tesla-Supplier Closure Shows Rising Fallout of Mozambique Unrest

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales