Europe’s Fragile Gas Market Shows Risk of Crisis Redux

(Bloomberg) -- The gas market is flashing warning signs that Europe could easily plunge back into crisis.

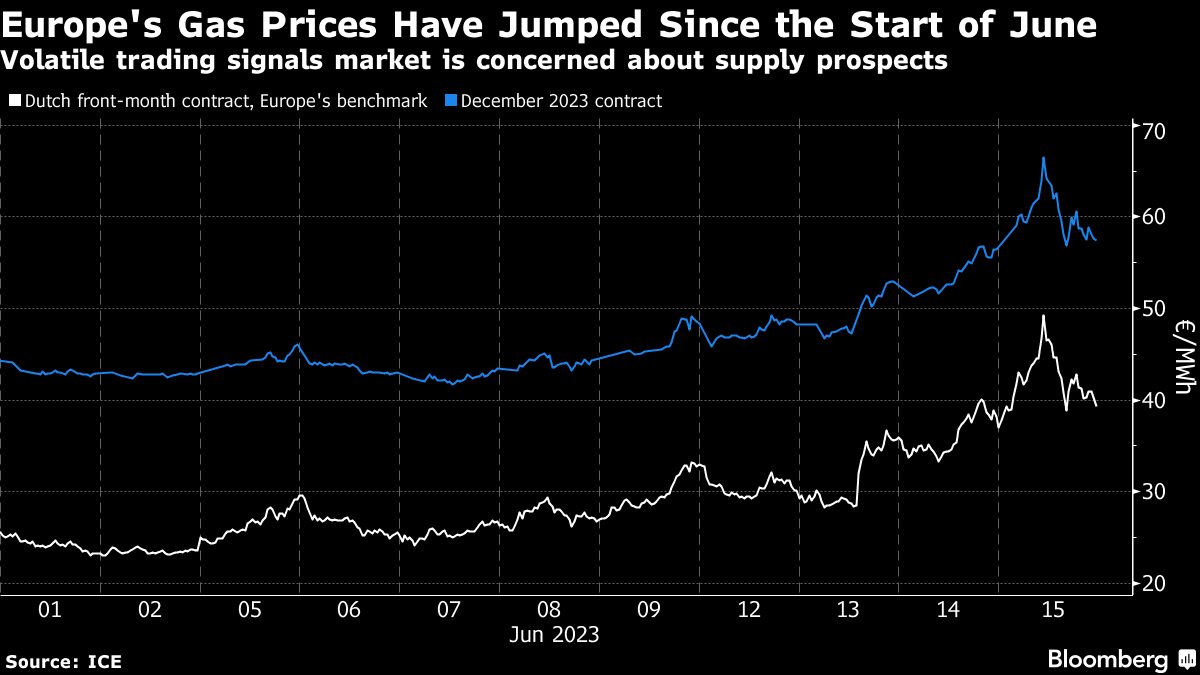

Huge price swings caused by a series of small outages at gas facilities in Norway and the planned shutdown of a key production site in the Netherlands have provided a glimpseof how fragile the market is to any threat of disruption to the region’s supply.

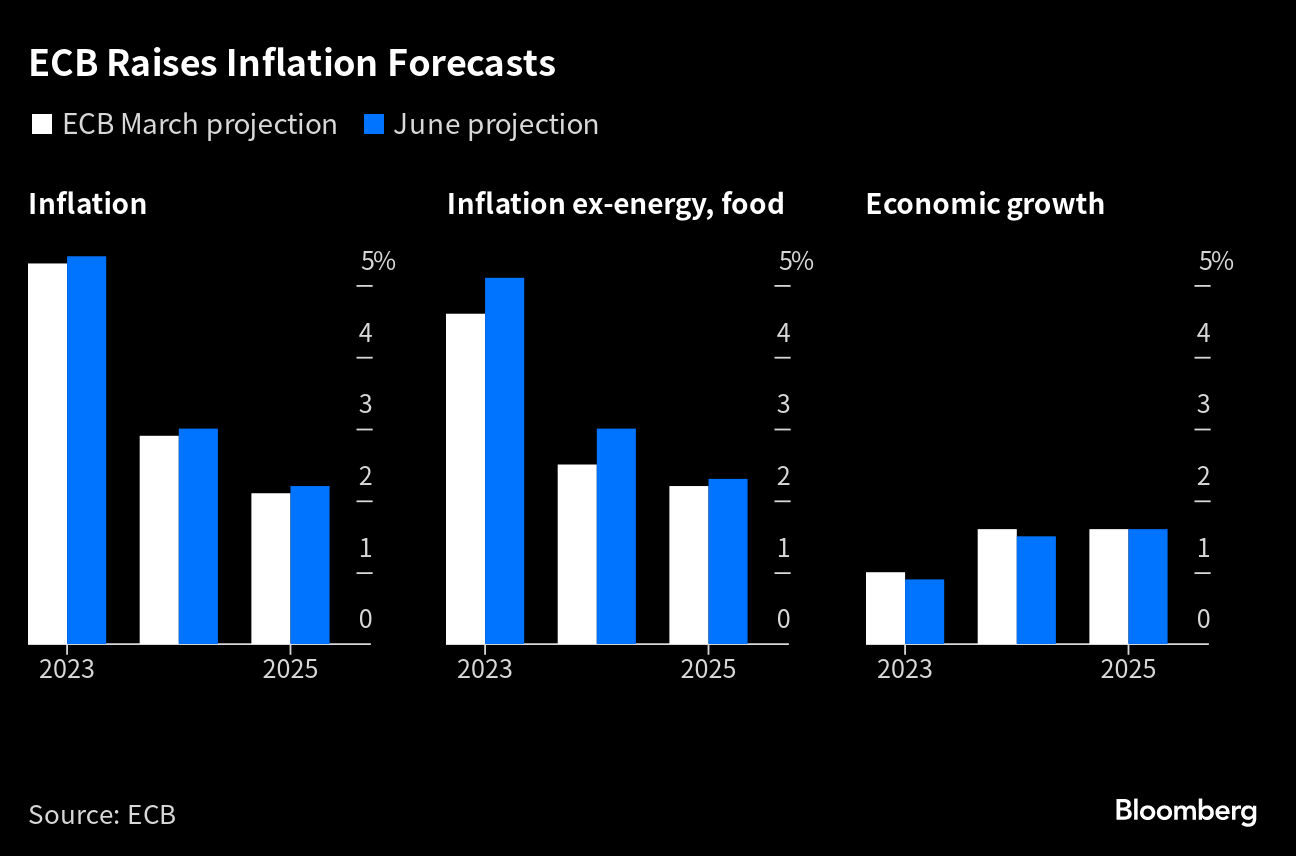

Traders have every reason to feel relaxed: storage sites are more full than usual, demand in Asia remains muted. And yet, volatility is at levels not seen since the height of the crisis. The lack of stability is bad news for industrial customers trying to get back on an even keel and for central banks trying to gauge how far to squeeze economies with tighter rates to keep inflation in check.

“This was a taster of the potential risk to come,” said Nick Campbell, a director at Inspired Energy. “Whilst this may convince large industrials to keep lower production or sites mothballed, which will ease any demand increase, all eyes are on supply.”

Record high energy prices were a core driver of the cost-of-living crisis engulfing Europe this past year. Germany, the region’s biggest economy, endured its first recession since the start of the pandemic during the first quarter. Britons struggling with double-digit inflation staged nationwide strikes across a number of industries.

The fact that the market is once and again flashing warning signs just as it seeks to rebuild its energy infrastructure may not bode well for the European Central Bank’s fight to curb persistent inflation. Although cost pressures have abated somewhat from their peak, they still are damping industrial activity, with traders saying that some demand could be permanently lost since many manufacturers that slowed production haven’t returned to normal yet.

Hotter-than-normal summer weather could also drive up energy demand for cooling. Last year, a drought across parts of the continent and deadly heatwaves dried up rivers, caused wildfires and tested the region’s energy infrastructure whilst prices skyrocketed.

China is also a factor as it wrestles with a weaker-than-expected economic recovery from strict coronavirus lockdowns. A return of Chinese liquefied natural gas demand later in the year as the government weighs a stimulus package to boost the economy could leave Europe tight during crucial months for heating.

Benchmark futures jumped as much as 30% on Thursday alone to their highest level since early April. Earlier in June, futures slumped to a two-year low.

While the market is in a “much better” position that last summer, gas prices could yet more than double should these risks all play towards a tougher gas outlook, according to Massimo Di Odoardo, vice president, gas and LNG research at Wood Mackenzie Ltd.

“Europe is not out of the woods yet, but a repeat of last summer prices at the peak of the market seems unlikely,” Di Odoardo said.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Slovakia Plans Talks on Gas Transit Via Ukraine Starting Next Week

Tesla-Supplier Closure Shows Rising Fallout of Mozambique Unrest

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales