Investment in climate adaptation needs to have high returns on growth

Climate mitigation is the best form of adaptation in the longer term. A quicker transition to net-zero will help avoid the worst-case scenarios of global warming, reducing the need to adapt. The prospects of net-zero by 2050 are fading, however, and there is increasing evidence that more warming will be associated with rising potential economic losses globally if adaptation is not stepped up.

Physical climate hazards increasingly affect economic activity and destroy capital. Chronic and acute physical risks reduce productivity, result in higher mortality rates and cause capital destruction. Rising losses from physical risks are increasingly likely with time, particularly if mitigation and adaptation efforts are not increased. Without adaptation, between 3.2% and 5.1% of world GDP could be wiped out by climate hazards annually by 2050 under a range of climate scenarios, according to a recent study by S&P Global Ratings.

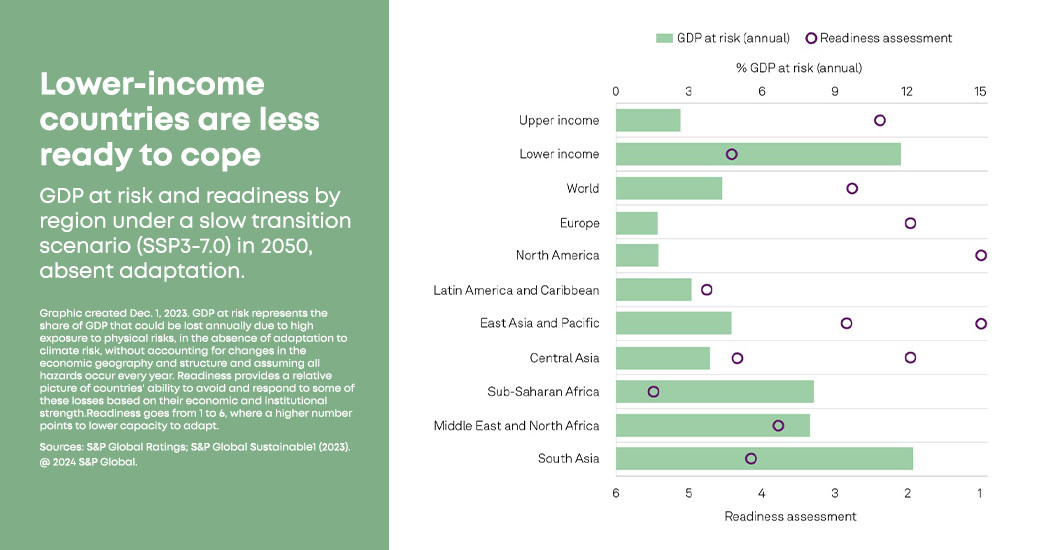

Regional differences in potential losses are stark. Under a slow transition scenario, approximately 12% of South Asia’s GDP could be lost annually by 2050 without adaptation. This potential economic loss is three times more than the world average. Sub-Saharan Africa and the Middle East and North Africa follow with roughly 8% of GDP at risk, while Europe and North America tend to be less exposed with about 2% of GDP at risk. These estimates represent the annual share of GDP that could be lost due to high exposure to physical risks, in the absence of adaptation to climate risk. They do not account for changes in economic geography and structure and assume all hazards occur annually.

Adaptation is key to avoiding short- and long-lasting negative impacts on GDP. When readiness to adapt is high, temperature increases have no long-lasting impact on GDP per capita, even in warmer climates. Lower- and lower-middle-income economies are more exposed, suggesting that they need greater relative amounts of investment to build resilience. These countries already face higher average temperatures and more climate extremes than their developed peers, and as temperatures rise, they have a larger share of physical risk-related damages. We estimate that about 12% of GDP of lower- and lower-middle-income countries is at risk of climate hazard-related losses annually by 2050 under a slow transition scenario. This is 4.4 times greater than their wealthier peers.

Less developed economies also have a harder time coping due to their economic structure, access to fewer resources and institutional weakness. Reduced long-term visibility, less developed infrastructure and weaker social safety nets, along with lower capabilities to carry out some long-term projects, all weigh on countries’ ability to adapt to risks in general, while less flexible labor and product markets make it harder to prepare or relocate production after a shock. Our assessment of readiness to cope with climate hazards shows that the regions with greater GDP at risk will have a harder time coping (see chart).

When expressed as a proportion of countries’ GDP, adaptation costs are much greater for lower-income countries (about 3.5% per year) than for lower-middle (0.7%) or upper-middle (0.5%) income countries, according to the UN Environment Programme. Investments are likely to become increasingly important as the impacts of climate change become more extreme, both in terms of intensity and frequency, with some risks becoming hard to adapt to entirely.

By contrast, more developed countries are better placed to soften the impact of physical risks and recover, given their greater financial means and stronger institutions. This explains why current economic losses from physical risks can appear relatively low in some, typically more developed, economies, even though exposure to physical risks is high or GDP at risk is significant.

Scaling adaptation finance in the most exposed countries is challenging. Lower- and lower-middle-income countries have less access to financial markets and borrow at a higher cost. Financing debt in these countries poses greater credit risk for investors, as higher macroeconomic and policy volatility increase uncertainty. In 2023, less than 9% of green bonds were issued outside developed economies. Although rising, climate finance to developing countries totaled $89 billion in 2021, according to the Organisation for Economic Co-operation and Development (OECD), or 0.03% of global debt. Most of that finance goes to mitigation, leaving adaptation funding relatively tiny.

The gap between existing climate adaptation finance and the investment need is big and likely to grow in the short term as financing conditions tighten and growth slows. The Intergovernmental Panel on Climate Change estimates that limiting global warming to 2 degrees C by 2050 will require $3 trillion each year in investment for climate adaptation and energy transition infrastructure. However, higher borrowing costs and other growth priorities are likely to push climate change down the list. According to the United Nations, the adaptation finance gap is already 10-18 times above current international flows. Estimated annual adaptation needs range from $215 billion to $387 billion per year, or 0.6%-1.0% of developing countries’ GDP, for this decade alone.

With expected losses from climate change rising, the case for investing in adaptation is increasing. Coupled with development goals, adaptation investments could present large multiplier effects for developing economies. Investing 0.6-1.0% of GDP annually seems relatively small compared to the risk of losing 12% of GDP without action, and points to a good return on investment in a world of high debt and higher interest rates. International collaboration and a combination of public and private capital will be required to make the transition affordable globally.

Energy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.