Five Key Charts to Watch in Global Commodities This Week

(Bloomberg) -- Here are some notable charts to monitor in commodities markets over the coming days.

Oil & Gas

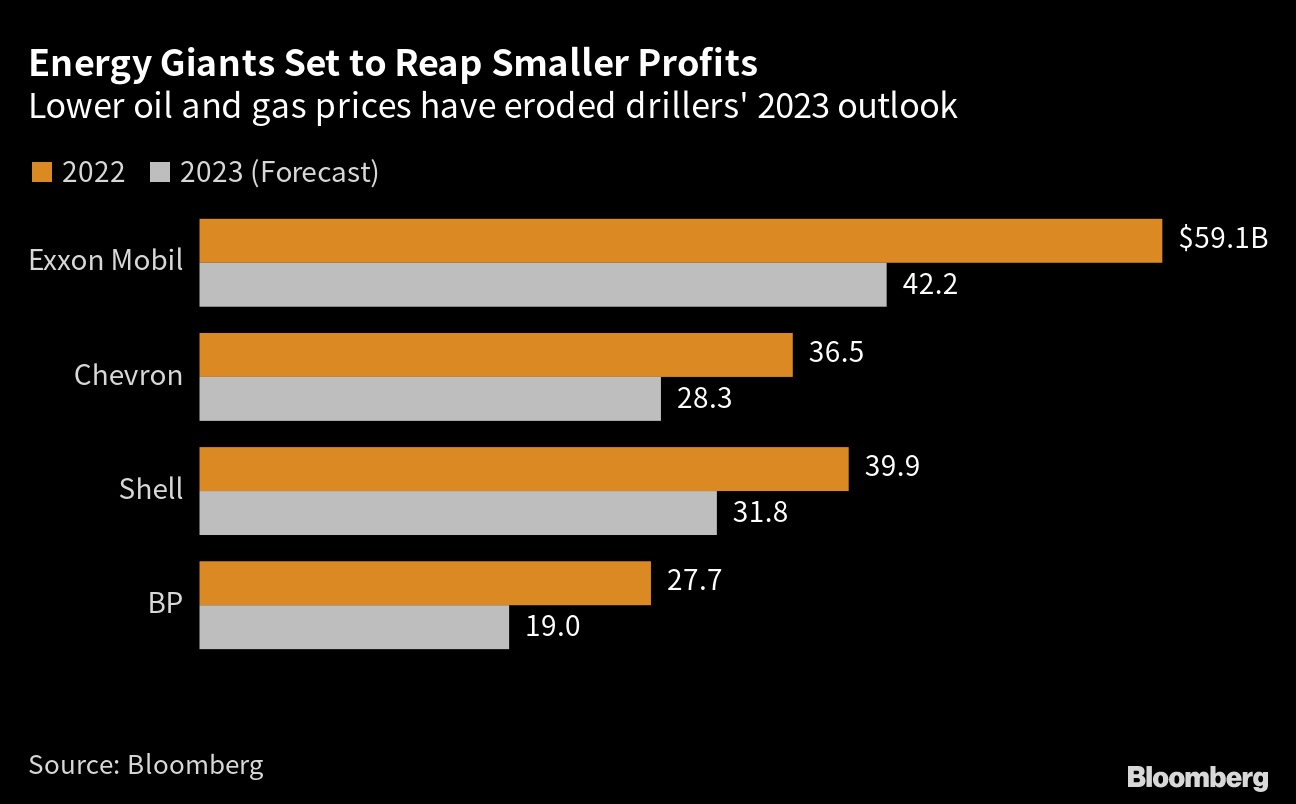

Oil extended losses on Monday after coming off its worst weekly rout since April 2020 as the turmoil in the banking sector fuels further concern that the global economy will tip into recession and hit demand, adding to a woeful first quarter for West Texas Intermediate and Brent futures. Both crude benchmarks are down at least 15% in 2023, while natural gas futures in the US and Europe have tumbled 46% and 47%, respectively. That spells trouble for the bottom lines of the world’s energy behemoths. Exxon Mobil Corp., Chevron Corp., Shell Plc and BP Plc all posted record profits in 2022, but lower prices for oil and gas dampen the chances of a repeat this year.

Shipping

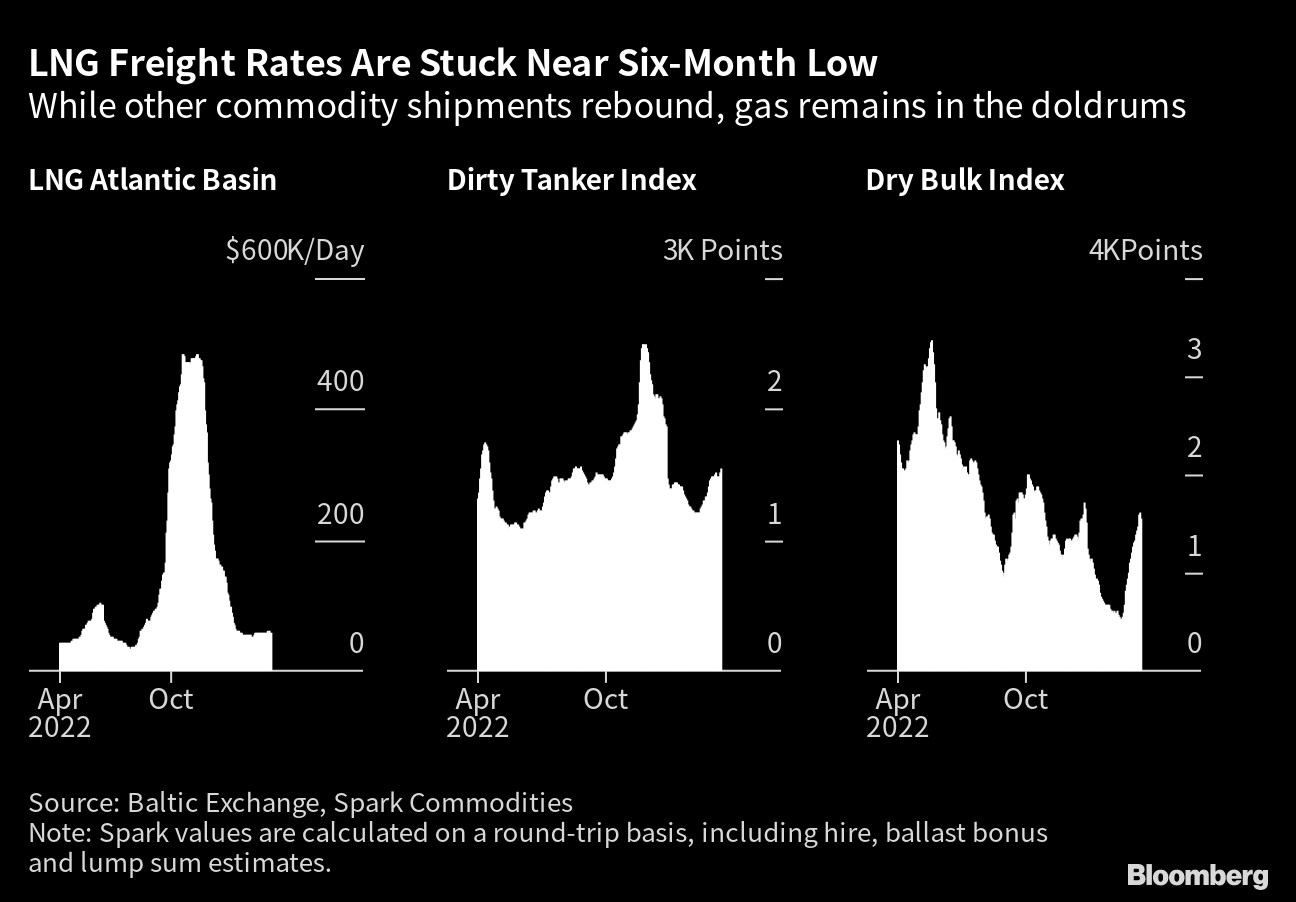

The volatility of natural gas is creating demand uncertainty for shippers. While vessel demand has rebounded for commodities including metals and oil, LNG freight rates are still stuck near a six-month low. Warmer weather is leaving ships aimless in the Atlantic Basin as Europe pulls fewer cargoes from the US. That’s a rapid change from a few months earlier, when freight rates hit record levels. Meanwhile, rates for bulk ships and crude tankers have surged after the Lunar New Year holidays in China.

Gold

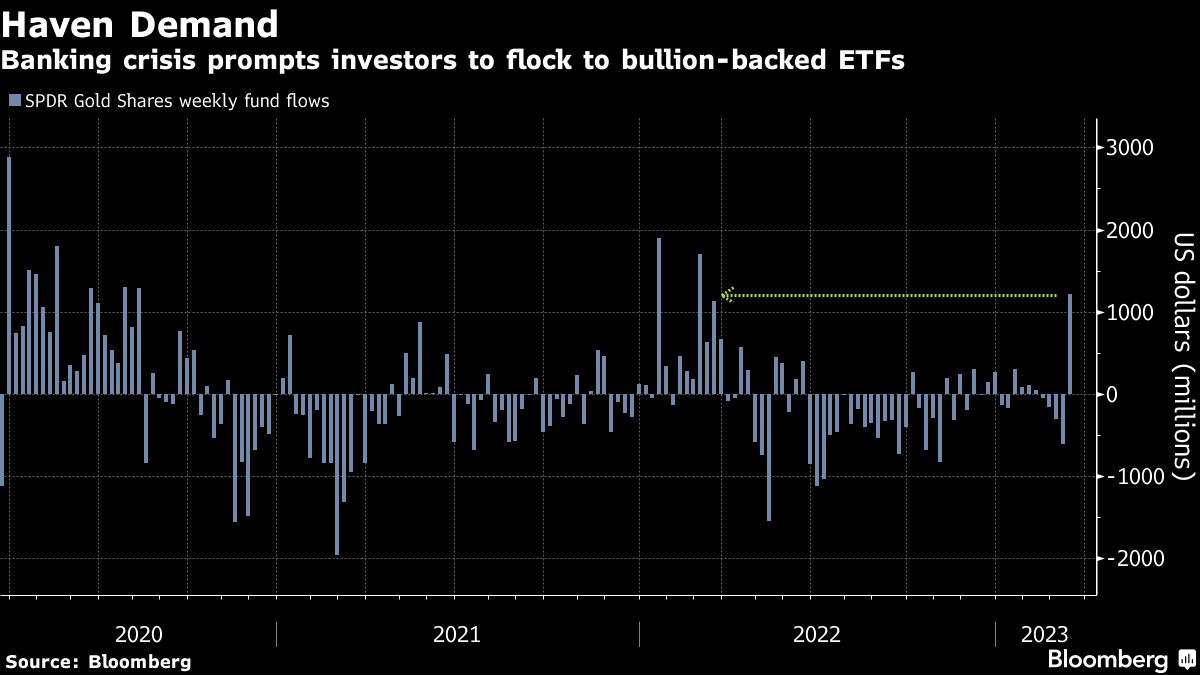

The top bullion-backed exchange-traded fund attracted the biggest fund flow in more than a year last week amid the unfolding bank crisis, and spot gold surged above $2,000 an ounce on Monday before retreating. The financial instability has dramatically shifted expectations for the rate-hike trajectory of the Federal Reserve, providing the perfect macro environment for the precious metal as investors seek safety in the haven asset. Focus will now turn to the US central bank’s March meeting, with most economists narrowly expecting policy makers to hike rates in an effort to tame high inflation, which could further bolster gold prices.

Soybeans

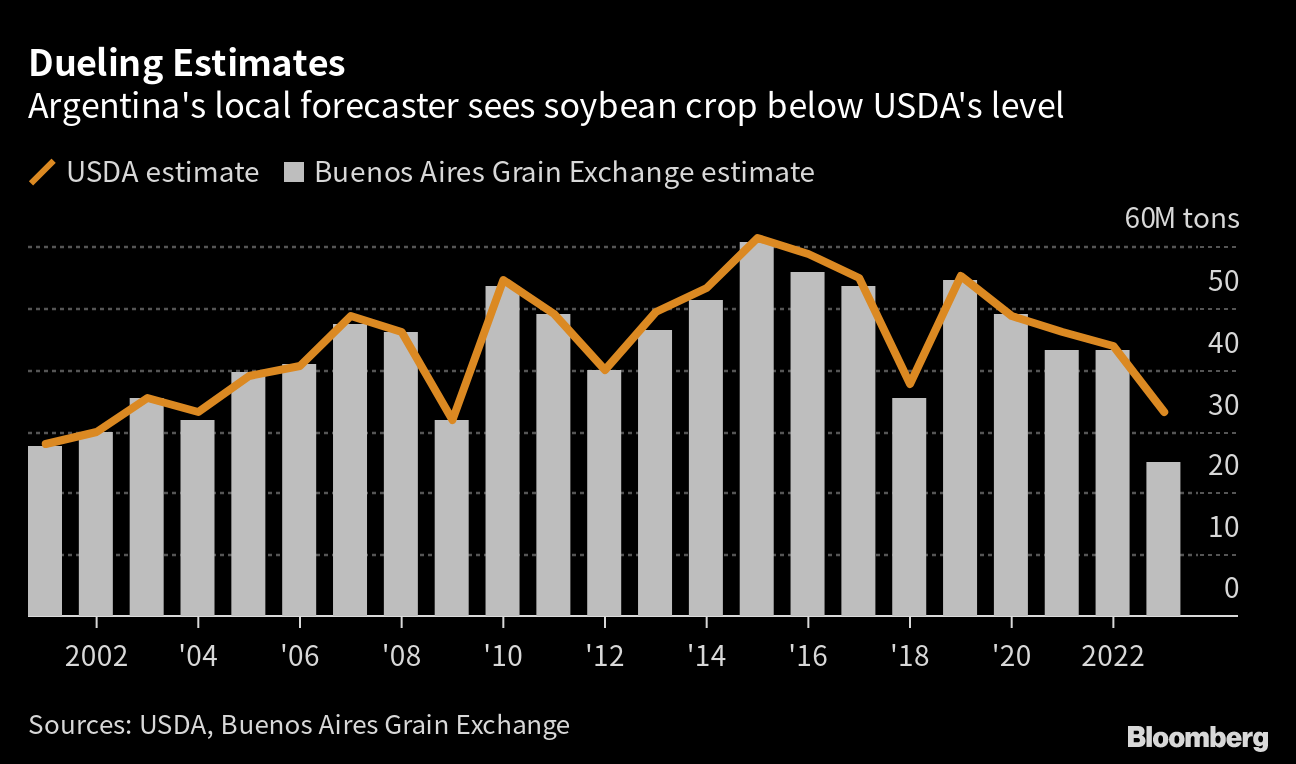

The Buenos Aires Grain Exchange, which last week slashed its soybean estimate by four million tons, will update its 2023 outlook on Thursday. The local forecaster’s current projection is eight million tons lower than the US Department of Agriculture’s estimate. It’s a stark difference, but the two agencies’ final figures have historically aligned. Argentina is the biggest global exporter of soy meal for livestock feed and soy oil for cooking and biofuels, so any more cuts risks further denting the global trade matrix.

Grains Trade

Keep an eye on food prices. While an agreement that safely allows Ukraine to export grains and other crops out of key Black Sea ports has been renewed, uncertainty lingers over the pact’s duration, casting a shadow over the future state of global supplies. That has the potential to add more pressure to food costs, which — while still elevated — have retreated since Russia’s invasion of Ukraine just over a year ago. The UN’s price index, which tracks five major exported food groups, is at the lowest level since September 2021 after surging to a record last year.

(Updates oil and natural gas prices in second paragraph, and gold in fourth.)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Tesla-Supplier Closure Shows Rising Fallout of Mozambique Unrest

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales

ADNOC signs 15-year agreement with PETRONAS for Ruwais LNG project